Deutsche: TSUI WAH a ‘Buy’

Deutsche Bank said it is assigning a “Buy” recommendation on Hong Kong-based teashop style restaurant chain Tsui Wah Holdings (HK: 1314) with a target price of 2.97 hkd (recent share price 3.01).

“We expect Tsui Wah to report SSS growth of 11-12% in HK and c.20% in China in 3QFY12. The company has already achieved its target of five new store openings in HK and opened three new stores in China ytd with the remaining two scheduled to open in January 2013,” Deutsche said.

The average breakeven period for the new stores is about one month.

China expansion

Tsui Wah has set up a localized management team in China.

All store managers are locals with currently only three HK personnel working in China – the COO, an executive responsible for fish ball production, and an executive responsible for procurement.

The company has a training school in Guangzhou, which provides a two-year chef program.

“The second batch of students is ready to support its future expansion. The average labour turnover is historically only 10%,” Deutsche added.

Potential in Hong Kong

Deutsche said that management believes there is still room for growth in the Hong Kong market.

“Delivery service could be a key driver of store traffic. With the increased motorcycle capacity, the delivery service could account for 15% of sales, vs. 7% previously, on a single-store basis.”

The company opened its first delivery center in Hong Kong in end-December 2012.

Food safety

Management stressed that internal control plays a key role in maintaining food quality.

“Hence, we believe a central kitchen is important, as centralized sourcing could lower its food safety risk,” the German research house said.

It will set up a new central kitchen in Hong Kong and Shanghai this year.

The company has strict supervision over suppliers and is increasing the part of sourcing from origin.

As for communication with media, it relies on PR in China, the investor note added.

Tsui Wah Holdings, founded in 1967, operates teashop-style restaurants and provides food catering services. As of November 2012, it owned and operated 26 restaurants, including 21 in Hong Kong, four in Mainland China and one in Macau.

See also:

Noodle Chain AJISEN 1H Net Up 32.4%

AJISEN: HK-Listed Noodlemaker Denies Margins ‘Souped-Up’

Photo: Tsingtao

Kingston: TSINGTAO Gets ‘Buy’

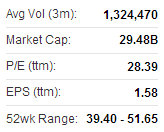

Kingston Securities said it is assigning a “Buy” recommendation on Chinese beer giant and globally recognized brand Tsingtao Brewery Co Ltd (HK: 168) with a target price of 50 hkd (recent share price 45 hkd).

The Buy-in price is 45.5 hkd and the Stop Loss is 44.

“With the opportunities from the London Olympic Games, the Group strengthened its brand promotion and marketing activities while confronting uncertainties from raw material costs,” Kingston said.

For Q3 2012, Group revenue increased 17.8% y-o-y to 8.4 billion yuan, driving revenue for the first three quarters up 13.7% to 21.8 billion.

The Group also achieved sales volume of 68.2 million hectoliters of overall beer, where Tsingtao Beer achieved sales volume of 36 million hl, up 10.2% y-o-y and accounted for 52.8% of total sales volume.

The Group formed a JV with Suntory Holdings in June of last year, intending to expand sales volume and market share in the East China brewery market.

“The Group also entered into a Supplemental Agreement with Asahi, allowing the Group to fully utilize the existing production capacity of Shenzhen Tsingtao-Asahi, diluting production costs, and increasing the utilization rate.

“As more expanding projects are gradually completed, the Group is confident of achieving 100 million hectoliters by 2014, which will help to stimulate revenue generated in the future,” Kingston added.

See also:

PASSE PREMIUMS: China Shares Now Cheaper Than HK Twins

Mainland Money Flooding HK Market