Excerpts from analysts' reports

OSK-DMG initiates coverage of HanKore with 16.1-c target

Analysts: Sarah Wong & Terence Wong, CFA

A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

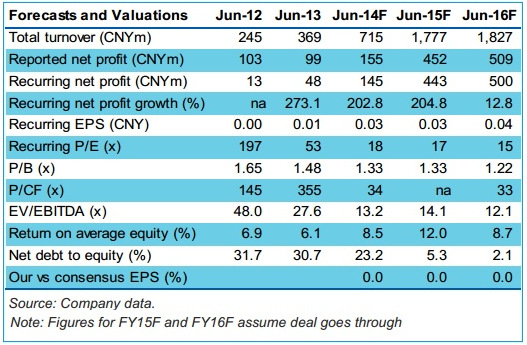

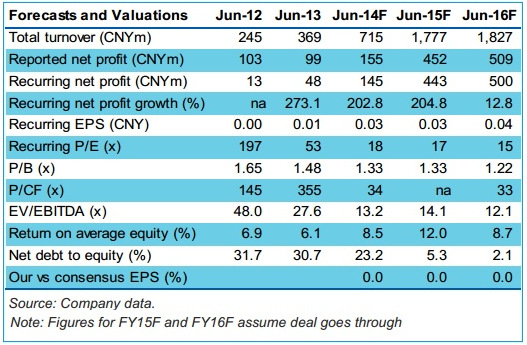

In a game-changing deal, HanKore is set to acquire all of China Everbright International Ltd’s water assets. Assuming the acquisition takes place successfully, we expect a 21% fully diluted EPS CAGR in earnings until FY16. Trading at 17x FY15F P/E, HanKore is undervalued against a peer average of 30x. We initiate coverage with a BUY, based on 25x FY15F earnings.

Game-changing catalyst. In a reverse takeover (RTO) deal, HanKore will acquire all water assets of HK-listed China Everbright International Ltd (CEI), which turns the former into CEI’s subsidiary. With an SOE backing, it now possesses a strong differentiator in parentage.

Strong surge in recurrent waste water treatment income from organic/inorganic capacity expansion and tariff rate hikes. We expect a strong, systematic ramp-up of running capacity on organic plants to 1.14m tonnes/day by 2QFY16 from the existing 590,000 tonnes/day, as well as a lift in tariff rates on completion of HanKore’s upgrading and plant expansion initiatives. In addition, contribution from CEI’s portfolio of 1.84m tonnes/day capacity will greatly boost revenues from FY15F onwards. Water treatment revenues will hit CNY258m in FY14F and CNY1.1bn in FY15F, significantly up from FY13’s CNY201m.

Newly-acquired EPC business to drive the company forward. Recently acquired EPC arm Jiangsu Tongyong Environment Group (JTEG) will allow HanKore to recognise CNY456m in revenue in FY14F – a sharp 170.5% spike from FY13F’s CNY168.6m – and on higher gross margins of around 25% vs 9.1% previously. HanKore’s pipeline of expansion plans, valued at CNY1.5bn, should further boost JTEG’s EPC orderbook, as well as its own revenue and earnings visibility.

Undervalued and an under-covered gem; initiate coverage with a BUY and SGD0.161 TP. Trading at 17x FY15F EPS, HanKore is undervalued against a peer average of 30x. We believe its strong growth profile and the top-tier SOE parentage backing does not warrant such a low valuation. We initiate coverage with a BUY and SGD0.161 TP pegged at 25x FY15F EPS.

Key risks and future catalysts. Risks include lumpy recognition from its EPC arm, while future catalysts include potential M&As of transfer-operate-transfer (TOT) projects as well as tariff rate hikes.

Recent story: HANKORE (buy), SUNTEC REIT (sell): What analysts now say

A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

A visit to Hankore by Singapore analysts in Dec 2013 has led to 2 initiation reports -- by OSK-DMG and UOB KH. File photo

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors