Recently, we visited The Trendlines Group in Israel. Below is our third report.

Our first was: TRENDLINES GROUP: Insights from our visit to Israel

Second: TRENDLINES GROUP: Case study of a star start-up (ApiFix)

The day may not be far off when patients who undergo surgery need not fret over scars from wounds that are sutured or stapled. The day may not be far off when patients who undergo surgery need not fret over scars from wounds that are sutured or stapled. IonMed in Israel has developed a technique for closing wounds that has been proven to be superior to suturing and stapling, as we learnt during our recent visit to The Trendlines Group in Israel. IonMed is one of 48 start-ups being incubated by Trendlines. Its innovative technique involves applying cold plasma (ionised helium gas) over a proprietary medical plaster (ChitoplastTM) placed on the wound, sealing the tissues, speeding up healing and disinfecting the wound. In trials in 2013, minimal scarring and zero infection were among the results for IonMed's "biowelding" technique to close skin openings arising from Caesarean sections. Founded in 2009 with Trendlines taking a significant stake, IonMed achieved the CE mark in Oct 2014 for sales in Europe. Recently, IonMed was able to extend the technique to skin grafts and is seeking CE clearance for this application. Next up is the treatment of skin diseases such as acne, and this looks like a massive market to service.  Shai Levanon, the CEO of IonMed, presenting to Singapore visitors recently. Photo by Leong Chan TeikAfter a recent round of fund-raising for IonMed, Trendlines' stake has been diluted to 28.8%. Shai Levanon, the CEO of IonMed, presenting to Singapore visitors recently. Photo by Leong Chan TeikAfter a recent round of fund-raising for IonMed, Trendlines' stake has been diluted to 28.8%.The value of the IonMed's innovation is not difficult to appreciate. Its addressable market is worth billions of dollars for the countless surgical wound closures and skin grafts that are carried out every year globally. The big payback for Trendlines will come when IonMed is acquired. In fact, there are three portfolio companies of Trendlines which have engaged investment banks to explore M&A opportunities. Trendlines has not specified if IonMed is one of them but given its relative maturity (five years of age) and its product development stage, it would not be a surprise if that is indeed the case.  @ the recent 6th Annual Trendlines Company Showcase where 10 Trendlines Group portfolio companies presented their stories to over 400 attendees (including investors) from all over the world. Read about them at Trendlines' website. Photo: TrendlinesCertainly, IonMed is a good example of the significant business value and the potentially wide impact of Trendlines as an incubator receiving Israeli government grants for developing promising start-ups. @ the recent 6th Annual Trendlines Company Showcase where 10 Trendlines Group portfolio companies presented their stories to over 400 attendees (including investors) from all over the world. Read about them at Trendlines' website. Photo: TrendlinesCertainly, IonMed is a good example of the significant business value and the potentially wide impact of Trendlines as an incubator receiving Israeli government grants for developing promising start-ups.We featured one such start start-up (Stimatix, which has developed a solution that dramatically enhances the quality of life of people who have undergone colostomy) in our pre-trip article (Heading to Israel to check out exciting innovations of TRENDLINES GROUP's portfolio companies) as well as in TRENDLINES GROUP: Case study of a star start-up (ApiFix) Listed on the Singapore Exchange in Nov 2015, Trendlines has 48 portfolio companies developing innovative medical devices and agri-tech solutions to achieve their stated goal of "improving the human condition". Now watch IonMed's CEO, Shai Levanon, present at a roadshow in the US ---> |

| Stock recovers 50% but still below IPO price |

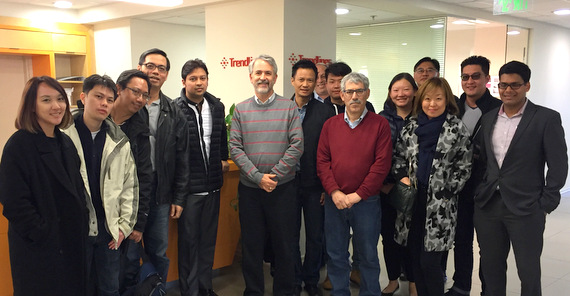

Recovering from the market downturn in Jan 2016, the share price of Trendlines Group has risen from a low of 14 cents (it happened on Jan 28 when we were visiting the company in Israel). It hit 21.5 cents this week for a 50% gain, valuing the company at just S$109 million. Following our visit, aside from media articles, DBS Vickers initiated coverage of the stock and pegged its one-year price target at 28 cents, based on 1.1x FY16F P/B. (See TRENDLINES: DBS initiates coverage with 28 c TP (74% upside) This is still below the IPO price of 33 cents when Trendlines listed on SGX in Nov 2015.  Singapore journalists, analysts and investors with Trendlines Group management. Photo: Trendlines Singapore journalists, analysts and investors with Trendlines Group management. Photo: Trendlines |