Translated by Andrew Vanburen from a Chinese-language piece in Cankao Xiaoxi

SOME PEOPLE ARE JUST conditioned to coexist with bears.

But unless we are talking Siberians, Alaskans or circus trainers, the rest of us are more likely to beat a quick retreat at the sight of a Kodiak, grizzly, brown, black or even an overly aggressive panda bear.

The same could be said for investors in equity markets worldwide.

Of course there are also those who relish the prospect of a falling market, because they are keen to snap up bargains at the suburban equivalent of garage/rummage/lawn sales.

But for our purposes here, we are more interested at this point in those investors – actual or prospective – who are more likely to run for the hills amidst the ongoing securities slump.

In other words, what is causing retail investors such angst vis-à-vis Mainland China these days?

The fact of the matter is that even though China’s capital markets have been gradually opening to a wider range of domestic investors as well as to the outside world, the benchmark Shanghai Composite Index has still been falling for several months.

This has transpired despite the ostensibly larger pool of participants in the stock market poolside party.

Nevertheless, the biggest problem remains the simple but somewhat somber fact that retail investors still lack a fundamental confidence and trust in Shanghai- and Shenzhen-listed A shares.

In short, there is widespread doubt among this class of shareholders as to whether there is a fundamental money-making ability in the Chinese share market.

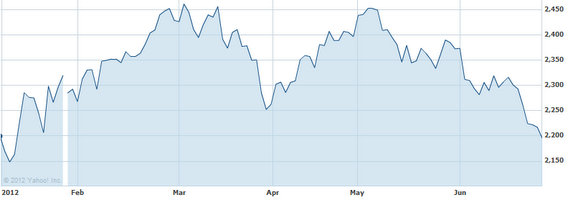

Not overlooking the slight Chinese Lunar New Year bounce that the Shanghai Composite enjoyed in February, the index has more or less been on a decidedly uninspired run since that celebratory season.

The calendar year began in a deep funk, and the fact that shares are only around 1.4% higher to this day speaks volumes about the state of Mainland China’s capital markets over the past half year.

Even foreign media are saying that the stock markets in the world’s second biggest economy have underperformed Wall Street’s expectations over the timeframe in question.

According to an amalgam of statistics, the average share price for many individual counters listed in Shanghai or Shenzhen remains at, or hovering near, 52-week lows.

This makes the performance and the lack of a sustained upward ascent all the more noticeable among retail investors.

The average price-to-earnings (P/E) ratios last year for constituent stocks of the Shanghai Composite Index stood at a humble 12 times.

But now, the average P/E ratio is flirting or exceeding historic lows.

In fact, the current average P/E ratio for Index constituents stands at an anemic 9.7 times, which is near to historic lows.

With all these lugubrious, laggard, litmus-test barometers of bourse health staring us in the face, it is little wonder that retail investors – who play for keeps and not for amusement – are quite intimidated by the current capital market environment in Mainland China.

That being said, investors in A- and B-shares are almost certainly crossing their fingers that the second interest rate cut in a month by Beijing, and the third credit loosening measure in a short span of time, will breathe new life into capital-intensive sectors like property and manufacturing.

Time will only tell.

But that is a commodity that retail investors are becoming tired of squandering.

See also:

TOUGH SELL? China Bears May Be Packing Bags

MARKET MAYHEM: Making Sense Of China Shares

Middle East Kingdom To Boost Middle Kingdom Shares?

CHINA ANALYST: ‘Why I’m Back On Diving Board’