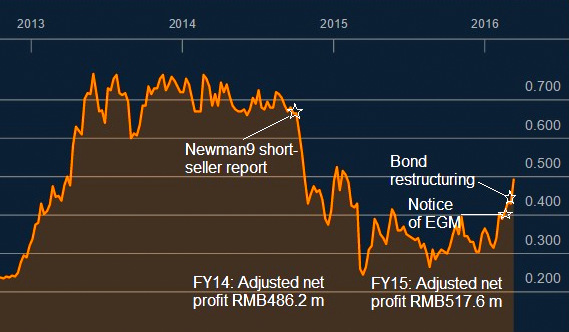

NextInsight infographics with Bloomberg chart.THE SHARE PRICE of Sino Grandness has surged 60% since end-January 2016 (from 30 cents to 51 cents). NextInsight infographics with Bloomberg chart.THE SHARE PRICE of Sino Grandness has surged 60% since end-January 2016 (from 30 cents to 51 cents). The fuel for that run is market expectation that the company is, in all probability, on the verge of submitting an application for the IPO of its beverage subsidiary, Garden Fresh, on the Hong Kong stock exchange. Sino Grandness has just passed two significant milestones on the road to that IPO -- an EGM that achieved shareholders' approval to dilute its interest in Garden Fresh, and an agreement with bond holders on how it would repay them. The next milestone is expected to be reached when Sino Grandness' external auditors complete their work (soon) on the FY2015 results. The audited accounts along with other documents are necessary for the IPO application. By then, the IPO journey could have clocked about 2.5 years. In this article, Loquat Fan traces the story of Sino Grandness which reaches far back to some 20 years ago when its CEO, Huang Yupeng, set up Sino Grandness. |

Founding of Sino Grandness

CEO Huang Yupeng aged 54 this year. NextInsight file photoFor 10 years, Huang Yupeng (黃育鵬) worked in a state-owned enterprise (“SOE”) in Shenzhen which exported canned fruits and vegetables to customers, mainly, in Europe.

CEO Huang Yupeng aged 54 this year. NextInsight file photoFor 10 years, Huang Yupeng (黃育鵬) worked in a state-owned enterprise (“SOE”) in Shenzhen which exported canned fruits and vegetables to customers, mainly, in Europe.

At the age of 35, he set up Shenzhen Grandness in 1997. Drawing on his past contacts, the business clinched many orders for canned vegetables from renowned overseas customers, including Lidl (which remains the largest export customer for the company today).

Just 12 years later, in 2009, a restructured entity named Sino Grandness was listed on the Singapore Stock Exchange. Its revenue the year before amounted to RMB330.3 m. Net profit was RMB52.7 million.

Although exports generated reasonable profit, Mr Huang saw limited growth potential in the West -- unlike the Chinese consumer market.

Beverage business

As successful beverage brands are lucrative, Mr Huang set his sight on this sector.

His first try, 八仙 V 动力 herbal drink, failed. The second attempt, mixed vegetable & fruit juice, suffered the same fate. He encountered resistance from major distributors who are usually tied to leading brands, and are reluctant to serve competing brands.

The first-ever loquat juice

Later, Mr Huang chanced upon the idea of making juice from loquats. In traditional Chinese medicine, loquats are used to make herbal remedies -- including syrups and soups -- for the relief of conditions such as coughs and sore throats.

As the loquat juice, branded "Garden Fresh" (鲜绿园), was the first of its kind and quickly gained acceptance by Chinese consumers, more and more distributors became willing to introduce it to major supermarket chains.

Sales growth

| Market share (%) from survey by | ||

| Frost & Sullivan |

Euromonitor |

|

| Garden Fresh | 78.2 | 86.1 |

| Furenyuan | 10.9 | 7.0 |

| Minzhong | 6.6 | 2.8 |

| Fujian Tianhai Diongfang | 3.9 | 2.5 |

| Others | 0.4 | 1.6 |

A survey conducted by Frost & Sullivan shows that in 2013 Garden Fresh had 78% of the loqaut juice market share.

Euromonitor, another market research firm, found that the market share rose to 86% in 2014.

Both surveys show that there are several brands other than Garden Fresh.

Fujian Tianhai Diongfang is the first company appointed to produce for Garden Fresh. Noticing the rising popularity of loquat juice, it decided to have its own brand.

Singapore-listed China Minzhong also entered the market but it could not gain significant market share. It is evaluating its dwindling presence in the loquat juice sector.

Major beverage players such as Tingyi, Uni-president, Huiyuan, have stayed away, probably because loquat juice would add little to their sales. Storing loquat puree extracted during the March-May harvest period for bottling year-round might also be another challenge they would rather not deal with.

