BOCOM: XTEP charges ahead of peers in order growth

China’s top casual sportswear firm Xtep International Holdings Ltd (HK: 1368) – fresh off a successful official supplier sponsorship of the wildly popular Standard Chartered Hong Kong Marathon 2012 – is expected to continue having the strongest order growth among its sportswear sector peers.

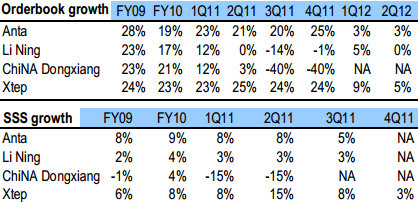

Bocom International said that compared to rivals Anta (HK: 2020), Li Ning (HK: 2331) and China Dongxiang (HK: 3818), Xtep has consistently been atop the heap in terms of order strength for its extensive line of running gear, athletic footwear and accessories.

“China’s sportswear sector has seen a strong share price rally over the last two weeks. We believe the price strength has been mainly due to the following two factors: 1) the laggard search given the sector’s depressed valuation; and 2) the impact of TPG buying into Li Ning recently helps to create some hope that the sector may bottom out,” Bocom said.

The brokerage has an ‘Underperform’ rating on China’s sportswear sector.

See also:

XTEP: In It For The Long Run With Marathon, Social Media

XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan

China Medical System Hldgs issues Positive Profit Alert

China Medical System Holdings Ltd (HK: 867), a Shenzhen-based distributor of popular pharmaceuticals in the PRC, has issued a Positive Profit Alert for full-year 2011.

“Based on the preliminary review of the unaudited management accounts, the Group is expected to record a significant increase in net profit for the year ended 31 December 2011 as compared to profit reported for the corresponding period in 2010.

“The Board considers that this is principally attributable to (i) the continued steady growth of Group’s sales and effective cost control; and (ii) the successful acquisition of Great Move Ltd and all its subsidiaries,” CMS said.

Tianjin Precede Medical Trade Development Co Ltd (which has been officially renamed Tianjin Kangzhe Pharmaceutical Technology Development Co Ltd. on 24 October 2011)is the main wholly-owned subsidiary of Great Move, which was a profitable company before merging with the Group and has committed to achieving not less than 150 mln hkd of net profit in 2011.

CMS added that this positive profit alert announcement is only based on the preliminary review of the unaudited management accounts of the Group for the year ended 31 December 2011, which has not been reviewed nor audited by the company’s auditors.

Annual results of the Group for the 2011 will be announced in mid March 2012.

CMS saw its first half 2011 bottom line nearly double to 30 mln usd, thanks in large part to the introduction of new pharmaceutical products to the market as well as a rapidly expanding sales network.

The firm mainly engages in M&As also with the intention of winning distribution rights in the PRC, and was keeping its eyes open for attractive assets both at home and abroad with the ultimate aim of controlling distribution of popular drugs in the world's most populous country.

See also:

CMS Doubles Profit, Boosting Drugs

Ex-SGX Listco SIHUAN, SINO BIOPHARM: Downturn-Resistant Firms Get ‘Buy’ Call Initiations