Cheung Kong is a major shareholder in Suntec REIT's manager.

I HAVE been asked many a time by friends to explain my pessimistic outlook on Singapore REITs. My starting point is that local analysts have not experienced a collapse of REITs before. Hence, they do not understand fully the inherent risks of REITS.

Here, I hope to explain the risks that one should examine prior to investing in a REIT.

A REIT, or Real Estate Investment Trust, is a company that derives most of its income from the rental of properties. It raises funds from the public and uses it to acquire, own and manage real estate. To qualify as a REIT, it has to pay out 90% of its taxable income as dividends to shareholders.

Other characteristics of REITs listed in Singapore include:

* At least 70% of assets invested in real estate;

* 75% or more of income to be derived from rents;

* Leverage limit is 35% of deposited properties, or 60% if a credit rating is obtained and made public.

The first Singapore REIT, CapitalMall Trust, was launched in 2001.

In the US, since its beginnings in 1960, when the Congress created this investment tool to allow the public to invest in large scale commercial properties, the industry has grown dramatically. By end 2007, there were over 180 REITs in the US with assets totaling USD 375 billion.

Benefits of REITs

REITs allow investors to hold a diverse portfolio of properties, without having to buy physical real estate. This diversification can be easily achieved through an allocation of investments in mixed portfolios of properties and geographical markets.

There are REITs that invest in Indian industrial properties, Japanese commercial properties as well as the different types of properties in Singapore. Unlike common stocks, REITs are taxed on an individual basis only. In Singapore, this is less of a problem as retail investors do not face double taxation.

CapitaCommercial Trust closed at 79.5 cents last Friday, translating into a projected 2009 yield of 15.5%.

Risks of REITs

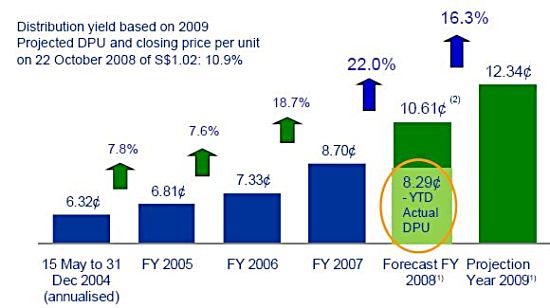

I have seen many research reports highlighting high distribution yields as the key selling point of a REIT / Shipping Trust, without explaining in detail the risks that lurk. Distribution yields, for one, are a function of REITs’ unit prices, so yields could be high simply because unit prices have dropped dramatically.

Refinancing Risk

The first risk that all REITs / Shipping Trusts face today is refinancing risk. Not many investors understand that refinancing is now the biggest headache faced by the senior management of REITs.

But the challenge of refinancing was highlighted by Mr John Lim, CEO of ARA Asset Management, who has openly asked banks to relax their lending to Singapore REITs.

He was quoted in the Business Times recently as saying: “In 2009 alone, you have S$4.6 billion of debt for refinancing. In the next four years, it may be close of S$20 billion, including rollover debt. The issue is very real.”

The worst case scenario is bankruptcy, as exemplified by a recent REIT case in Japan. New City Residence filed for bankruptcy protection on 9 October in a decision prompted by difficulties relating to financing a recent acquisition and the scheduled repayment of borrowings.

If no sponsor is found, New City is expected to be liquidated with its debts to be repaid from the proceeds of all properties to be sold. Any outstanding funds would be distributed to investors.

Over the weekend just past, you would have read that Frasers Commercial Trust (FCOT) has taken a $70 million loan from parent company Fraser and Neave (F&N) to repay debt.

The money has been used to repay $70 million of loan notes issued to Australia's Commonwealth Bank. Other than the $70 million loan, FCOT also owes Commonwealth Bank a further $400 million and $150 million, due in July and December 2009 respectively.

You would also recall that FCOT is actually ex-Allco REIT. In July 2008, Frasers Centrepoint bought 17.7 per cent of Allco Commercial Reit and 100 per cent of the trust's manager for $180 million and renamed Allco REIT as FCOT.

If F&N have not stepped in to refinance this $70 million loan, do you think Allco REIT could be the first REIT casualty in this financial tsunami?

