Main reference: Story in Sinafinance

CHINA'S STOCK MARKETS are so fraught with perils that some are warning inexperienced retail investors to give shares a wide berth for the time being, including “China’s Buffett.”

A year ago, China’s most famous investor – Wang Yawei – left China AMC to strike it out on his own. Investor Wang Yawei says China's retail investors have no business buying a stock until they first fully understand the firm. Photo: Sinafinance“China’s Warren Buffett,” as he is sometimes called, has also jumped on the bandwagon of notable market players urging the uninitiated to steer clear of the A-share markets for now given uncertainties, unpredictability and unforeseeable risks.

Investor Wang Yawei says China's retail investors have no business buying a stock until they first fully understand the firm. Photo: Sinafinance“China’s Warren Buffett,” as he is sometimes called, has also jumped on the bandwagon of notable market players urging the uninitiated to steer clear of the A-share markets for now given uncertainties, unpredictability and unforeseeable risks.

“There are very few stocks that are safe bets for ordinary retail investors these days, unless said investor has an intimate, comprehensive understanding of the company’s business,” Wang said.

“China’s Buffett” thus has a similar mindset to Warren Buffett himself, who often preaches of the need to first comprehend a company’s operations and growth strategies before jumping in headfirst.

What Wang says is very revealing and telling, not only because of his stature in investment circles, but because he presumably has much to gain from naïve neophytes entering the A-share markets with uninformed investing motives.

By extension, he is arguing that regardless of whether Shanghai or Shenzhen-listed shares are on an upswing or downswing, there is just too much inscrutability and opaqueness in domestic bourses at present to justify the risk/reward calculus for most retail investor participation.

“China’s Buffett” and other seasoned market players are increasingly arguing that when the benchmark Shanghai Composite Index is enjoying a rising trend, very few retail investors are willing to cash in their chips and quit while they are ahead.

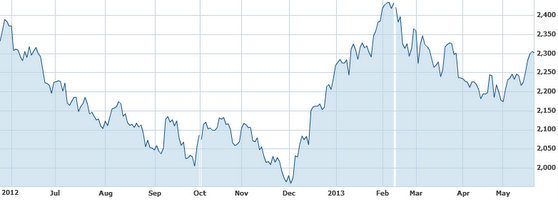

The preponderance of domestic broker calls are overbearingly bullish and group chatter within impromptu market conversations focuses almost solely on the rare windfall successes of a few lucky investors while ignoring the less auspicious news concerning shareholders who have lost their family silver into the bargain. Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

On the opposite side of the coin, when the overall market is enduring an extended sell-off, many first-time investors are shell shocked to the extent that they are gun shy about ever buying another share, no matter how much of a sure thing it might actually be.

Therefore, much more needs to be done to educate retail investors of the simple theorem that ups and downs are a natural and indeed healthy phenomenon in equity markets worldwide, with China being no exception.

And until China’s retail investors have a more comprehensive understanding of how a stock market works – which will instill much-needed confidence in shareholders -- “China’s Buffett” and other successful bourse experts are urging inexperienced investors to leave it to the pros.

At least for now.

See also:

My 22 Years Playing With A-Shares: A Speculator's Strategies