This article was recently published on Ernest Lim's blog, and is republished with permission.

This article was recently published on Ernest Lim's blog, and is republished with permission.

I TOOK A look at China Sunsine around 4Q2012 but decided to give it a miss due to its weak operating business conditions. One savvy investor friend of mine recently suggested that I take another look at it.

Description of Sunsine

According to its annual report 2012, Sunsine is the largest producer of rubber accelerators in China and, probably, the world.

It serves all the global top 10 tyre manufacturers such as Bridgestone and Michelin and top local tire companies such as Hangzhou Zhongce, and GITI Tire.

In fact, out of the top 75 tyre manufacturers in the world, about 55% are Sunsine's customers.

Please refer to Sunsine’s website for an overview of its products.

Investment merits

Likely turnaround play

With reference to Table 1, Sunsine has been reporting improving results for the past three quarters.

In fact, 9MFY13 net profit of RMB59.2m was 85% higher than the entire FY12 net profit of RMB32.0m.

In its latest 3QFY13 press release, Mr Xu Cheng Qiu, Executive Chairman, said the company is confident of its growth and outlook for the next 12 months. This is the strongest statement made in the past few quarters.

Why FY14F results may be better:

Rubber accelerators in powder form being packaged by Sunsine workers wearing safety masks. NextInsight filephoto Firstly, Sunsine’s 4,000 ton DPG plant (accelerator) at Weifang started commercial production in Sep 2013.

Rubber accelerators in powder form being packaged by Sunsine workers wearing safety masks. NextInsight filephoto Firstly, Sunsine’s 4,000 ton DPG plant (accelerator) at Weifang started commercial production in Sep 2013.

Secondly, Phase 1 of its project in Dingtao Economic Development Zone will have seen the construction of a plant to produce 10,000 tonnes of insoluble sulphur a year by end 2013.

These should contribute in 2014.

Thirdly, any increase in the average selling price, or sales volume, or reduction in raw material costs in 2014 is likely to bode well for Sunsine too.

Dividend yield of approximate 4%

The company has been giving dividends per share of $0.01 for the past four consecutive years, even in years with poor performance.

It is likely to continue this practice. At Friday’s closing price of $0.255, this represents a yield of around 3.9%.

Sunsine expects to report 4QFY13F results on 26 Feb 14.

Decent valuations

Sunsine trades at 0.7x P/BV and annualised 2013F PE of around 7.5x. Net asset value per share is around $0.350.

Investment risks

Illiquidity

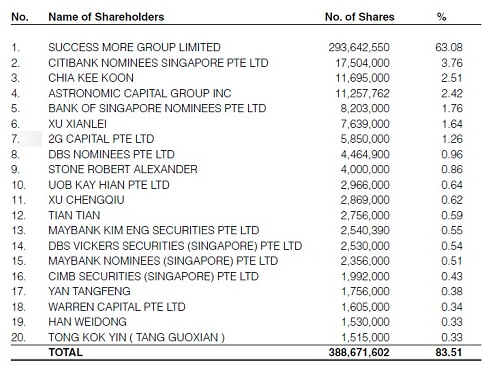

With reference to Figure 1 below, the top twenty shareholders have about 83.5% of Sunsine’s outstanding shares.

Thus, there is little free float, which results in its illiquidity. Average 30-D and 100-D volume amount to 1.19m shares and 422K shares, respectively. This is not a liquid company which investors can enter or exit quickly.

S chip risk

Sunsine executive chairman Xu Chengqiu,70. NextInsight file photo This is a Chinese company helmed by Chinese management, hence the usual S chip risk applies.

Sunsine executive chairman Xu Chengqiu,70. NextInsight file photo This is a Chinese company helmed by Chinese management, hence the usual S chip risk applies.

No analyst coverage

According to Bloomberg, there is currently no rated analyst coverage on this stock. It is reasonable to say that the investment community is not familiar with Sunsine.

In addition, its small market capitalization of S$119m precludes some funds from taking a position in it.

Exposed to the vagaries of the automotive industry cycle

As Sunsine’s products are used mainly by the tyre manufacturers, Sunsine is exposed to the vagaries of the automotive industry cycle in China.

China auto sales rose 13.9% in 2013 vs 4.3% in 2012.

According to a China Association of Automobile Manufacturers (“CAAM”) estimate released in January, auto sales will grow at the same pace in 2014.

However, it is noteworthy that car sales in China inched up only 6% in January 2014 compared to January 2013.

Margins dependent on raw material cost

Most of Sunsine's cost of sales come from direct raw material costs, namely aniline.

According to Sunsine’s AR2012, ceteris paribus, every 10% increase in the price of aniline would have the effect of decreasing the net profit by RMB24.3m in FY12.

As such, raw material costs do play a significant role in Sunsine’s profitability.

Other developments

Firstly, Sunsine announced on 17 Dec 2013 that they have formed a new subsidiary called Shanxian Sunsine Hotel Management Co., Ltd to make a strategic long term investment in the hospitality sector in Heze City.

Management emphasised that they do not intend to manage the property on their own and will appoint a suitable hotel management company to manage this investment.

Secondly, Sunsine announced on 30 Dec 2013 that it has formed a new subsidiary called Shanxian Guangshun Heating Co., Ltd to set up a centralised heating company (“CHC”) to produce steam for internal usage and to supply to all the companies in the Shanxian Chemical Industrial Zone (“SCIZ”) at market rates.

(It is noteworthy that users of steam pay the charges upfront before usage).

For electricity which is a by-product of steam generation, the State Grid will purchase it from the CHC.

Sunsine’s decision to set up the CHC arises because the local government has indicated to Shandong Sunsine (Shandong Sunsine accounts for more than 50% of the total consumption by all companies in the SCIZ) that either it sets up and operates the CHC, or provides financial assistance and/or guarantee to any third party which undertakes the operation of the CHC.

After a feasibility study, Sunsine management believes that it is in the best interest for the company to set up the CHC on its own. Personally, pending more information from the company, this seems to be an interesting cash flow generating investment over the medium term.

Management will provide more details on the above developments in due course. For more details, please view the announcements on SGX website. Sunsine stock has traded in the 20-30 cent range for the last 5 years. It offers a trailing dividend yield of 3.9%. Chart: FT.com

Sunsine stock has traded in the 20-30 cent range for the last 5 years. It offers a trailing dividend yield of 3.9%. Chart: FT.com

Sunsine’s chart analysis

Sunsine has appreciated about 49% from $0.205 on 23 Dec 2013 to an intraday high of $0.305 on 22 Jan 2014 on the back of an increase in volume. The recent profit taking which saw it drop to a low of $0.225 on 13 Feb 2014 was accompanied by low volume. It closed last Friday at $0.255.

The trend seems to be up as evidenced from the rising moving averages. In addition, the moving averages have made golden crosses in Jan 2014 which further support the uptrend observation.

Supports and resistances are as follows:

Supports: $0.245 / 0.235 / 0.225 – 0.230

Resistances: $0.265 / 0.275 – 0.285 / 0.305

Conclusion – This is just an introduction

Sunsine seems to be on the cusp of a recovery based on its results from the preceding three quarters, coupled with decent valuations (NAV / share is $0.350) and dividend yields amounting to around 4%.

Nevertheless, this is an S chip which is subject to S chip risk, fluctuations in raw material prices and the vagaries of the automotive industry cycle in China.

Readers who are interested should take a look at its website and AR2012 for more information.

China Sunsine reports 4QFY13F results on 26 Feb. A results briefing will be held on 27 Feb.

Previous story: CHINA SUNSINE’S TAO Of Management

An investor has provided us the info: http://www.sunsirs.com/uk/prodetail-258.html

Is there a listed peer we can compared with ?

Aniline as a raw material has a lot of impact on profitability. Is the price stable, or trending up / down? Is there a website that tracks aniline price? I can't find any after a brief search on Google.