Source: Deutsche Bank, May 25

DEUTSCHE BANK in a report today (May 25) reckoned that a bottom has been established for the Singapore housing market, as price cuts have catalysed latent demand and accelerated inventory clearance.

It added: “That said, the conditions for a sustained price recovery have yet to fall into place. Supply is ample as developers release delayed projects and speculators unwind units bought under the Deferred Payment Scheme.”

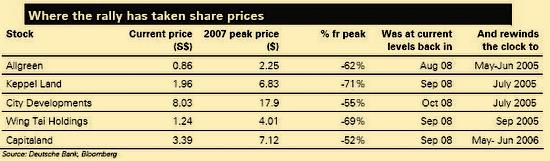

The report authored by Gregory Lui and Elaine Khoo said that property stocks are still at 2005 levels, with better near-term value in the mid-cap players (especially those with upper-mid residential exposure) and the REITs.

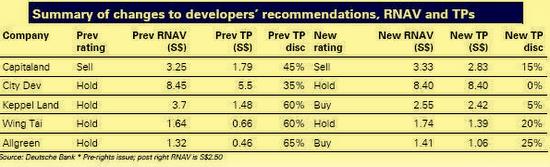

”We upgrade Keppel Land and Allgreen to Buy, and we downgrade CapitaMall Trust to Hold. Refinancing risk is abating, and REITs still offer attractive valuations.”

Large cap stocks are trading at parity to RNAV while smaller cap stocks are trading at a 20-37% discount

The FTSE Real Estate Holdings and Developer Index (FSTREH) has risen 76% from its lows in Mar, narrowing the average discount to RNAV to 16% from a high of 67% in October 2008 (after falling 72% peak-to-trough, vs. 82% for the Asian Economic Crisis).

That said, according to the Deutsche Bank report, on a long-term perspective, stock prices not only have returned to 2005 levels but also have now lost much of gains recorded during the last property cycle.

Property developers have traditionally been valued on RNAV. Discounts to NAV typically expand as asset prices fall and solvency risk rises, while they compress sharply as growth returns.

Deutsche Bank said property developers are trading at an average discount to RNAV of 16%, which is broadly on par with the long-term average of 20%.

Large cap stocks are trading at parity to RNAV vs. a long-term average of 7-15%, while smaller cap stocks are trading at a 20-37% discount.

Deutsche Back said mass market demand had been surprisingly resilient but attributed that to lower prices and low mortgage rates. There is upside to come.

“We expect upper-mid segment sales to accelerate. Signs of market clearance should boost confidence, as the premium gap over mid-range homes has compressed and unlocked liquidity from en-bloc sellers. Developers have been delaying supply, and are in stronger positions after inventory clearance this year and cash calls.”

As for the office market, Deutsche Bank said office rents have corrected faster than expected, as landlords focus on tenant retention ahead of the wall of supply next year.

The “worst of declines” is likely this year, it said. “We expect vacancies to approach the previous highs of 17% in 2012. We believe that the rental decline will decelerate sharply in 2H, although any recovery is likely to lag.”

Source: Deutsche Bank

Deutsche Bank finds mid-tier property developers and REITs to be attractive.

”We raise our target prices sharply, setting our 12-month target NAV discounts on past recovery cycles (vs recession averages previously) as GDP rebounds next year.”

The large cap stocks appear to already be pricing in recovery, and hence Deutsche Bank maintained its ‘Sell’ on Capitaland and ‘Hold’ on City Dev.

Recent story: REITS: Goldman Sachs says time is on REITS' side