Cordlife closed recently at 91 cents for a market cap of S$236 m and a trailing dividend yield of 2.2%. Chart: Bloomberg.

Cordlife closed recently at 91 cents for a market cap of S$236 m and a trailing dividend yield of 2.2%. Chart: Bloomberg.THE RECENT SHARP fall in Cordlife's share price from a peak of $1.27 in late August has attracted a number of insiders to accumulate the stock.

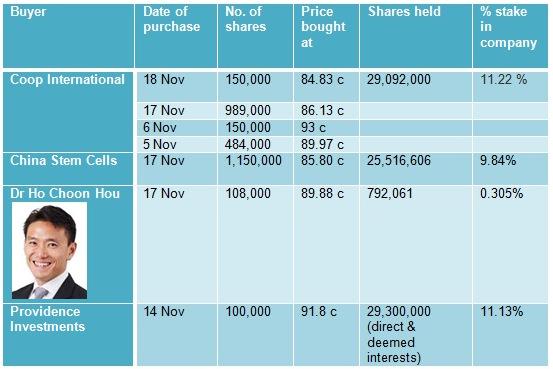

They include the chairman of Cordlife, Dr Ho Choon Hou (see table below).

The most enthusiastic buying came from Coop International, which is an investment vehicle of Bonvests Holdings.

The recent share price of 91 cents represents an upside of 43% to the target price of $1.30 of both Maybank Kim Eng and OSK-DMG.

On the flip side, substantial shareholder FIL Limited sold 100,000 shares -- by no means a significant amount -- on 31 Oct at $1.015 each, reducing its deemed stake to 23.262 million shares or 8.97%.

Private cord blood bank operator Cordlife has a presence in mature markets Singapore and Hong Kong and high growth markets like India, Indonesia and the Philippines.

Through strategic stakes in Stemlife and China Cord Blood Corporation (CCBC), Cordlife has exposure to Malaysia and China, respectively.

Stem cell isolation is a critical step in cord blood banking. It affects the number of stem cells that can be harvested or recovered from the cord blood. Photo: CompanyKey developments at Cordlife in recent months include:

Stem cell isolation is a critical step in cord blood banking. It affects the number of stem cells that can be harvested or recovered from the cord blood. Photo: CompanyKey developments at Cordlife in recent months include:» The purchase of convertible bonds of China Cord Blood Bank Corporation (CCBC),

» The grant of financing facility to Golden Meditech chairman so he can buy convertible bonds of CCBC.

» 1QFY15 results.

For more, read: @ CORDLIFE's EGM: Questions on loan repayment, China dream, etc