Riverstone executive chairman and CEO Wong Teek Son (seated) fields questions from analysts and fund managers after the formal Q&A session and presentation for the FY13 results.

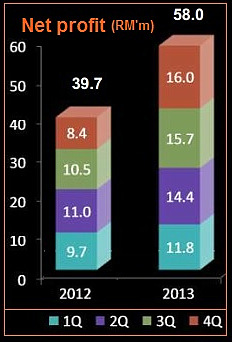

Riverstone executive chairman and CEO Wong Teek Son (seated) fields questions from analysts and fund managers after the formal Q&A session and presentation for the FY13 results. Photo by Leong Chan TeikRIVERSTONE HOLDINGS surprised with its 4Q2013 profit jumping 91% to RM16.0 million, a historical quarterly high.

FY2013 profit of RM58.0 million was, well, another historical high on record revenue of RM357.9 million.

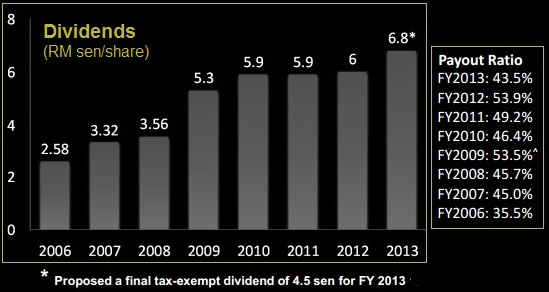

And the Malaysian-headquartered glove manufacturer proposed a final dividend of 4.5 RM sen a share, lifting the total for the year to 6.8 sen -- yes, another historical high.

With performance of this calibre, investors have bid up the stock to a historical closing high of 80 cents, translating into a trailing PE of 12.9X.

This is one business that has other lovable attributes:

> Positive free cashflow since listing in 2006.

> A higher dividend every year since listing.

> Expansion of production capacity translating into both higher revenue and profit.

More music to the ears of the analysts and fund managers at a briefing last Friday (Feb 27) took the form of management's projection that the cashflow from operations is expected to be strong enough to fund the next 2 phases of capacity expansion.

In other words, there's no pressing need to raise money from shareholders or banks -- and Riverstone will maintain its cherished debt-free status.

Riverstone's CEO and CFO travelled from their Kuala Lumpur HQ to brief analysts and fund managers at NTUC Centre, Marina Boulevard, last Thursday. Photo by Leong Chan Teik

Riverstone's CEO and CFO travelled from their Kuala Lumpur HQ to brief analysts and fund managers at NTUC Centre, Marina Boulevard, last Thursday. Photo by Leong Chan Teik Here are some highlights of the Q&A session:  Q: What was the utilisation rate for 4Q last year and how much more can you grow? Q: What was the utilisation rate for 4Q last year and how much more can you grow?Wong Teek Son, chairman: We achieved 90% in 4Q and we probably can go up to 92%. Last year, we produced 2.66 billion gloves and are targeting 3.4-3.5 billion this year. Last year, 69% of gloves we sold were for the medical sector while 31% were for the clean room sector. This split was consistent throughout the year. In terms of revenue, the split was 49-51%, respectively. In terms of gross profit, it was 30-70% SP Lim, CFO: The average gross profit margin for 2013 rose from 23.1% to 27.3% because of lower raw material pries and a more favourable USD-RM rate. Q: What was the trend in average selling prices? Wong: For clean room gloves, the price was maintained but for healthcare gloves, the prices were reduced slightly because of lower raw material prices and competition. Competition has always been there but it seems to be getting tougher and tougher. Q: What's the capex for this year? Wong: For 2014/2015, the capex for phase 1 of the expansion is RM72 million. For Phase 2, in 2014/2015, it is RM50 m. Q: With more capex, will you be able to maintain your dividend payout ratio? Lim: I don't see why not if the results continue to be as good or even better. We have had internal cashflow funding our expansion in the past but we may use external financing to leverage a bit. Wong: Our target is a 45% payout ratio. Q: You have about RM80m cashflow every year and cash in hand, so it means you don't have to borrow money? Wong: When we plan our expansion, we get bank approval first and whether we draw down the money depends on whether we need it. It's a reserve. Even for phase 2, we estimate that our cashflow will be enough for it, unless we have collection problem for our trade receivables.  Riverstone has been paying higher dividends every year since its listing in 2006. Riverstone has been paying higher dividends every year since its listing in 2006. CFO Lim Sing Poew: Photo by Leong Chan TeikQ: Can you update us on the new Taiping plant that will open soon? CFO Lim Sing Poew: Photo by Leong Chan TeikQ: Can you update us on the new Taiping plant that will open soon?Wong: The first line will be commissioned in July. Then it's 1 new line a month. In total, there will be 6 lines under the first phase. Lim: We are going into Phase 2 and target to complete the building by the end of this year. Q: There's a lot of expansion going on in the industry. What will you do to cope with an oversupply challenge? Wong: Most of the expansion in Malaysia is for medical gloves. Currently, the competition is on pricing and there are factories that do not have enough orders to run. For us, this is not an issue: In Jan, Feb, March, we have more orders than we can produce. From the first day we entered this healthcare segment, we have focused on customised products. We value-add, so customers are willing to pay a slight premium for them. Q: A basic question: What is the price difference between clean room gloves and healthcare gloves? And if there is a lot of capacity in healthcare, what barriers are there to a competitor switching to clean room? Wong: Clean room gloves protect the products from being contaminated while being handled while healthcare gloves are for personal protection. Clean room gloves are produced through 3 processes while healthcare gloves, only 1 process. In terms of selling price, clean room gloves are 2.5-3X higher. To convert from healthcare, it is not easy -- it's not just the facilities but also the compound formulation. Click below for NextInsight's video of Riverstone's production facilities in Taiping PowerPoint presentation for FY2013 results can be downloaded here. Recent story: RIVERSTONE: Record 3Q profit, on track for all-time high full-year earnings |