Time & date: 1.30pm, 29 Apr 2014

Time & date: 1.30pm, 29 Apr 2014

Venue: Suntec City Convention Centre

Shareholder Frederic Tan wants to see more publicity efforts from World Precision Machinery that will boost its trading volume.

Shareholder Frederic Tan wants to see more publicity efforts from World Precision Machinery that will boost its trading volume.

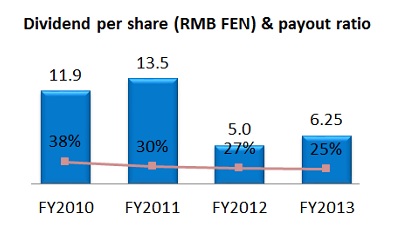

Photos by Charlotte Fu ON 2 JUNE, when World Precision Machinery pays its FY2013 final dividend of 1.25 SG cents per share, it would have handed out cumulative dividends, over the past 8 years, amounting to 1.5 times the IPO proceeds it received.

ON 2 JUNE, when World Precision Machinery pays its FY2013 final dividend of 1.25 SG cents per share, it would have handed out cumulative dividends, over the past 8 years, amounting to 1.5 times the IPO proceeds it received.

To date, it has declared dividends of Rmb 241 million (S$48.2 million) since its IPO in 2006.

In comparison, its IPO raised net proceeds of S$32.4 million (or S$37.8 million of gross proceeds).

At the company's AGM, independent director Lawrence Phang pointed out that many investors have been burnt by small-cap S-chips but World Precision stood out for its consistent dividend payout.

Non-executive Director Wang Weiyao is World Precision's controlling shareholder with a 67.35% stake.

Non-executive Director Wang Weiyao is World Precision's controlling shareholder with a 67.35% stake.

It has declared dividends for every one of the past 5 financial years.

An investor allotted with IPO shares issued by World Precision (known as Bright World back then) and who has kept them to this day would have collected about 12 cents a share.

However, there is a negative: The stock has low trading liquidity as only 18.8% of the company's shares are in public hands.

This, and a lack of frequent publicity about the company, may have affected the stock's valuation. Executive Chairman Shao Jianjun owns 13.5% of World Precision.It is currently trading at 36 cents, the same as its IPO issue price.

Executive Chairman Shao Jianjun owns 13.5% of World Precision.It is currently trading at 36 cents, the same as its IPO issue price.

As a manufacturer of precision stamping equipment, World Precision has benefited from China's growing demand for automobiles and white goods.

During 1Q2014, China's production of automobiles was up 9.2% year-on-year at 5,891,700 units.

The following are highlights from World Precision's 1QFY2014 financial results, posted one day after the AGM.

* Net profit was up 30.0% year-on-year, at Rmb 28.2 million

* Gross profit margin improved by 2.2 percentage points to 31.2%

* Order book was Rmb 101.6 million as at 25 April 2014, a 7.4% increase quarter-on-quarter.

Click here for its full set of 1QFY2014 financial results.

Independent director Lawrence Phang pointed out that World Precision has paid more dividends to-date compared to its IPO proceeds.

Independent director Lawrence Phang pointed out that World Precision has paid more dividends to-date compared to its IPO proceeds. CEO Wu Yufang.Below is a summary of questions raised at the AGM and the replies provided by its board of directors.

CEO Wu Yufang.Below is a summary of questions raised at the AGM and the replies provided by its board of directors.

Q: Are there efforts to improve the trading liquidity of World Precision shares?

Shao Jianjun: Our machinery manufacturing business has done very well over the past 8 years, and we have been profitable every year.

We are one of China's top 3 players in equipment manufacturing, and with a massive scale of operations.

Unfortunately, our stock price has been dragged down by the bad name surrounding other S-Chips.

We consider World Precision shares undervalued, based on its current share price.

We will consider doing placement exercises when our market valuation improves, so that more people can participate in our success.

Independent Director Cheng Hong.Q: What checks and balances are in place to allow independent directors to be effective as whistle-blowers, if the need arises?

Independent Director Cheng Hong.Q: What checks and balances are in place to allow independent directors to be effective as whistle-blowers, if the need arises?

Lawrence Phang: Nexia is our internal auditor. They visit our factories frequently. They were at our factories just last November.

The board's audit committee meets Nexis regularly and we have obtained good reports about the company.

Baker Tilly is our external auditor.

Most people are concerned about the audit integrity of China companies. Yet, neither our internal nor external auditors has ever picked up any major audit issues with us.

Mr Wang and Mr Shao are Singapore permanent residents while the 3 independent directors are Singapore citizens.

The independent directors have visited the company's China facilities many times over the years.

I have met many Chinese companies in the course of my work over the years and I feel that World Precision is among the better ones.

Recent story: WORLD PRECISION: To Sustain Margins In 2H2013, Overseas Marketing In 2014