Excerpts from analysts' reports

NRA Capital pegs Chip Eng Seng's fair value at $1.04

Analyst: Joel Ng (left)

Analyst: Joel Ng (left)

NRA Capital pegs Chip Eng Seng's fair value at $1.04

Analyst: Joel Ng (left)

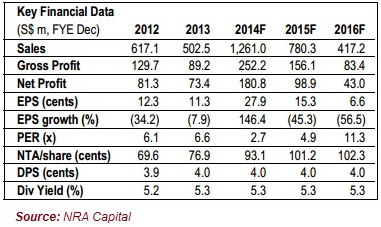

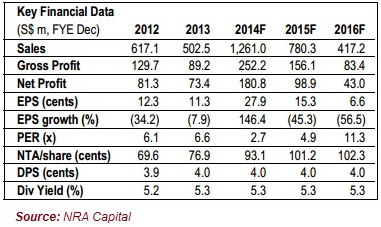

Analyst: Joel Ng (left)We re-initiate coverage with an Overweight recommendation and a S$1.04 fair value, based on SOTP of its property development and construction business. We value its construction business at 6x FY14 PER, in line with its peers in the construction sector.

Meanwhile, we apply a 30% discount to RNAV (property development, property investments and hotel).

Meanwhile, we apply a 30% discount to RNAV (property development, property investments and hotel).

Furthermore, it has consistently paid out 4 Singapore cents dividend over the last four years, this implies an attractive 5.3% dividend yield at current prices.

Record revenues to be recognised this year. As per IFRS 115, the group will recognise revenues and related costs upon TOP for 3 projects in FY14.

They include Alexandra Central, Belvia, and 100 Pasir Panjang and which we estimate would contribute around 65% of the record S$1.3b revenues in FY14. It will also fully recognise 40% of profits from Belysa.

Riding on firm Australian property demand. It successfully launched its first property in Australia back in 2012 with the 33M at 33 Mackenzie Street, Melbourne and is currently developing Melbourne’s tallest CBD residential building – the Tower Melbourne. The 71 floors Tower Melbourne was 99% sold as at the end of 4Q13. The group is expected to launch another new development project in Doncaster, Australia this year.

Hotel business to provide recurring revenues. Its hotel at Alexandra Central is expected to be completed in mid-15 and will begin to provide a steady recurring revenue stream to the group from 2H15 onwards.

Although we estimate it will provide only around 5-10% of total group revenues in our forecast period, we believe it is a milestone for the group’s effort to diversify into the hospitality sector.

Construction business still healthy. Its construction business remains a stable business with a healthy order book of S$520m as at end 4Q13.

Although order book is slightly lower than the S$575m as at end 4Q12, the group should benefit from the S$5.2bn-S$5.5bn building works estimated for 2014 by the Building and Construction Authority of Singapore (BCA). In the medium to long term, as the supply-demand balance stabilises, the government is expected to moderate its building program but remains committed to providing 700,000 new homes by 2030. This should still continue to benefit Chip Eng Seng.

See forum discussion here.

Although order book is slightly lower than the S$575m as at end 4Q12, the group should benefit from the S$5.2bn-S$5.5bn building works estimated for 2014 by the Building and Construction Authority of Singapore (BCA). In the medium to long term, as the supply-demand balance stabilises, the government is expected to moderate its building program but remains committed to providing 700,000 new homes by 2030. This should still continue to benefit Chip Eng Seng.

See forum discussion here.

OCBC Inv Research maintains buy call on Sheng Siong Group

Analyst: Yap Kim Leng

CEO Lim Hock Chee.

CEO Lim Hock Chee. NextInsight file photoMargin improvement drives 1Q14 results Sheng Siong Group’s (SSG) 1Q14 revenue increased by 5.7% YoY to S$190m, forming 26.3% of our FY14 forecast.

This is within expectations as 1Q results are typically stronger due to Chinese New Year.

As a result of better gross profit (GP) margin, 1Q14 operating profit increased proportionally higher by 20.7% to S$12.5m (vs. 5.7% YoY increase in revenue), forming 29.0% of our FY14 forecast.

GP margin improved from 22.5% in 1Q13 to 23.8% in 1Q14, which we identify as the key driver for the significant YoY increase in operating profit as COGS made up 82.1% of operating costs in the quarter.

We see limited downside to the share price at the last close of S$0.60 as FY14F dividend yield at 4.8% is expected to lend strong support.

Maintain BUY with fair value estimate of S$0.68.