RIGHTS ISSUES have been common occurrences on the Singapore Exchange: On average, more than 3 rights issues took place a month in the last 12 months.

RIGHTS ISSUES have been common occurrences on the Singapore Exchange: On average, more than 3 rights issues took place a month in the last 12 months.These corporate exercises result in changes in the stakes of existing shareholders, depending on whether they agree, or do not agree, to contribute to the fund raising.

If they do, and contribute in proportion to their shareholding percentage, their shareholding percentage stays unchanged.

If they had 0.11% per cent equity stake, for example, their shareholding would stay at 0.11% after shares are issued to them upon payment of the subscription monies.

If instead they sell off their alloted rights, their shareholding percentage will be reduced.

The latter event, ie a reduction in shareholding, would in due course be announced by the company they are substantial shareholders (ie someone who owns 5% or more of the equity stake of the company).

However, the announcement would come a week or two after the disposal -- ie, after the deadline has passed for entitled shareholders to hand over their subscription money.

This lateness in announcement stands in stark contrast to the Companies Act requirement which applies to ordinary transactions of shares by substantial shareholders. It requires:

1. A shareholder to disclose his direct and indirect interests in shares of the company when his stake crosses 5% of the company’s outstanding shares; and the disclosure should be made within two business days after crossing the 5% threshold. 2. Thereafter, the substantial shareholder has to disclose a change in his shareholding (discrete level of 1%) within two business days from the event that gives rise to the change. Reference here. |

A NextInsight reader has pointed out to us that, during a rights issue exercise, substantial shareholders are not required to disclose significant dealings in the provisional allotment of rights shares -- even if such actions affect their shareholding percentages significantly or lead to their ceasing to be substantial shareholders.

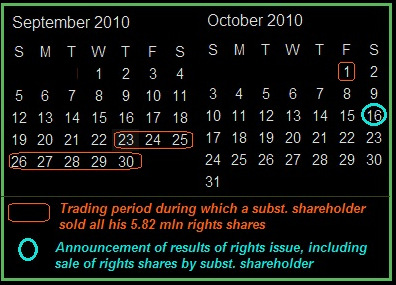

He cited the case of Sinwa Limited's rights issue exercise in 2010, for which the provisional allotments of rights shares were traded between 23 Sept 2010 and 1 Oct 2010.

He cited the case of Sinwa Limited's rights issue exercise in 2010, for which the provisional allotments of rights shares were traded between 23 Sept 2010 and 1 Oct 2010."A substantial shareholder sold all his allotments, and this fact only came to light on 16 Oct 2010, when the results of the rights issue were announced," said the reader (see illustration on the right).

"Only then did the market come to know that this substantial shareholder had sold all his 5.82 million alloted rights, resulting in him ceasing to be a substantial shareholder after the completion of the rights issue exercise."

The reader contends that the Companies Act should require substantial shareholders to report any significant transaction involving alloted rights in a timely fashion, which is to say within the same time frame they would have to make the disclosure after dealing in ordinary shares.

The same principle should apply: Timely notification of such changes is necessary for a fair, efficient and transparent market.

Submission of Form 3 under the Securities & Futures Act (Cap. 289) is required under Section 135 to 137F where, in general, notice must be given to the company within 2 business days after the major shareholder becomes aware of the change of his shareholdings.

The word "becomes aware" therefore can be abused by the shareholder because that person can say that he is not aware of the change.

The rights is not a share until it is officially allotted and deposited with the CDP, and SGX may need to review its rules regarding rights allotted to and disposed of by major shareholder.