This article first appeared in the June edition of Pulses magazine

IF THE two Ang sisters and their mother had looked for a fund manager to invest their money, they didn’t look very far. Right at home was Ang Hao Yao, who became a stock analyst after graduating with two bachelor’s degrees in mathematics and economics.

He began investing in stocks at 21, and went on to attain a Master’s in Business Administration degree and Chartered Financial Analyst certification. He read extensively about Warren Buffett’s billions and investment philosophy, and became even more passionate about investing.

At 27, after a few years as a bank officer, he quit to become a full-time investor. Very few Singaporeans have taken this path at such an early age. It helped that he had become financially comfortable with money left three years earlier by his father, Professor Ang Kok Peng, an academic and a Member of Parliament who died of cancer.

Over time, Mr Ang’s sisters – who are medical doctors - and academic-mother, Dr Ang Wai Hoong, entrusted Hao Yao to invest on their behalf. Largely, their money flowed into the same stocks that Hao Yao picked for himself - stocks that he deemed to be of relatively low risk and offering decent returns.

He reads company annual reports as part of his thorough efforts in assessing the merits of a stock. He figures he has some 2000 annual reports at home.

The 35-year-old makes time for volunteer activities. He sits on the management committee of the Securities Investors Association as the Chairman, Membership.

He is also on the board of directors of a charity, Singapore Anti-tuberculosis Association (SATA) where he also sits on the investment and finance committee. He is a member of the Accounting Standards Committee of Institute of Certified Public Accountants.

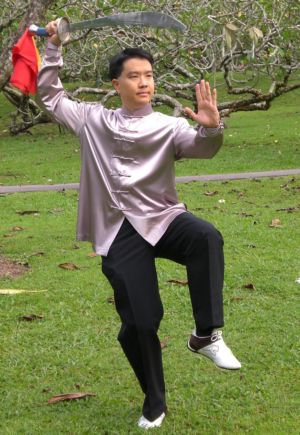

Away from the financial sphere, he teaches the martial art of Wu Style Tai Chi at Singapore Jian Chuan Tai Chi Chuan Physical Culture Association, whose executive committee he also sits on. He is as passionate about martial arts as he is about investing. In fact, he had an earlier start with martial arts as he was sent to taekwondo classes from the age of six.

Hao Yao is married with two daughters aged three years and seven months, respectively. They live with his mother in a 6,000 sq ft home in Bukit Timah that he grew up in.

What key moves have you made with your portfolio since the start of the year?

Last year was, for the most part, a bullish year in the stock market. The increased liquidity and prices allowed me to take profit on a number of stocks I had held like Eng Wah, Nippecraft and Lasseters. Now, I have a large part of my portfolio in cash and aside from some small purchases, I have not made any significant new investments.

Why do you refrain from re-investing your profits?

I cannot predict where the market is going but I currently have a negative view on the world economic environment due to the expected slowdown in the US and UK economies. In addition, I believe that the sharp rises recently in oil and commodities, particularly food, will have a negative impact on the stock market. That said, I still continue to seek potential investments which I feel offer value.

What is your investing approach?

My approach has always been to buy shares of companies which are undervalued by the market in terms of price-earnings ratio, net tangible assets or dividend yields, and which I can reasonably predict profit growth for the next one to two years.

Can you give an example of a business that met these criteria and which you once owned, or still own?

Vicom, for instance, at the current price of $1.75 is trading at a historical PE of 11. Profit grew 30% and it paid dividends of 18.25 cents for financial year 2007.

What are some key influences in how you have developed your approach?

My father invested in shares for several decades and I received my first investment lessons from him. Thereafter, when I worked in a bank, I had the opportunity to meet large investors whom I learnt from when I interacted with them. Over the years, I also purchased a collection of investment books. I have a wide network of wealthy investors with whom I converse with on a regular basis.

When did you get started on investing?

I have been interested in investing since I was in secondary school where I remember discussing shares with a teacher whom I saw perusing share prices listed in the newspaper. My first job when I graduated at 21 was as a stock analyst. It was also the first year I opened a trading account and started investing in shares. It has been 15 years since and I have enjoyed every day of it.

Being a remisier and schooled in business, your wife would make a perfect partner in investing for you. Do you both exchange ideas?

As investing has been my passion since I was a teenager, it would make sense for me to choose a partner who also shared the same interest. Priscilla was my broker then and we naturally got on well. We married nine years ago and we discuss market developments daily. Our portfolios are not identical but we do invest in the same stocks sometimes. It is probably better for a couple to own different shares so that the risk of a family setback due to the collapse of any single counter is eliminated.

What are your top holdings and some details about their performance to date?

I currently have only one main holding – Vicom, which I own about 1 per cent of and which has a current market value of around $1.4 million. I started investing in the company over five years ago when it was trading at around 60 cents. The company has paid generous dividends over the years and currently trades at $1.75. I have several small holdings and the rest is in cash.

Tricky question: Would you mind revealing what stocks you may be accumulating so we can buy them too?

Picking stocks is a matter of personal preference. Even if two people picked the same stock, one can make a profit and another may not. The reason is that picking the stock is but only one part of the battle. Other important decisions thereafter are when to take profit, average down or cut losses. I have recently purchased initial stakes in Sarin Technologies, an Israeli company involved in the diamond industry; QAF, a food manufacturer; and Orchard Parade, a hotel owner.

What is the most disappointing stock you have ever owned?

I have a small position in New Toyo which I have held for several years. The price has dropped 30% below my cost despite the company being profitable and dividend paying. I intend to hold on to it.

You have not mentioned blue chips and China stocks. Do you shy away from them?

I do not intentionally shy away from blue chips. I am interested in purchasing blue chips if they are substantially undervalued. However, because of the wide coverage by analysts and fund managers, the chances that a small investor like me spotting something they don’t are rather small. I also do not avoid foreign stocks. For example, I am comfortable holding Sarin Technologies as I find that the company is transparent in its reporting and currently trades at an demanding PE of less than 10. As for China stocks, if I come across one that fits my investing criteria I have no qualms about buying it.

Have you ever allowed your emotions to influence your investment decisions?

It is difficult not to be emotional about stocks which I have spent years owning and following. Sometimes, other investors buy shares that I own after seeing my name in the top shareholders list or after meeting me at shareholder meetings. However, I try to use emotions to my advantage by delaying the selling of a stock till it has moved to irresistible levels!

What are the types of stocks you won’t touch?

I will not touch companies that have poor corporate governance. These companies can be identified by negative news reports about governance issues or companies which have unresolved tussles with retail investors. I also generally do not invest in companies which are loss making or pay poor dividends and companies which make dubious acquisitions or have questionable assets on their books.

When we last talked about this subject four years ago, you said you had other types of investment aside from shares. Is that still the case?

Four years ago, I had mentioned that in addition to shares, I invested in the euro currency and gold. Both assets have appreciated substantially. I have held on to the positions and have not sold any part of it.

Why not?

With the US dollar in decline, the euro - because of the size of its economy - is the next most popular global currency. Thus, holding the euro as part of my personal reserves is a logical move. Globally, inflation has been on the rise, which will continue to push investors into buying gold as a store of value. My gold investment is a hedge against inflation. I started buying gold in 2002-2003 when it was around USD300. Recently, it hit a high of over USD1,000.

Do you invest in property?

I bought two commercial units at Concorde Shopping Centre in Outram Road early last year. Both were mortgagee sales. Subsequently, I sold one unit at a 65% profit and I occupy the other as my office.

Ultimately, what might you do with a large enough pile of money?

I hope to one day make sufficient money through investing to start a foundation to fund activities of various non-profit organisations.