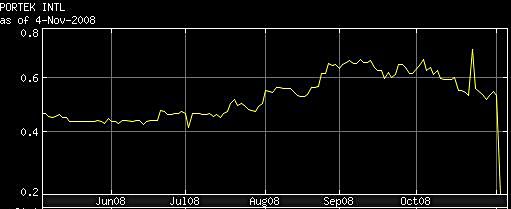

PORTEK’S STOCK price crashed more than 60% overnight to close at 20 cents on Tuesday (Nov 4) after it announced that the past year’s talks of selling itself had been called off.

Yesterday, it inched down half a cent to close at 19.5 cents, slightly lower than its cash per share of 20 cents.

A dividend of 0.807 cents per share (4% yield) went ex today.

Difficulty in securing financing is a reason the potential buyer pulled out, but perhaps more critical is the austere outlook of shipping markets.

Being a port terminal operator and third-party provider of equipment and services supporting ports worldwide, Portek’s growth is driven by container throughput at the ports where it operates.

Even though its revenues of S$138 million for FY08 (ended 30 June) were up 36% yoy, the outlook is likely to be affected by the sharp slowdown in global trade.

And net margins of 2.8% in FY 08 were not exactly fat.

It probably is small consolation that Portek chairman Lam Choon Seng was in the market yesterday, buying 500,000 shares at 20 cents apiece.

The Baltic Dry Index has crashed by 90% in the past half year. Freight rates have become so dismally low that ship managers are shaking their heads in disbelief over the recent slew of vessels being chartered below operating costs.

Portek’s revenue contribution currently is divided between terminal operation (which includes cargo handling) and engineering services.

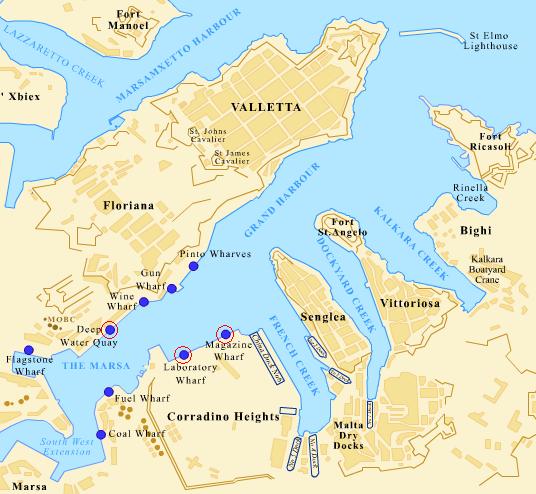

A terminal is a facility in a port where cargo containers are stored and trans-shipped between different transport vehicles, such as from a container ship to a lorry for onward transportation.

Terminals managed by Portek are small to mid-sized with container capacity for 200,000 to 300,000 TEUs a year.

Its strategy is to focus on inexpensive, small undeveloped ports in export-rich areas all over the world which are too small for large players such as PSA Corp and Hutchison Port Holdings.

It now has concessions to operate container and bulk terminals in Indonesia, Algeria (North Africa), Malta (Europe) and Gabon (Central Africa).

Portek’s engineering services revolve around container cranes, which is a special gantry crane used to load and unload container ships at dockside.

(1) Sale of equipment, components and spares

Portek sells container and bulk cranes and related handling equipment. Each sale includes engineering processes such as modification, upgrading, relocation and customization of equipment.

(2) Equipment leasing

Terminal operators may opt to lease cranes and other equipment from Portek. Leases include equipment upgrades and maintenance in addition to services provided under equipment sales.

(3) Crane mobilization, modification and modernization

When a terminal operator wishes to redeploy a crane to another location, Portek disassembles the crane, transports it (usually by sea), and upon arrival at the new location unloads and re-commissions the crane. This involves modifying a crane’s structure and dimensions for its new environment.

Thereafter, a crane’s mechanical and electrical system needs to be refurbished for optimal performance during loading and unloading of cargo.

(4) Technical services

Portek makes its design and engineering, maintenance, security and surveillance, crane surveys and project management available to third-party crane owners and manufacturers.

| Stock Price S$ |

Mkt Cap S$mln |

Sales S$mln |

Historic |

Gross Margin % |

|

| (SGX-listed) | |||||

| PORTEK | $0.195 | 28.4 | 140.3 | 7.3 | 44.4 |

| ENG KONG | $0.110 | 27.8 | 71.1 | 4.1 | 26.6 |

| (HKSE-listed) | |||||

| TIANJIN PORT | $0.300 | 535.8 | 228.0 | 10.6 | 53.0 |

| DALIAN PORT | $0.414 | 440.4 | 340.2 | 4.9 | 44.4 |

| XIAMEN PORT | $0.147 | 145.1 | 626.4 | 4.6 | 22.2 |

| CHINA MERCHANT | $3.533 | 8,521.8 | 1,195.2 | 11.2 | 38.2 |

| COSCO PACIFIC | $1.337 | 3,001.3 | 450.5 | 4.7 | 49.0 |

| Average | 7.2 |

Port players data from Bloomberg / NextInsight

At 19.5 cents a share, Portek’s historical PE of 7.3X is close to the 7.2X that large port players listed in Hong Kong are trading at.

Container depot operator Eng Kong is an SGX-listed peer of similar size. Unlike Portek, however, Eng Kong’s revenues rise in times of low global trading; i.e. when depot space is in demand to store inactive containers.

A third port operations player listed on SGX is Pan-United Corp, albeit with less than 10% revenue contribution from its stake in Changshu Xinghua Port.

Comments

ICTSI offered S$1.20 per share, a premium of 69 per cent over Portek's last traded price before the takeover announcement. !!!