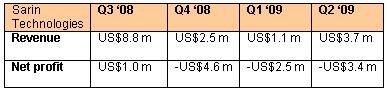

Daniel Glinert, chairman of Sarin, in interview with NextInsight at Fullerton Hotel. Photo by Sim KihSARIN TECHNOLOGIES, a global leader in the development and manufacturing of advanced planning, evaluation and measurement systems for diamond and gemstone production, suffered its third consecutive quarter of losses in the Mar-June period, amounting to US$837,000.

Daniel Glinert, chairman of Sarin, in interview with NextInsight at Fullerton Hotel. Photo by Sim KihSARIN TECHNOLOGIES, a global leader in the development and manufacturing of advanced planning, evaluation and measurement systems for diamond and gemstone production, suffered its third consecutive quarter of losses in the Mar-June period, amounting to US$837,000.

But the silver lining was the positive cashflow from operations amounting to US$1.4 million for the Singapore-listed company which has a market cap of about $55 million based on a recent stock price of 21 cents.

That helped boost the cash and cash equivalents and short-term investments from US$8.3 m as at end-March’09 to US$9.4 m at end-June.

The Q2 loss (US$837,000) resulted in part from non-cash amortisation (US$550,000) of the know how previously capitalized R&D expenses for Sarin’s newly-commercialised product called Galaxy 1000.

Then there was a non-cash US$300,000 write-down of inventory mainly because of aging (instead of obsolescence) under the company’s policy of marking down by 50% inventory that is more than a year old and 100% of inventory over 2 years old.

The amount of markdown is related to the inventory level going back to Q3 of 2008 when Sarin’s sales was US$10 million a quarter (which had since plunged, with Q2 of this year raking in only US$3.7 m of sales).

As the diamond market recovers, Sarin is looking to a suite of new products to drive its growth, said Mr Daniel Glinert, chairman of Israel-headquartered Sarin, when he was in town and met with NextInsight last week.

* The Instructor, which provides ongoing quality control for the polishing of diamonds. It will be launched this quarter and is expected to contribute significant revenue in Q4, said Mr Glinert.

This is software that will be sold under US$10,000 and may be sold with Sarin’s proprietary hardware for clients who don’t already have the latter at a cost of between US$20,000-30,000 each.

* The Galaxy which “is completely radical, there’s nothing in the market that even comes close,” said Mr Glinert. “It has the potential to change the way the work is done and to shorten the production cycle of a polished diamond by 25-50%.”

Revenue contribution from The Galaxy is “very minimal” to date because Sarin is still educating the customers on the system, said Mr Glinert.

“Q3 will see more but we don’t believe it will be significant. More significant revenue generation will come towards the end of the year and in 2010,” he said.

The Galaxy will be available at service centers for customers who have a limited number of diamonds to use the service, and in customers’ facilities. In the latter case, Sarin will impose a one-time charge and an ongoing service fee.

Analysts Ng Ai Lien and Sharon Wong from Standard & Poor’s initiated coverage of Sarin last week (Aug 14), saying: "The introduction of its new Galaxy 1000 product is well-timed with manufacturers still looking at ways to improve financial liquidity and reduce costs.

"While the industry’s sales are unlikely to recover to 2008 levels until at least 2011 or 2012

given our outlook for sluggish US consumption, Sarin’s profit growth could exceed the industry’s, as the Galaxy 1000 gains market acceptance.

They added: "We believe the diamond industry has bottomed and expect Sarin’s earnings to continue to show recovery as clients’ activity rebounds. Recent 2Q09 results were a marked improvement over 1Q09 but Sarin is likely to record a net loss driven by weak demand especially in 1Q09, amortization of costs related to the Galaxy 1000 and inventory write-downs. We do expect a return to profit in 4Q09."

Here are some of the questions and answers during the NextInsight interview with Mr Glinert:

Q Do you foresee that Q3 might be a profitable quarter?

Mr Glinert: We don’t give forward-looking estimates. In Q2, we saw a partial industry recovery but it’s too early to discern if this is a blip or a beginning of an ongoing trend. I think that if it continues, and if there's no systemic shocks down the road, we believe the worst is behind us. And it would be fair to assume if the industry activities continue to trend upwards, our sales would increase. It would take a minimal increase in sales for us to return to P&L profitability.

Q How have the prices of diamonds fallen in the major markets such as the US?

Mr Glinert: Prices for high-end and large diamonds have dropped more significantly than for other diamonds. There has been a reduction between 10-20% on an overall basis. There has been a reduction in prices of rough diamonds but an uptick in May and June because mining companies such as De Beers have reduced their overall output by about 50%.

Q: Have prices of polished diamonds pick up in prices?

Mr Glinert: Not as far as I know.

Q What’s a good leading indicator for investors to look at when they think about Sarin’s near-term prospects?

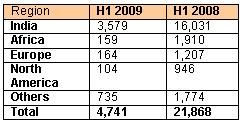

Mr Glinert: They should look at the overall economic situation. As the economy in US and Europe recovers, we will see significant more sales of diamonds. Having said that, it’s important to note also that the market in China for polished diamonds is increasing significantly and is a major driver of the industry recovery so far.

Q The majority of your sales are to Indian clients. They manufacture diamonds for the Chinese market?

Mr Glinert: Definitely.

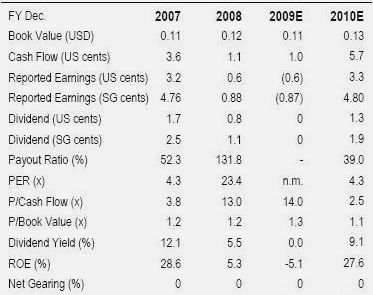

Q Do you expect to pay a dividend this year and next?

Mr Glinert: We will probably not pay a dividend this year but we expect to pay dividends in 2010.

For more on the business of Sarin, read our March 09 exclusive interview with the chairman: SARIN TECHNOLOGIES: Banking on a revolutionary new product