WITH TWO POSITIVE reports issued this morning by analysts, World Precision Machinery stock rose by as much as 3.5 cents to touch 56.5 cents in morning trading.

Volume was heavy at more than 1.8 million shares by 12.30 pm, compared to merely 103,000 for the whole of yesterday (March 26).

World Precision (market cap: S$220 million) has been regularly covered on NextInsight in the last one year or so, and the URLs for recent coverage are provided below.

Just to highlight a few points from this morning's reports which came after the analysts visited the company in Danyang in the Chinese province of Jiangsu over the weekend.

Maybank Kim Eng analyst Eric Ong said:

* World Precision's profit margins are expected to improve along with a positive shift in its product mix.

* Management said that the group’s contract wins so far have caused order momentum to pick up after a lull following the Chinese New Year holiday in January.

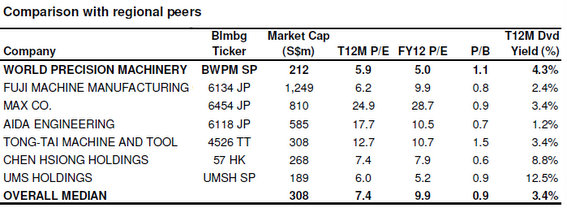

* Based on consensus estimates, the stock trades at an attractive 5x FY12 PER, with support from a decent dividend yield of about 5%.

Maybank Kim Eng rated the stock four chillies out of five. For its full report, click here.

The other analyst, OCBC Investment Research's Sarah Ong, said World Precision has ‘good growth prospects’ as it produced more high-performance and high-tonnage stamping machines.

Such high-end machinery and equipment is part of an industry that has been identified along with six other strategic industries to receive tax incentives and other subsidies under China’s 12th Five Year Plan.

For OCBC's full report, click here.

Both analyst reports are un-rated, and thus do not have target prices for the stock. However, the consensus target price among analysts who cover the stock is 78 cents.

Recent stories:

WORLD PRECISION: First photo essay on its operations

WORLD PRECISION, YONGNAM: Latest happenings....

WORLD PRECISION CEO: Time Will Tell which are the Good S-chips