Excerpts from latest analyst reports....

DBS Vickers, first to cover GLOBAL PREMIUM HOTELS, says its fair value is 29 cents

Analyst: Derek TAN CPA

• Household name in the Economy hotel space

• Resilient operating model with portfolio expansion from the development of a new 265-room hotel

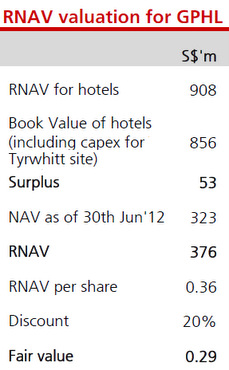

• Fair value of S$0.29 based on 20% discount to RNAV

Fair value of S$0.29. Given GPHL’s leading position in the economy tier segment of the Singapore hotel sector, we derive a fair value of S$0.29, based on a 20% discount to its RNAV of S$0.36.

This implies FY14F EV/EBITDA of 17x, in line with hospitality peers.

Earnings upgrade will be a price catalyst. Better than expected performance from its hotel segment in the coming quarters or acquisitions not factored in our forecasts are likely to drive profitability and stock price.

Balance sheet is relatively highly geared. GPHL’s net debt to equity ratio is relatively high at 1.4x, due to acquisition of its initial portfolio upon listing.

We noted that other metrics, such as interest cover, is comfortable at c.4-5x.

Recent story: GLOBAL PREMIUM HOTELS: Lots of insights from Q&A session

Maybank KE says AURIC PACIFIC still worth a bet (after 50% run-up)

Analyst: Gregory Yap

Auric Pacific may see more interesting times following ex-SMRT CEO Saw Phaik Hwa’s appointment as new CEO.

Since we first pointed out the stock in May 2012, Auric’s share price has shot up by almost 50%.

We wonder if her key mandate by the Riady family, which owns 71% of the stock, is turning around the company for sale?

After all, food is a negligible part of Lippo’s vast business interests and Auric is no longer the family’s flagship in Singapore.

49.3% of Auric is directly held by Lippo but the Riady family’s effective stake is actually 71.2% via a separate private investment vehicle.

If they decides to sell, their overwhelming interest would not make it difficult at all.

UOB Kay Hian raises CORDLIFE's target price to 62 cents but keeps 'hold' rating

Analyst: Andrea Isabel Co

• Gross margin should improve from FY13 onwards after Cordlife relocates to Yishun A’Posh Bizhub, a property owned by the group.

Cordlife will not only benefit from rental savings but also from sub-leasing income. We forecast gross margin to improve from 69.4% in FY12 to 71.1% in FY13-14.

• One-time relocation expenses may affect bottom line in FY13-14.

The A’Posh Bizhub will be ready for occupancy by early-13. The group expects to incur one-off costs related to the relocation.

Earnings Revision

• Reduce net profit forecasts by 2.2% and 3.0% to S$9.0m and S$9.6m for FY13 and FY14 respectively to account for the additional expenses for the relocation.

Valuation

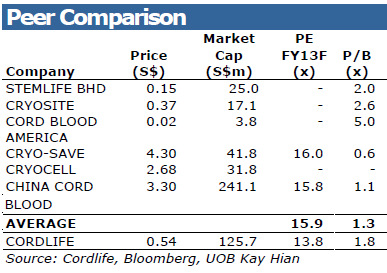

• Maintain HOLD with a higher target price of S$0.62 (previously S$0.53), based on its peers’ average of 15.9x PE and applied to our FY13F EPS of 3.9 S cents.

Our valuation peg increased from 13.6x to 15.9x PE as we roll over our peers’ PE average to FY13. Total dividend for FY12 was 3.8 cents, or a yield of 7.0%.

Recent story: CORDLIFE: Undervalued at PE of less than 10?