Guoco: Maintaining ‘Hold’ call on GCL POLY on weaker solar demand

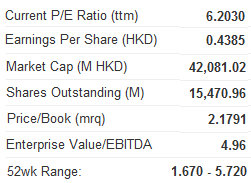

Guoco Capital said it is maintaining its ‘hold’ call on solar power firm GCL Poly Energy (HK: 3800) with a target price of 2.4 hkd due to a sluggish demand outlook.

“Short-term investors should take profit on GCL Poly,” Guoco said.

The brokerage said it believes that there are no convincing signs for a strong pricing rebound and profitability improvement in the solar sector.

“Recent price rises are a short-term performance caused by holidays (Christmas and Chinese Lunar New Year) and anti-dumping duty expectations. Spot volumes of poly-silicon from traders also decreased significantly, and spot prices of solar downstream cells and modules remained stable,” Guoco said.

It added that it believes there will be “limited” solar demand in 1Q12, though demand may start to pick up in 2Q12.

“We believe GCL's manufacturing cost leadership should allow it to become an industry consolidator, but at the expense of reduced margins. Investors should not chase GCL at current price levels in our view.”

See also:

COMTEC SOLAR: ‘Buy' With 134% Upside, Says Yuanta; But 'Hold' Says UOB

CHINA WIND Sees Less Turbulence; GCL Eyes Sunny Skies Ahead

Kingston: TSINGTAO BREWERY Target 46 hkd

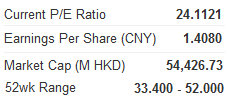

Kingston Securities said it is assigning a 46 hkd target price (recent share price 41.75) to Tsingtao Brewery (HK: 168).

Tsingtao recorded an operating income of 19.17 bln yuan for the first three quarters of 2011, up 17% year-on-year.

Meanwhile, net profit rose 9% to 166 mln yuan and the Shandong Province-based brewer’s net profit margin increased slightly to 8.7%.

However, the company’s sales volume of beer reached 60.4 million hectoliters during the period, up 14.5% year-on-year, representing a slight growth slowdown.

“The group expected beer sales volume to be over 70 million hectoliters this year. As for China Resources (HK: 291), its domestic rival which holds the “Snow” brand, the beer business achieved a revenue of 22.1 bln hkd.

Yet, with a net profit margin of only 3.9%, Tsingtao Brew clearly outperformed China Resources with a better performance.”

Kingston’s buy-in price for Tsingtao is 41 hkd, with the stop-loss at 40 hkd.

See also:

Hong Kong Property Selloff Overdone? Tsingtao Facing Soaring Costs

PRC BANKS, TSINGTAO, AIR CHINA: What Analysts Now Say...