The current market price of gold at the US$1,330 level per oz is far higher than the all-in production cost of US$761 per oz achieved by CNMC in 4Q2013. Chart: www.nasdaq.com LAST YEAR, GOLD suffered its biggest annual drop in price in over 3 decades but has made an 11% or so recovery since the start of this year (see chart).

The current market price of gold at the US$1,330 level per oz is far higher than the all-in production cost of US$761 per oz achieved by CNMC in 4Q2013. Chart: www.nasdaq.com LAST YEAR, GOLD suffered its biggest annual drop in price in over 3 decades but has made an 11% or so recovery since the start of this year (see chart).This recovery, if sustained, will directly benefit CNMC Goldmine Holdings as the gold it extracts from its concession area in Kelantan, Malaysia, will fetch higher market prices than in recent months.

CNMC has another positive going for it this year: It will be able to raise its production of gold and will enjoy greater economies of scale as a result. Its production facilties have expanded sharply since 3Q2013 and will be further expanded this year.

CNMC started operating its second leach yard in 3Q2013 and its third leach yard will come on stream sometime this year.

The second yard raised the leaching capacity of CNMC from 70,000 tonnes to 210,000 tonnes per cycle.

The impact is evident in the 4Q2013 results:

> Production of fine gold rose by 335.6% y-o-y to 5,813.26 ounces.

> CNMC’s revenue from the sale of fine gold surged 230.8% to US$7.38 million.

CNMC Goldmine CEO Chris Lim at a briefing on the FY2013 results. With him is CNMC vice chairman Peter Choo Chee Kong.

CNMC Goldmine CEO Chris Lim at a briefing on the FY2013 results. With him is CNMC vice chairman Peter Choo Chee Kong.Photo by Leong Chan TeikBoosted by its strong 3Q and 4Q performance, CNMC's net profit attributable to shareholders for the full year 2013 jumped 260% to US$2.7 million.

CNMC proposed a final dividend of 0.1 cent a share.

In December 2013, it had declared a 0.1 cent interim dividend and paid it in Jan 2014.

These are the first ever dividend payouts by CNMC since its listing in 2011.

While management could not commit to a dividend payout ratio, it indicated that it would continue to pay dividends when asked at the FY13 results briefing last week.

Voyage Research analyst Liu Jinshu, in a report dated 3 March, said he expected CNMC to grow its net profit by 240% in FY14, boosted by the start of operations of the third leach pad from 2Q or 3Q this year.

"We maintain our valuation of CNMC at S$0.800 per share," he said. In comparison, CNMC stock price currently trades at the 25-cent level.

"The key change to our model is a revision of cost of equity to 10.9% versus 11.5% previously.

"We are of the opinion that the company’s risk profile has improved based on its realized production levels, financial performance and dividend policy. As such, a lower cost of equity is justified."

FY13 results briefing at CNMC's office in Toa Payoh. Photo by Leong Chan Teik

FY13 results briefing at CNMC's office in Toa Payoh. Photo by Leong Chan TeikHere are some of the questions raised by investors at the FY13 results briefing and answers given by senior management.

Q: Your 10-sq km concession in Kelantan -- how long can it last?

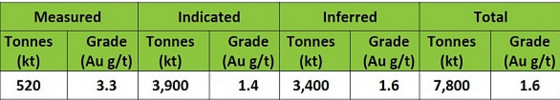

CEO Chris Lim: As at end-2012, we had 7.8 million tonnes of ore. Assuming we process 1 m tonnes a year, that would translate into 7.8 years of mining work.

We didn't do much exploration last year as we focused on gold production. This year, we want to grow our reserves and resources.

I'd like to emphasise that we are doing a lot of exploration work to discover more gold reserves, which will extend our mine life.

Total gold mineral resources at the Sokor Gold Project was 7.8 million tonnes as at end-2012. At 1.6g/tonne, the ore contained 410,000 ounces of gold.

Total gold mineral resources at the Sokor Gold Project was 7.8 million tonnes as at end-2012. At 1.6g/tonne, the ore contained 410,000 ounces of gold. Q: What is the duration of your licence from the Kelantan government?

Chris: It's 10 + 21 years and it started in 2008. After it expires in 2018, it's renewable for another 21 years. Yes, there will be cost and it's spelt out in the Mineral Development Act of Malaysia.

Previously, we paid slightly under RM1 million for 10 years.

Vice-chairman Peter Choo: Aside from that, we are paying royalty to the government. Last year, the royalty amounted to nearly RM5 million.

Q: Is there a peak season for production?

Chris: The monsoon season from mid-Nov to Feb affects our mining work as it's dangerous to work when it's raining and slippery. During that period, our workers will do maintenance work on equipment.

Q: Your all-in production cost in 4Q was US$761 per oz while the global industry average was US$1,200. Why?

Peter: It's a lot cheaper to produce in Malaysia. And our mine is easy to access. As an indication, you can fly from Singapore in the morning to the mine and return home by midnight.

Chris: In Australia, for example, the labour cost is very high and there are many regulations to comply with. And some companies do underground mining -- the deeper you go, the higher the cost of extraction. But we are doing open-pit mining.

Q: In Malaysia, who are your competitors?

Chris: We don't have competitors in the same way that Samsung and Apple compete for the same customers. The beautiful thing is we can sell what we produce -- and what we produce can be immediately sold, so we don't have marketing cost, no warehouse, no stock.

Q: Gold price has been volatile. Do you plan to hedge against the volatility?

Chris: We have no plans yet -- we are a production company and not a gold trading company.

What we like to do is to lower further our all-in production cost. We are working towards US$700 per oz.

Q: In your financial statements, the expenses in several areas have jumped. Can you explain that?

Chris: Royalty fees have gone up because of an increase in production. There's a percentage formula.

As for employee compensation, we gave them bonuses for reaching certain milestones last year. Our on-site crew worked very hard. We have 230-250 people on-site -- part-timers, full-timers and our drilling contractor.

Professional fees -- these are for independent consultants to do mineral resource estimates, etc. Such work doesn't come cheap.

CNMC's financial statement is available on the SGX website.

Recent stories: