Saizen has a yield of 38.6% in 2008.

REITS, REITS, REITS!

They are increasingly in focus at stock brokers and in the media.

They have mouth-watering high yields and, some people would say, very high risks.

We have published several articles on Reits. Please see links below.

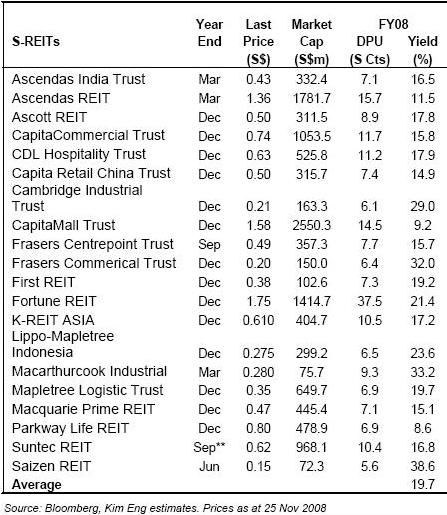

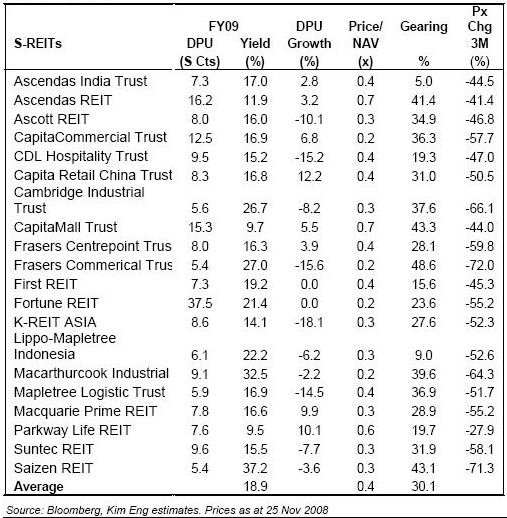

This morning, Kim Eng Securities published a table on their estimates, and Bloomberg’s, of dividend per unit (DPU) of Reits. Here is the table which we have split up into two for easy reading:

* For S-REITs with year ending Mar and Sep, FY08 DPU estimates represent that for FY3/09 and FY9/09 respectively. ** Change of FYE to Dec not reflected.

Mouth-watering yields in 2009?

Recent stories:

REITS: 'Please weigh the risks!'

REITS & SHIP TRUSTS: Bargains today because of uncertain tomorrow?

Forum discussion threads:

MacarthurCook Reit....now potentially at 24% yield

Cambridge Reit: 27% yield!