ON a Facebook forum on stocks, an investor was noticeably frustrated with the stock price movement (non-movement, to be more precise) of Yongnam Holdings.

He recently posted: "Nett profit +16%, Div 1 cents. Strong order book and many projects under its belt. But it's not moving!!! What can move this gem???"

We decided to take a look at the stock, digging up the positive and negative aspects.

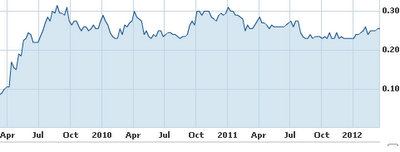

The stock price has indeed been stuck in a tight trading range for a long time -- three years, which is almost an eternity in the market -- and now trades at just 5X last year’s earnings.

But Yongnam has the unanimous thumbs-up from analysts.

After all, it has been reporting record profits every year for the past six years.

The stock closed at 25.5 cents recently, is up 8% to 10% year-to-date, but has still some way to go before reaching the 50-cent target price that Credit Suisse analyst Chua Su Tye has for it.

That target is the highest among analysts.

Other houses – DBS Vickers, CIMB, UOBKH, Citigroup - have target prices ranging from 31 cents to 42 cents, and their calls are either ‘Buy’ or ‘Outperform’.

Credit Suisse sees its valuation of 5X FY12E PE as ‘undemanding given its strong growth prospects’, and had an ‘Outperform’ call on the stock on 1 March.

There is one thing weighing down on the stock --the company has 364.7 million warrants outstanding at an exercise price of 25 cents.

The warrants expire on 14 Dec 2012. If fully exercised, the warrants will result in significant dilution because, in comparison, currently there are 1.25 billion Yongnam shares outstanding.

Less dilutive, but not insignificant, are the 86.015 million employee share options which have not been exercised. About two-thirds of these share options have strike prices way below the current stock price, which means they will likely be exercised.

Another concern of some investors is the recently announced investigation that the Commercial Affairs Department is investigating Yongnam's CEO for possible breaches of the law on insider trading.

Yongnam does, however, have many key positives, including:

1) Earnings visibility

It had an order book of a whopping S$462 million at end-December last year. About 60% of these projects are scheduled for completion in the current year.

Contracts have been secured for the Downtown Line 3, Sports Hub, National Arts Gallery, NUH Medical Centre, and Express Rail Link (in Hong Kong).

This means it has already secured for FY2012 revenue amounting to some 80% of its FY2011 revenue of S$332.7 million.

2) Market leader

It is a leading steel specialist contractor with an impressive track record of iconic projects, and has one of the largest steel fabrication facilities in Southeast Asia.

Structural steel projects it has achieved include Changi Airport Terminal 1, Suntec City, Capital Tower, National Library Building, One Raffles Quay, ION Orchard, Marina Bay Sands Integrated Resort, Suvarnabhumi International Airport in Bangkok, Dubai Metro Rail and New Delhi International Airport.

Its specialist civil engineering projects include the MRT lines in Singapore, as well as the Dubai Metro Rail and Hong Kong MTR.

Yongnam has two production facilities in Singapore and Nusajaya, Johor, Malaysia, with a combined annual production capacity of 78,000 tons of steel fabrication.

Given its track record, it is a front-runner for the many high profile infrastructure and commercial projects up for tender in 2012/13 in Singapore as well as overseas.

3) Geographic expansion

Yongnam mainly operates in Singapore, Middle East and Malaysia.

Singapore contributed 86% to FY2011 revenue but with the slowdown in local construction demand, it is setting sights on Malaysia, Indonesia, Hong Kong, India and the Middle East.

According to Credit Suisse, about S$1.1 billion of structural steelworks and S$330 million of specialist civil engineering projects are up for tender in 2012/13, and more than 60% of this are overseas projects.

These are part of billion-dollar government infrastructure projects outside Singapore and include Malaysia’s plan to build MRT lines in the Greater Kuala Lumpur / Klang Valley region with a total budget of about M$36.6 billion, Indonesia’s infrastructure development projects for roads, rail lines and airports, Hong Kong’s MTR projects, etc.

The company has proposed a 1-cent dividend for FY2011, translating into a dividend yield of 3.9%.

While not exactly very high, the dividend payouts have been rising every year: from 0.4 cent for FY08 to 0.5 cent (FY09), 0.65 cent (FY10) and now 1 cent (FY11).

Related story: WORLD PRECISION, YONGNAM: Latest Happenings...

Comments

What has Atlan's stock price rising higher got to do with Duty Free? What other biz apart from Duty Free does Atlan own which can explain the rise in stock?

In June 2012, SGX will link up with Bursamalaysia,c oupled with the pending annoucement of the Sale and Purchase Agreement to sell it's JB Zon, Duty Free will also going to hit historical high when the interest comes over to duty free internation here in SGX, Bucket up... No point looking at Yongnam..