Photos by Sim Kih

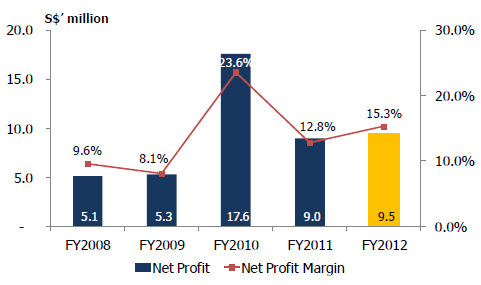

XMH HOLDINGS has posted a net profit attributable to shareholders of S$9.5 million for its financial year ended 30 April 2012, up 5.9% year-on-year.

The solutions provider of diesel engines, propulsion and power generation for marine and industrial sectors has proposed a final tax-exempt cash dividend of 1 cent per share.

At its recent close price of 16.2 cents, this translates into a 6% dividend yield.

Group revenue declined 11.4% to S$62.2 million, mainly due to:

(i) Re-scheduling of deliveries by customers due to project delays

(ii) Order cancellation

(iii) Delays in the supply of some components by suppliers

(iv) Fewer orders due to uncertainty in global markets

Other income increased to S$3.9 million due to a one-time gain arising from the deposits forfeited from a customer for order cancellation.

There was also a forex loss of S$1.3 million due to the sharp appreciation of the Japanese Yen against the Sing dollar after the Tsunami in March last year.

The Group is in a net cash position with cash reserves of S$39.2 million as at 30 April 2012.

During the year, the Group secured two new principals: Guangzhou Diesel, which produces industrial/marine diesel engine and power generating sets, and Kamome Propeller, which produces propellers and thrusters.

CEO Elvin Tan, executive director Sam Chua and financial controller Johnson Yap met investors yesterday and here is a summary of the questions raised and the management’s replies.

Q: What was the reason for the contract cancellation?

There was an oversupply situation for platform supply vessels in China's offshore market. The entire contract was worth about S$10 million.

Q: What happens to the equipment in the cancelled contract?

We can resell the equipment and components. Some of it has been sold to other parties.

Q: What are the chances that you incur a forex loss to the scale of what was encountered last year?

We don’t foresee this happening unless there is a crisis at a macro-economic level.

Q: Why did inventories go up even though sales were down?

The current uncertain economic outlook caused some customers to delay taking delivery of their orders. Also, when component suppliers delay delivery, our assembly is delayed and this affects timely delivery on the entire order.

Q: Given the global shipbuilding slump, are equipment prices dropping?

Prices for equipment used in small vessels have remained stable. However, the market for equipment used in large vessels is highly challenging now. We have seen some suppliers dump inventory by slashing prices.

XMH's Powerpoint presentation slides are available on the SGX website here.

Related story: PLASTOFORM, CHINA SKY, XMH: Latest Happenings...