Excerpts from analysts' reports

CIMB says catalysts for ASL Marine could come from "shipbuilding orders and earnings strength"

Analyst: Yeo Zhi Bin

ASL Marine's shipbuilding division had to do a provision of $4.7m due to engineering and design faults. NextInsight file photo1HFY14 core net profit of S$7.1m (+12% yoy) formed 48% of our FY14 forecast and was slightly below expectations. 2QFY14 made up 20% of our FY14 forecast. The negative deviance stemmed from higher taxes and shipbuilding losses. We lower our FY14 EPS by 4% to factor in the weaker set of results and cut our FY15-16 EPS by 16% as we scale back our profitability expectations.

ASL Marine's shipbuilding division had to do a provision of $4.7m due to engineering and design faults. NextInsight file photo1HFY14 core net profit of S$7.1m (+12% yoy) formed 48% of our FY14 forecast and was slightly below expectations. 2QFY14 made up 20% of our FY14 forecast. The negative deviance stemmed from higher taxes and shipbuilding losses. We lower our FY14 EPS by 4% to factor in the weaker set of results and cut our FY15-16 EPS by 16% as we scale back our profitability expectations.

Viewing 2Q execution issues as one-offs, we maintain our Add call with a slightly lower target price, still pegged to 0.9x CY14 P/BV or its 5-year mean. Catalysts could come from shipbuilding orders and earnings strength. Target price: 89 cents.

CIMB says catalysts for ASL Marine could come from "shipbuilding orders and earnings strength"

Analyst: Yeo Zhi Bin

ASL Marine's shipbuilding division had to do a provision of $4.7m due to engineering and design faults. NextInsight file photo1HFY14 core net profit of S$7.1m (+12% yoy) formed 48% of our FY14 forecast and was slightly below expectations. 2QFY14 made up 20% of our FY14 forecast. The negative deviance stemmed from higher taxes and shipbuilding losses. We lower our FY14 EPS by 4% to factor in the weaker set of results and cut our FY15-16 EPS by 16% as we scale back our profitability expectations.

ASL Marine's shipbuilding division had to do a provision of $4.7m due to engineering and design faults. NextInsight file photo1HFY14 core net profit of S$7.1m (+12% yoy) formed 48% of our FY14 forecast and was slightly below expectations. 2QFY14 made up 20% of our FY14 forecast. The negative deviance stemmed from higher taxes and shipbuilding losses. We lower our FY14 EPS by 4% to factor in the weaker set of results and cut our FY15-16 EPS by 16% as we scale back our profitability expectations. Viewing 2Q execution issues as one-offs, we maintain our Add call with a slightly lower target price, still pegged to 0.9x CY14 P/BV or its 5-year mean. Catalysts could come from shipbuilding orders and earnings strength. Target price: 89 cents.

2QFY14 results highlights

Strong turnover negated by execution; cautious guidance. ASL generated strong revenue growth of 129.5% yoy for 2Q as all divisions made ositive contributions. However, the operating performance was marred by a one-off execution blip from its shipbuilding division. Higher-than-expected taxes also eroded profitability. Shipbuilding incurred a slight gross loss of S$0.4m due to engineering and design faults, resulting in a provision of $4.7m.

MD Ang Kok Tian at a briefing for analysts. NextInsight file photo.Management has guided that there should not be further provisions. Meanwhile, ASL was markedly cautious during the results briefing, citing margin pressures from rising labour costs and competitive pressure from China yards. This has prompted us to scale back our profitability expectations for future contracts, resulting in the earnings cut.

MD Ang Kok Tian at a briefing for analysts. NextInsight file photo.Management has guided that there should not be further provisions. Meanwhile, ASL was markedly cautious during the results briefing, citing margin pressures from rising labour costs and competitive pressure from China yards. This has prompted us to scale back our profitability expectations for future contracts, resulting in the earnings cut.

