Major PRC fan maker Airmate recently attended an investor conference in Shenzhen. From left: FPR Taiwan’s Mr. Richard Chang, Airmate Vice GM Mr. Daniel Luo, Airmate CEO Mr. Yang Yu-Fu, Airmate Group CFO Mr. Sam Huang, Airmate IR Dept. Manager Ms. Chuang YaSung and FPR Taiwan’s Ms. Meei-Yueh. Photo: Aries Consulting

Major PRC fan maker Airmate recently attended an investor conference in Shenzhen. From left: FPR Taiwan’s Mr. Richard Chang, Airmate Vice GM Mr. Daniel Luo, Airmate CEO Mr. Yang Yu-Fu, Airmate Group CFO Mr. Sam Huang, Airmate IR Dept. Manager Ms. Chuang YaSung and FPR Taiwan’s Ms. Meei-Yueh. Photo: Aries Consulting

AIRMATE (CAYMAN) INTERNATIONAL (1626.TT) is finding a red hot market for its cooling products like fans and other household appliances in the PRC, with sales in the world’s most populous country surging.

Airmate’s first quarter revenue rose over 20% year-on-year to just under three billion twd, with the gross margin improving to 19.34% from 18.71% a year earlier.

This helped the Shenzhen-based firm swing to a January-March net profit of 88 million twd from a bottom line loss of 49 million in the first quarter of 2012.

“Due to strong demand in China’s domestic market in the second quarter last year, Airmate achieved a net profit of 263 million twd for the period, jumping 3.6 times year-on-year,” said Airmate CEO Mr. Yang Yu-Fu.

Airmate's cooling and heating products are targeted at large Chinese city markets, but the firm is beginning to penetrate Tier III and IV cities as well. Photo: AirmateSpeaking at the Aries Consulting-organized “Scaling New Heights Investor Conference 2013” in Shenzhen on Friday, Mr. Yang said this strong sales performance in the firm’s home market converted the manufacturer away from a majority exporter status.

Airmate's cooling and heating products are targeted at large Chinese city markets, but the firm is beginning to penetrate Tier III and IV cities as well. Photo: AirmateSpeaking at the Aries Consulting-organized “Scaling New Heights Investor Conference 2013” in Shenzhen on Friday, Mr. Yang said this strong sales performance in the firm’s home market converted the manufacturer away from a majority exporter status.

“In 2012, sales to the PRC surpassed 50% of total sales for the first time,” he said.

And there is tremendous growth potential for years to come.

“In developed markets like the US, there are an average of around 20 fans per household, including box fans, floor fans, ceiling fans, ventilator fans, humidifiers/dehumidifiers and kitchen range fans.

“But in Mainland China, this number is less than 10 per household, so it’s definitely a growing market.”

Airmate CEO Mr. Yang Yu-Fu (left) toasts fellow participants at a conference in Shenzhen. Photo: Aries Consulting

Airmate CEO Mr. Yang Yu-Fu (left) toasts fellow participants at a conference in Shenzhen. Photo: Aries Consulting

In 2012, revenue contribution breakdown was as follows: electric fans (60%), heaters (27%), small household appliances (7%) and electrical products (6%), with nearly 90% of revenue reliant on seasonal products like fans and heaters.

Besides the hot weather so far this year in much of China, which Mr. Yang said it a major driver of sales when the mercury climbs higher than usual, a major demographic transformation underway in the PRC is one of the biggest factors boosting revenue.

Airmate's cordless DC-powered fans keep spinning away, even during power outages. Photo: AirmateBeginning in 2011, China for the first time in its five-thousand-year history became a majority urban population.

Airmate's cordless DC-powered fans keep spinning away, even during power outages. Photo: AirmateBeginning in 2011, China for the first time in its five-thousand-year history became a majority urban population.

This has helped to raise living standards, move villagers into more densely-populated living spaces and create a larger market for home appliances like fans, heaters, dehumidifiers, juicers and a host of other products rolling out of Airmate’s factories.

“In China, the urbanization drive has been a huge boost for our sales, and we pay a lot of attention to the rise in per capita incomes,” Mr. Yang said.

Airmate fans have been ranked in the top two in the PRC for a decade while its heater products have been tops in the country for the past six years, with domestic market shares for both product categories at over 20%.

And brick and mortar sales venues are not the only way Airmate sells its products, as last year the firm dove into the e-commerce world, with online shopping now accounting for around a fifth of the firm’s top line.

This year, Airmate has boosted cooperation with Taobao, T-Mall, Sunning and JD.com to ramp up its e-commerce business.

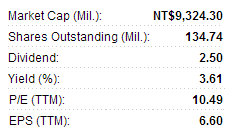

Airmate recently 69.30 twd with a

Airmate recently 69.30 twd with a

52-week range of 54.30-84.00.Despite Airmate now seeing most of its output sold at home in China, it still earned some 49% of its revenue from exports, with just two countries – Japan and South Korea – accounting for nearly half of overseas orders.

“Brand image, and hence quality, are our most important concerns.

“This is especially true in the Japanese market where consumers and importers are very particular. Even if the fan box is flawed or scuffed in a minor way, we will hear about it,” he said.

And major names like Yuasa, Morita and Toto in Japan and Samsung in South Korea rely on Airmate for OEM production, an honor which Mr. Yang says verifies the firm’s reputation for quality production.

However, this does not always translate into equal levels of profitability for Airmate as OEM production for established electronics brands in North America and the EU only produces around 14% gross margins while own-brand sales in the PRC generate double that, with a GM of 28%.

That makes maintaining Airmate’s continued dominance in its home market of Mainland China all the more critical.

“The strong brand recognition of ‘Airmate’ in the PRC also boosted sales growth in the second quarter.

“We currently have a sales network of some 13,000 outlets and we plan an annual growth rate of 10-15% and will continue a nationwide rollout plan of our sales network,” Mr. Yang said, adding that the strategy included penetrating into more Tier III and IV cities from a current focus on bigger urban areas.