Piper Jaffray: Keeping CHOW SANG SANG ‘Overweight’

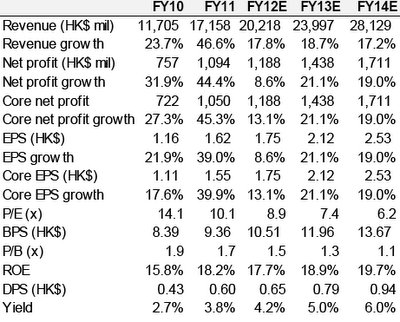

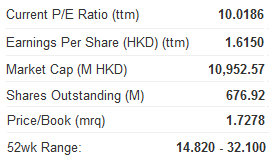

Piper Jaffray Asia Securities said it is maintaining its “Overweight” recommendation on leading Greater China jeweler Chow Sang Sang (HK: 116), calling its current 8.9x FY12E P/E “attractive.”

However, the research house is lowering its FY12E-14E earnings forecast on Chow Sang Sang (CSS) by 8%-10% to reflect a lower same store sales growth (SSSG) industry-wide in May-June, a continuously unfavorable product mix change (increased sales of low-margin gold products), and operating deleveraging.

“That being said, we still find the revised 18% FY11-14E core EPS CAGR solid. In light of the potential margin recovery in FY13E we maintain our call with a lowered price target of HK$21.10 from HK$23, based on 12x FY12E P/E (unchanged).”

Piper Jaffray added that given the slowing industry-wide sales in May-June, it expects SSSG to slow to a high single digit level in May-June from the low teens in January-April.

“Therefore, we have revised down our FY12E/13E/14E SSSG forecasts to 12%/14%/13% from 14%/16%/16%, and we also lower our gross margin assumptions to 19.1%/19.4%/19.7% from 19.4%/19.8%/20.2% due to an unfavorable sales mix with increased sales of low-margin gold products.”

The research note also said it is lowering its operating margin assumptions to 8.0%/8.2%/8.4% from 8.5%/8.7%/8.8% to reflect the research house’s lower gross margin forecasts and operating deleveraging mainly as a result of labor and rental cost hikes.

“Overall, the impact on our net profit forecast would be -8%/-8%/-10%.”

Earnings growth still solid; potential margin recovery in FY13E

“While we lower our FY12E-14E earnings forecast, we still find the revised 18% FY11-14E core EPS CAGR solid.

“With management's increasing focus on and effort in expanding the jewelry retail business, we believe the company’s gross margin will pick up in FY13E-14E,” Piper Jaffray said.

It projects the jewelry retail revenue contribution to increase to 78%/80% in FY13E/14E from 77% in FY12E.

“Given this business’ ~23% gross margin vs. non-jewelry business’ ~5%, we expect the blended gross margin to improve to 19.4%/19.7% from 19.1% in FY12E.

"We believe the better business mix would provide the company with a buffer against the margin volatility caused by gold price fluctuations and enhance its earnings visibility.”

After its earnings revision, Piper Jaffray said it expects the FY12E/13E/14E net profit to rise 13%/21%/19% on 18%/19%/17% revenue growth.

“We believe such earnings growth momentum is still solid. The stock has underperformed the Hang Seng Index by 18% in the past three months, and is now trading at 8.9x FY12E P/E and 0.5 PEG.

“We believe the valuation is attractive in light of the potential earnings growth recovery in FY13E.”

See also:

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept At ‘Buy’, HK Property Initiated ‘Outperform’

Piper Jaffray: HK DISCRETIONARY RETAIL Seen Slowing

Hong Kong's jewelry and watch sales growth in May weakened to 3.1% from 15.1% in April, dragging down the overall retail sales growth to 8.8% from 11.4%.

“We expect a similarly weak growth in luxury sales in June, with the downtrend stabilizing in 3Q, to be followed by a slight improvement in 4Q on a low base and the traditional peak season,” said Piper Jaffray Asia Securities.

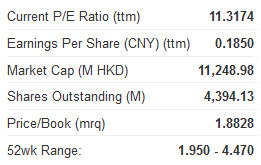

The research house has revised down its earnings forecasts on Emperor Watch & Jewellery (EWJ) to reflect the industry-wide weakness in demand.

“We maintain our forecasts for Luk Fook (LF), which we have revised down in late June to reflect a similar downtrend. We prefer Hengdeli (03389.HK, OW), CTF (01929.HK, OW) and CSS (00116.HK, OW) to EWJ (00887.HK, N) and LF (00590.HK, N) in the watch/jewelry retail space given the former three's relatively lower margin pressure and higher earnings growth potential.”

HK jewelry/watch sales weakened in May

Hong Kong's jewelry and watch sales growth in May weakened to 3.1% from 15.1% in April, dragging down the overall retail sales growth to 8.8% from 11.4%.

“We believe the slower growth was due to the weak macro environment, slack season and the high base effect. We expect a similar lackluster sales growth in June and the trend to stabilize in 3Q, followed by a slight improvement in 4Q on a low base and traditional peak season,” Piper Jaffray said.

The research house added that it has revised down its FY12E/13E earnings forecasts for EWJ by 13%/18%, to reflect the lower industry-wide SSSG and operating deleveraging amid a weak sales trend.

“We prefer Hengdeli, CTF and CSS in the jewelry/watch retail space. We expect them to deliver higher earnings growth due to their above-industry SSSG and lower margin pressure.”

The research note added that it expects the current year's core EPS growth of Hengdeli/CTF/CSS to be 12%/17%/13%, vs. EWJ/LF's -13%/-13%.

See also:

MING FUNG JEWELLERY: Domestic Sales Surge On China Gold Rush

CHOW SANG SANG: Jewelry Shows Recession-Resistant Results

UOB Kay Hian: Luxury Boosting China Retail Sector

UOB Kay Hian said that jewelry retailers “stole the limelight” recently with Chow Tai Fook (BUY) and Luk Fook (BUY) FY12 earnings, but management’s lower guidance for 2H12 prompted a slew of earnings downgrades, including from UOBHK.

“Sparkle Roll’s management echoed the cautious view, with year-to-date orders down by one-third from 2011.

"It appears that high-end spending remains weak, and a recovery is likely to take longer than previously expected,” UOB said.

The research house is trimming Dah Chong Hong’s (DCH) 2012 EPS estimate by 4% due to continued sales weakness in the luxury car market amid widespread price discounting.

“We lower our target valuation from 12x to 10x 2013F PE, reducing our target price from HK$11.00 to HK$9.00. However, we maintain our BUY call, as we believe the current price has already factored in the key negatives.

“Moreover, a 4.1% dividend yield is certainly appealing,” the investor note said.

See also:

TOP 1H HONG KONG GAINERS: Property King Of The Hill

HK Flicks, Footwear & Financiers: Latest Happenings...