Excerpts from analysts' reports

OSK-DMG says buy RH Petrogas despite no takeover offer

Analyst

Analyst: Lee Yue Jer, CFA (left)

RH Petrogas stated that based on an update from its controlling shareholder, there has been no further discussions or progress regarding the potential proposal which may lead to a takeover.

There have been, to-date, no receipt of any offer nor indication of terms.

While this may be negative for sentiment in the near term, we believe that RHP's assets, which are heavily weighted in oil resources, have a liquidation value of around SGD0.95 (translating into an NPV of USD6.70/barrel of oil equivalent) and should form a lower bound for valuation. Investors can look to reestablish positions if RHP's share price overreacts.

We continue to see near-term catalysts in a potential brownfield acquisition, for which project financing would be available and is potentially NPV-accretive.

Also, current geopolitical concerns over Iraqi oil supplies has pushed Brent crude to USD115/bbl, which is positive for RHP's oil revenues. Maintain BUY with unchanged SGD1.23 TP.

|

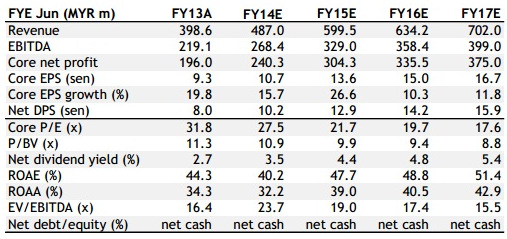

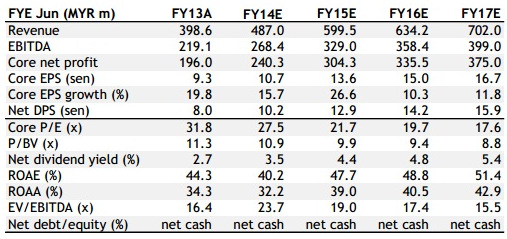

Maybank Kim Eng initiates coverage of Silverlake Axis with street-high $1.40 target

Analyst: Derrick Heng

Initiate at BUY with TP of SGD1.40.

Our DCF-based (WACC= 9.3%, terminal g= 3.0%) TP of SGD1.40 implies a 21% upside. Despite the strong 32% share price performance YTD, we expect the solid 16% FY6/14E-17E EPS CAGR to sustain its re-rating. Furthermore, the highly cash generative nature of its business should support rising dividends.

Reasons to be optimistic

§ Entrenched position in the huge addressable Asia-Pacific banking market. Ranked fifth in Asia Pacific and top 2 in Southeast Asia, we expect SAL to benefit from growing IT spending by banks (five-year CAGR= 6.8%). The ongoing drive to upgrade ageing core banking systems will continue to drive sales of its flagship product and allow it to monetize the large installed base of its products.

§ Strong momentum in software licencing: leading indicator for recurring income. Software licencing sales increased by 15% YoY in 9MFY6/14 and we expect this to translate into growing recurring income (FY6/14E: 43% of group revenue) over the next few years.

§ Strong capital management potential. With an ungeared balance sheet and sizeable war chest of more than MYR300m in cash, SAL could optimize their capital structure by announcing a special dividend or initiating a share buyback program.

Catalysts: Acquisitions by existing customers, new customers.

Risks: Key personnel departure, loss of customers, curb in IT spending by banks and removal of tax incentives.

|

Analyst: Lee Yue Jer, CFA (left)

Analyst: Lee Yue Jer, CFA (left)