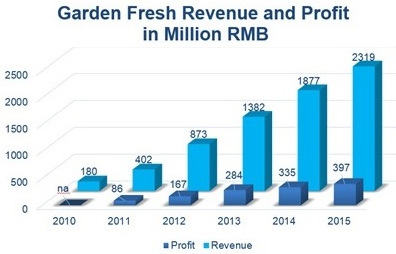

Foreign beverage players are absent from this market, as 81% of global loquat output is from China. With little competition, sales of Garden Fresh surged to RMB 2,319m in 2015, from RMB 180m in 2010, a13-fold increase.

With little competition, sales of Garden Fresh surged to RMB 2,319m in 2015, from RMB 180m in 2010, a13-fold increase.

The strong growth is by no means over. Loquat juice is still in the early phase of its product life cycle. Euromonitor has estimated that by 2019, retail sales of loquat juice could reach RMB 9,000m (equivalent to RMB 4,500m ex-factory).

As the dominant player, Garden Fresh should grab the lion's share of overall sales growth of loquat juice.

Garden Fresh's emphasis on developing a strong sales network as well as advertising & promotion has paid off. A&P expenses of Sino Grandness Group were RMB 360m in 2015, up sharply from RMB 200m in 2014 and RMB 60m in 2013.

The beverage business has been enjoying mid-to-high teens net profit margin despite intensive A&P.

High gross profit margin of Garden Fresh Garden Fresh's loquat beverages on the shelf of a supermart.

Garden Fresh's loquat beverages on the shelf of a supermart.

File photo.Competition in the beverage sector is intense, generally. For example, the fight for market share in the orange juice sector between Minute Maid (owned by Coca Cola) and Huiyuan drives gross profit margin down to around 30%.

Garden Fresh’s gross profit margin is above 40%, because of its dominant market share and higher retail price as fresh loquat fruits are sold as a premium fruit when compared to oranges.

Other loquat juice producers have also benefitted from the absence of competitive pricing. Minzhong used to fetch a high margin of 46%, before succumbing to 35% recently because of low production resulting in low economies of scale.

China National Research Institute of Food and Fermentation Industries

Garden Fresh has tied up with the China National Research Institute of Food and Fermentation Industries in product development.

Dr Liu Ling (刘凌), Director (hi-tech food engineering) of the Institute and holder of a Ph.D. in agriculture from the University of Tokyo, now sits on Sino’s board as an independent director.

Dr Liu’s predecessor on the board, Mr Zeng Ming, was the Institute’s deputy director of technology before he resigned to join Sino Grandness as its executive director in 2012.

The Institute and Garden Fresh have jointly developed beverages which blend loquat juice with juices of fruits such as mango and pear to appeal to more consumers. The mixed juices now account for a significant share of Garden Fresh sales.

Convertible bonds and Initial Public Offering

Garden Fresh issued zero-coupon 3-year convertible bonds of principal amount of RMB 100m in 2011 and another tranche of RMB 270m a year later, for funds to expand sales.

Bondholders were entitled to convert their bonds into Garden Fresh shares if the juice company listed with good valuation. They set high profit targets as conditions for conversion. They also imposed hefty high interest rates (25% for 2011 bonds and 20% for 2012 bonds) for redemption in the event that a listing does not materialise.

As fraudulent or reckless misrepresentations in initial public offering (IPO) are a criminal offence, the professionals managing the listing process of Garden Fresh took nearly two years to complete their due diligence, which included meeting with existing as well as former distributors in various provinces.

In the meantime, both bonds matured on 25 July 2015 without redemption. By end-2015, the redemption amounts for both bonds reached RMB 703m for the outstanding RMB 350.5m principal amounts.

On 23 Feb 2016, Sino Grandness secured shareholders’ approval at an EGM to proceed with the listing. Calling for an EGM was a strong indication that due diligence by the IPO professionals had been completed or was nearing completion.

| “By reducing the bondholders’ collective stake in Garden Fresh by 8.7 percentage points, Sino Grandness will pay RMB286 m in cash to them instead of issuing to them Garden Fresh shares that potentially could be worth RMB 518m in the market.” |

On 1 Mar 16, an agreement was reached for the redemption -- ie repayment in cash -- of 40% of both 2011 and 2012 bonds. The bondholders would also be given a 14.7% stake in Garden Fresh.

If instead of the cash redemption, the bondholders were repaid entirely with Garden Fresh shares, their stake would be 23.4% based on a valuation of RMB 1,500m set in 2011 when Garden Fresh was a start-up.