MD Ang Kok Tian at a briefing for analysts. NextInsight file photo.Management has guided that there should not be further provisions. Meanwhile, ASL was markedly cautious during the results briefing, citing margin pressures from rising labour costs and competitive pressure from China yards. This has prompted us to scale back our profitability expectations for future contracts, resulting in the earnings cut.

MD Ang Kok Tian at a briefing for analysts. NextInsight file photo.Management has guided that there should not be further provisions. Meanwhile, ASL was markedly cautious during the results briefing, citing margin pressures from rising labour costs and competitive pressure from China yards. This has prompted us to scale back our profitability expectations for future contracts, resulting in the earnings cut. Ship repair picked up shipbuilding slack

Ship repair revenue increased by four-fold to S$54.8m due to the completion of rig repair works of S$40.2m in 2Q. Its gross profit was not as impressive, increasing by 1.5x to S$10.5m as more of the group’s overheads were charged to this segment, as a result of declining shipbuilding activities. Otherwise, its margin performance could have been better.

Recent positive developments

Vessel sales + new yard. After 1.5 years of order drought, ASL managed to secure the sales of six vessels worth S$97m. It also recently agreed to acquire neighbouring Miclyn Express Offshore’s Batam yard due to the waterfront access it offers. ASL intends to re-position that yard as a topside-fabricator.

Recent story: ASL MARINE acquires shipyard, Hi-P issues profit guidance

Recent story: ASL MARINE acquires shipyard, Hi-P issues profit guidance

DBS Vickers says Mermaid Maritime is on track to deliver strong earnings

Analyst: Suvro SARKAR

Highlights

Creditable performance in seasonally slower quarter. Mermaid posted a net profit of US$13.2m in 1QFY14, a significant y-o-y improvement over its US$0.1m loss in 1QFY13.

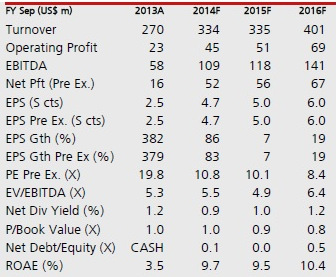

Source: DBS VickersThe improvement was driven by subsea revenue growth and consequent margin expansion. Subsea revenues were up 71% to US$64m in the quarter, driven by a US$24m contribution from the 5-yr landmark Saudi Aramco diving services contract.

Source: DBS VickersThe improvement was driven by subsea revenue growth and consequent margin expansion. Subsea revenues were up 71% to US$64m in the quarter, driven by a US$24m contribution from the 5-yr landmark Saudi Aramco diving services contract. Vessel utilisation remained high at 86% in 1QFY14, despite the onset of monsoon season in SE Asia from December. This is an encouraging sign and better than our full-year utilisation forecast of 82%. The key outperformance, though, came from drilling rig associate AOD, which contributed US$7.1m to the bottomline, against our expectation of about US$6m.

This implies a superior net margin of about 50%, likely achieved through better-than-expected contract economics.

Our View

Visibility remains unchanged. To recap, close to 100% of FY14 revenues and about 50% of FY15 revenues are backed by secured contracts. The Group continues to focus on higher vessel yields and longer contract durations in growth areas such as SE Asia, the Middle East and the North Sea.

While 1QFY14 results are above expectations, we choose to remain conservative and keep our earnings expectations largely unchanged, after factoring in a slightly lower margin growth for the subsea business and higher profit contributions from AOD.

Recommendation

On track to deliver strong earnings. On the back of improving fleet utilisation and day rates, improving subsea margins (operating leverage), contribution from associate AOD and fleet expansion initiatives, Mermaid’s bottomline is expected to grow at an impressive 61% CAGR over FY13-16.

Its ROE is expected to improve significantly to 10.4% in FY16, with gearing at a reasonable level of 0.5x by end-FY16. We maintain our BUY call with TP of S$0.60, pegged to 1.2x FY14 P/BV.