Time & date: 10 am, 17 Oct 2014

Time & date: 10 am, 17 Oct 2014Venue: NTU@one-north Executive Centre, 11 Slim Barracks Rise

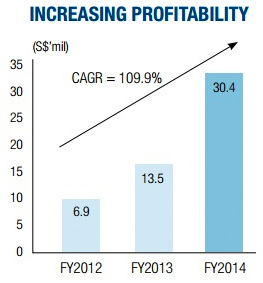

WHILE CORDLIFE's earnings in FY2014 had gone up 125% to S$30.4 million, a shareholder wanted management's comment on the cashflow (operating cashflow was positive S$3.753 million but cashflow from investing was negative S$13.517 million).

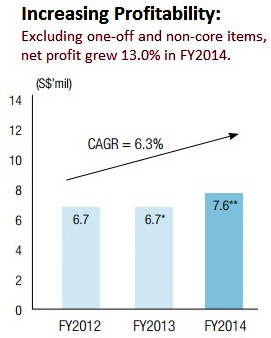

Jeremy Yee, CEO of Cordlife Group. NextInsight file photo.CEO Jeremy Yee placed the earnings figure in perspective by saying that it had two parts -- organic business growth of 13.0% to S$7.6 million and non-cash gains including a revaluation of its investment in China Cord Blood Corporation (CCBC).

Jeremy Yee, CEO of Cordlife Group. NextInsight file photo.CEO Jeremy Yee placed the earnings figure in perspective by saying that it had two parts -- organic business growth of 13.0% to S$7.6 million and non-cash gains including a revaluation of its investment in China Cord Blood Corporation (CCBC). (CCBC has exclusive rights to operate the cord blood banking business in Beijing, Guangdong and Zhejiang. CCBC also holds a 24.00% equity interest in Shandong Province Qilu Stem Cells Engineering Co. Ltd., the exclusive cord blood banking operator in the Shandong province.)

In pursuit of growth, Cordlife has deployed cash to invest in India, Indonesia and the Philippines, contributing to the 41% revenue growth of Cordlife in FY2014, he added.

In pursuit of growth, Cordlife has deployed cash to invest in India, Indonesia and the Philippines, contributing to the 41% revenue growth of Cordlife in FY2014, he added.The shareholder next asked: How long would it be before markets like India and Indonesia turn in positive cashflow?

Mr Yee said typically, a market could take 3.5-4 years for the "operating cashflow to meet up with the earnings" at which point the business would reach a steady state.

Steady state companies no longer exhibit growth. Hence, "cash cows are not necessarily great" because it will also mean that the firm would stop re-investing for growth. Without growth, the value of the stock should be at its maximum, he said.

The same shareholder, noting that Fidelity has bought shares in Cordlife, wanted to know if there was a particular buyer behind Fidelity or it's Fidelity itself which owns a 9.22% stake in Cordlife.

Saying that he has spoken regularly with Fidelity, Mr Yee noted that it is one of the biggest funds in the world with roughly US$4 trillion of assets under management and offices around the world.

Like many peers, Fidelity portfolio managers allocate some money to smaller companies and according to region -- and other criteria. "So you can't say there's someone behind the fund buying."

A shareholder asked if Cordlife's revenue could be broken down by geographical markets but Mr Yee said the information is not disclosed in order not that Cordlife's competitors may not make use of it.

A shareholder asked if Cordlife's revenue could be broken down by geographical markets but Mr Yee said the information is not disclosed in order not that Cordlife's competitors may not make use of it. "In India, for example, I am fighting against 20 other companies," he quipped.

To a shareholder's view that the share price of Cordlife had been affected by the company's subscribing for convertible notes of CCBC recently, Mr Yee pointed out that world markets had been falling in the light of various factors such as weak global economic growth and Ebola.

Instead, he said, Cordlife's investment in convertible notes enables it to plug further into China for growth prospects.

"Our annualised IRR in China is more than 50%. It doesn't make sense for me to retreat from China, right? The country is allowing people to have a second child in major cities such as Guangzhou, where CCBC has exclusive licence to operate, and in Beijing, where CCBC has exclusive contracts with 158 hospitals."

|

|

Cordlife's corporate presentation materials are here.

Recent story: Targets: CORDLIFE $1.55; CNMC GOLDMINE 84 cents