By reducing the bondholders’ collective stake in Garden Fresh by 8.7percentage points, Sino Grandness will pay RMB286 m in cash to them instead of issuing to them Garden Fresh shares that potentially could be worth RMB 518m in the market.

The bond agreement allows staggered repayments by Sino Grandness -- RMB 107m on 31 May 2016, and RMB 179m, at a much lower interest rate of 10%, on 28 Feb 2017.

Garden Fresh has been building up its juice production capacity and spending on A&P to enhance its investment merits on listing. It now has two operating factories (90,000-tonne in Sichuan in south-western China and 200,000-tonne in Hubei in central China). Another one (projected 240,000-tonne capacity) is currently being built in Anhui, in the eastern part of China.

(Garden Fresh's 2015 revenue was RMB 2,319m with approximately 50% being contributed by external factories).

Garden Fresh is also installing two lines in the existing Hubei base to produce juice in aluminium cans. In 2015, approximately RMB 147m was spent on fixed assets, and another RMB 596m pre-paid for work in progress which would be reclassified as fixed assets upon completion of construction.

Debut of Garden Fresh juice in Hong Kong

To familiarise the Hong Kong market with its products ahead of the IPO, Garden Fresh debuted its beverages in Hong Kong in late 2014. Distribution is undertaken by Hing Sang, a listed company involved in the manufacture and distribution of health products.

Garden Fresh's beverages are now sold in four retail chains -- Wellcome, 7-Eleven, ParknShop and Taste. Jardine Matheson owns Wellcome and holds the 7-Eleven franchise. The last two chains are owned by Hutchison Whampoa.

Entry of Thai investors

In late 2014, Sino Grandness issued an aggregate of 86m placement shares to Thoresen Thai Agencies (TTA, listed on the Bangkok Stock Exchange) and the PM Group. After share purchases in the open market, the two now have a combined stake of 14.3%.

TTA has undertaken to lock up 47.1m shares for ten years, and Mr Prayudh Mahagitsiri, the controlling shareholder of the two companies, is now the honorary chairman of Sino Grandness.

The PM group has a joint venture with Nestle that grows coffee in Thailand and manufactures 3-in-1 Nescafe.

Mr. Kamolsut Dabbaransi, Prayudh's son-in-law, is heading the newly-created F&B division in TTA. He had previously worked in Green Spot, a major beverage company in Thailand.

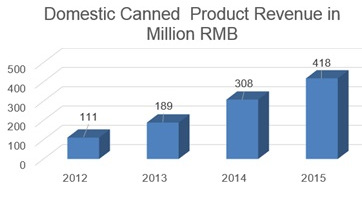

Grandness (振鹏达) fruits in glass containers In 2011, Sino Grandness ventured into selling canned fruits under the Grandness (振鹏达) brand in China.

In 2011, Sino Grandness ventured into selling canned fruits under the Grandness (振鹏达) brand in China.

In early 2013, Asdew Acquisition subscribed for 17m placement shares at 82 cents apiece (before adjusting for a subsequent stock split) as an investment in the Grandness brand.

Grandness has been achieving strong sales growth, with gross profit margins of around 40%.

Consumer confidence in Grandness products is high because fruits are visible as they are canned in glass, instead of metal, containers.

| ♦ Valuation of Garden Fresh | |

|

In 2015, Garden Fresh's net profit could be close to RMB 397m (excluding any non-cash adjustments), assuming a net margin of 17%. Gross profit margin was a high 44.3%, from 42.9% in 2014. A PE of 15 times historical profit will translate into a potential valuation of RMB 5,955m for Garden Fresh. The assumed 15 times PE is not excessive. Dali Food was listed on the Hong Kong Stock Exchange in Nov 2015 at 17 times its expected 2016 profit. Investors are likely to grant Garden Fresh a more favourable PE than Dali's 17 times given its dominance in the loquat juice sector, which is still fast growing. The economic woes in Europe saw Sino Grandness' exports dip to RMB 576m in 2015, from RMB 690m in 2013. The decline was more than offset by the robust growth in domestic sales, which accounted for 87% of the overall revenue in 2015.

Its balance sheet is strong. As at end-2015, equity was RMB 1,807m, against bank borrowings of RMB 130m and convertible bond liabilities of RMB 1,033m (vs RMB 703m payable on redemption). |

Previous article by Loquat Fan: SINO GRANDNESS: Whatever happened to its share price?

Very good write up that will benefit many investors.

You have my upmost respect.

I have never seen an analyst report better than this. Genius.