Dividends will be cut in 2009

It is my belief that the Singapore REITs / Shipping Trusts would have to cut their Dividend Per Unit (DPU) in 2009 to preserve their cash holdings. Distribution yields will be adjusted downwards subsequently.

And since, the REITs are mainly valued via a Dividend Discount Model (DDM), doesn’t it make sense to downgrade the REITs if the dividends are cut?Some REITs are taking the innovative approach of offering units as dividends instead of cash. Kudos to the management!

Going forward, REITs would be valued more as a bond, rather than a hybrid of debt and equity, given their inability to sustain capital appreciation. Look at the AA-rated bonds trading in the US and you would know roughly how much yields you would be expecting from the REITs.

Reduced Rental & Lower Occupancy Rates

In the past, REITs made acquisitions of properties based on assumed rental rates and occupancy levels. In this current economic downturn, I would be surprised if the REITs are still optimistic about those assumptions. They would be more concerned about keeping their tenants rather than talking about increasing rental next year. Occupancy levels are also likely to take a hit as tenants either reduce their demand for space or source for cheaper alternatives.

Capital Tower is HQ of CapitaLand, and part of the CapitaCommercial Trust.

Supply Side of the Equation

Having stated the demand side of the equation, I now take a look at the supply portion – which is essentially the strength of the Singapore banking system.

Goldman Sachs in a November report said: “In our view, the market seems to be focused on the demand side of the equation, i.e. demand for financing/refinancing, and market participants appear to have simply extrapolated the blanket of tight liquidity from the US and European banking systems onto Singapore. However, we believe that it is equally important to look at the supply side, i.e. the health of Singapore’s banking system and overall system integrity.”

Goldman has noted that there are funds available for lending (should banks choose to do so), although banks have become more selective in extending credit. The level and recent progression of SIBOR rates underscored the assertion of continued system liquidity.

According to Goldman Sachs, a snapshot of Singapore’s banking system (Domestic Banking Units, DBU) shows a comfortable level of loans to deposits of about 80% as of August 2008, while loans to total assets stands at 41%.

There is a significant amount of assets tied up in interbank funding which can easily be moved to higher yielding loans if required (most interbank loans are conducted at SIBOR vs. non-bank loans at SIBOR plus a margin).

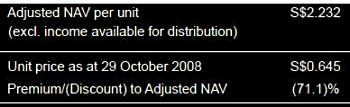

Suntec Reit is trading at a big discount to NAV

2 REIT picks by Goldman Sachs

So are there any good REITs that one can keep a lookout for? Goldman Sachs’ Nov report highlighted CapitaCommercial Trust (CCT) and Suntec REIT (SUN). In its view, CCT’s chances of refinancing are strong given its prime commercial office portfolio and the strength of its sponsor, CapitaLand.

CCT (Moody’s Baa1 credit rating) has S$656m of debt due by end Dec-09, the bulk of which comprises S$580mn of CMBS due in Mar-09.

CCT’s gearing (total debt to assets) is 36.3% as at September 30, 2008. The company has advised that it has undrawn facilities of S$225mn and it intends to complete the refinancing well in advance of the debt maturity date (Mar-09).

SUN’s refinancing risk is limited but definitely higher than CCT. In the relative sense, although SUN’s asset portfolio is also of prime quality, its shareholding is fragmented and it lacks a “committed patron” (such as CapitaLand in CCT’s case).

However, Goldman Sachs also noted that Cheung Kong is a major shareholder in SUN’s REIT manager (ARA Asset Management). SUN (Moody’s Baa1 credit rating) has S$125mn in short term financing, though of more significance is the S$700mn of CMBS due in Dec-09.

As at September 30, 2008, SUN’s gearing stood at 34.8%. Management has stated that it has started negotiations with its bankers on refinancing its debt that is due in Dec-09, and has further advised it has no plans for equity financing in the foreseeable future.

In conclusion, the report highlighted CCT and SUN’s debt refinancing chances are strong, and prime location commercial space landlords like CCT and SUN will be able to sustain their core operations in an environment of declining rental rates.

Recent story and tables on exceptionally high yields: REITS & SHIP TRUSTS: Bargains today because of uncertain tomorrow?

You are welcomed to post a comment or question at our forum.