|

|

Credit Suisse initiates coverage of SIIC Environment with Outperform rating

Analyst: Trina Chen

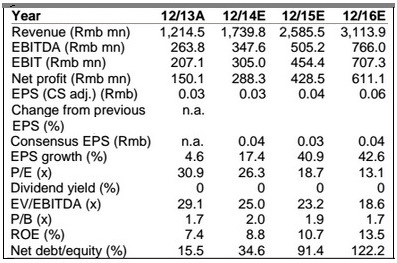

Source: Company data, Thomson Reuters, Credit Suisse estimates.We initiate coverage on SIIC with an OUTPERFORM rating and a target price (TP) of S$0.260. We view SIIC as an emerging consolidator in China’s water sector, with strong, potentially the strongest, growth profile.

Source: Company data, Thomson Reuters, Credit Suisse estimates.We initiate coverage on SIIC with an OUTPERFORM rating and a target price (TP) of S$0.260. We view SIIC as an emerging consolidator in China’s water sector, with strong, potentially the strongest, growth profile.As a local government SOE, with on-the-ground networks through its regional platforms, access to capital and a management team with a solid track record and focus on growth, SIIC has the right ingredients to capture the sector’s growth and M&A opportunities.

On an ex-construction income basis, the stock is at par with BEW (Beijing Enterprise Water) on 2014E (30x), yet becomes more attractive as operations ramp-up (2016-17E P/E is 10-16x, or a 25-40% discount to BEW).

Recent story: Kim Eng Says 'Buy' SIIC ENVIRONMENT; YONGMAO Net Profit Up 168%