BNP Paribas' fair-value target P/E for Golden Agri is 17x 2008 earnings, translating into a stock price of $3.RECENTLY, BNP Paribas presented 17 companies listed on the Singapore Exchange in the Singapore leg of its Asean conference.

BNP Paribas' fair-value target P/E for Golden Agri is 17x 2008 earnings, translating into a stock price of $3.RECENTLY, BNP Paribas presented 17 companies listed on the Singapore Exchange in the Singapore leg of its Asean conference. These companies, a mixture of both large and small caps, provide a diverse representation of Singapore in industries such as:

* property (Guocoland, Yanlord Land),

* offshore & marine (KS Energy, Ezra, Cosco, IMC),

* construction (CSC Holdings, United Engineers, Chip Eng Seng),

* plantations (Golden Agri-Resources),

* financials (SGX),

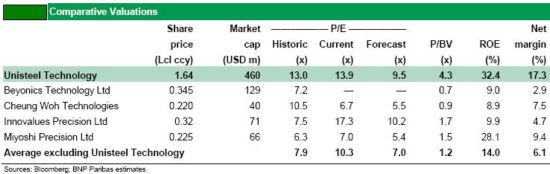

* technology (CSE Global, Datacraft, Unisteel) and

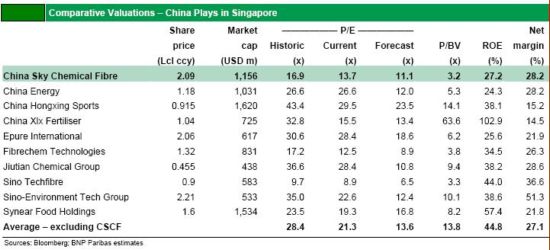

* S-chips (China Sky, Fibrechem, Sinomem Technology).

BNP Paribas says it specifically targeted companies in the property/construction and the offshore & marine sectors as it feels they “will provide value and sustainable earnings growth, respectively, in 2008.”

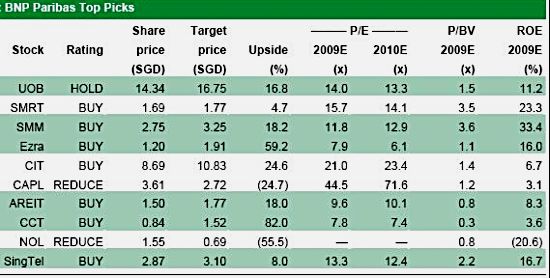

The following are excerpts from BNP Paribas’ report. The seven stocks below were rated “buy” by BNP Paribas, with the indicated stock prices being those at the time of publication:

1. China Sky ($2.09): It was able to raise its selling prices in 4Q07 to compensate for higher raw-material costs. The group’s expansion plans remain on track, suggesting a strong 2H08 when its production of super-resilient products commences. China Sky appears to be very close to concluding an earnings-accretive acquisition. Target price of SGD3.44.

(Update: On Jan 29, China Sky announced that it had entered into an agreement to acquire Qingdao ZhongDa Chemical Fibre Company Limited for RMB 450 m.)

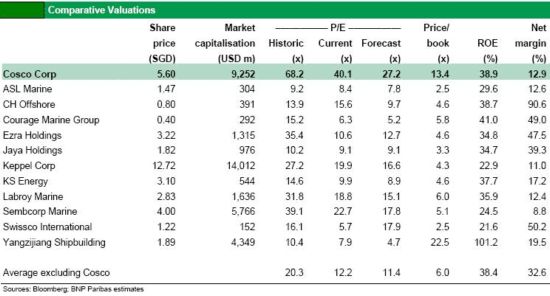

2. Cosco Corp ($5.60): It is a “compelling multi-year investment story.” It has undergone massive restructuring over the past decade, increasing the significance of its shipyard operations vis-à-vis its bulk-shipping operations.

Critical strategic success factors of market leadership, labour intensity, labour-cost advantage and location, which are almost tailor-made for its shipyard business. Target Price: $8.60.

3. CSE ($1.23): Recent checks with management suggest CSE is on track for a solid 4Q07. Besides continued strong order flow from theoil and gas sector, CSE should also benefit from:

a) potential penetration into new health-care cluster in the UK;

b) potential OEM partnerships with product companies; and

c) installation of more ERP gantries in Singapore.

Target Price: $1.79.

4. Datacraft (US$1.23): Despite turmoil in the finance sector due to subprime woes, our recent checks with management reveal that there has been no cutback on IT spending in Asia by its financial clients.

Goodwood Residence: A Kuwait fund paid $818.4 million for all the 97 four-bedroom apartments, or slightly over $3,000 psf, a record.

Goodwood Residence: A Kuwait fund paid $818.4 million for all the 97 four-bedroom apartments, or slightly over $3,000 psf, a record.Hence, we believe Datacraft remains on track for EPS growth of 20.5% in FY08. Dividend per share of USD0.063 (yield of 5.0%) to be paid out in March after AGM. Target price: USD1.60.

5. Golden Agri-Resources ($2.12): It has delivered rising earnings in the first three quarters of 2007; 4Q07 results should be even stronger, given higher crude palm oil prices.

Sector fundamentals remain promising and Golden Agri is among the best plays, being undervalued relative to peers despite ranking as one of Asia’s largest plantations. Target price of $3.00 offers 42% upside.

6. GuocoLand ($5.49): It is well-diversified, with a presence in Singapore, China, Malaysia, Vietnam and India. Despite the subprime credit woes and other cooling measures introduced by the government, its Goodwood Residence Phase 1 was snapped up entirely by a fund recently, before launch.

Target price SGD6.60 at 10% premium to its RNAV of SGD6.00.

7. Unisteel ($1.64): It should see a stronger 4Q07 (on a q-q basis), mainly on seasonal strength. We expect strong growth to resume this year driven by hard disc drive industry strength as well as contributions from JC Metal and several new customers. Expected lower raw-material costs this year should also help the group. Target price: $2.58.

Another 9 stocks were not rated by BNP Paribas while the 10th, Singapore Exchange ($12.72), was given a “reduce” recommendation.