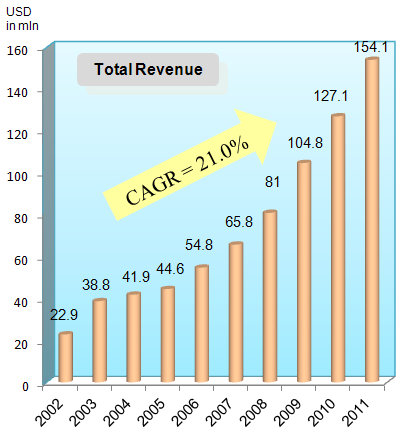

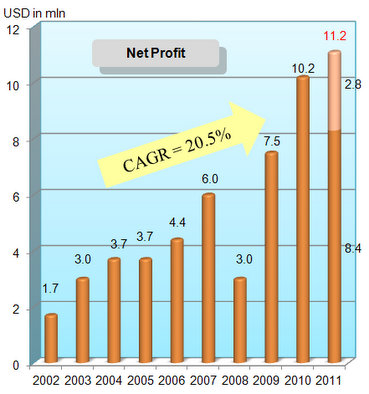

TECHCOMP HOLDINGS maintained its track record of steady revenue and operating profit growth in FY2011, although the headline numbers refer to an alarming 20% fall in net profit.

The 20% decrease in net profit to US$8.4 million was due to a non-recurring expense of US$2.8 million for the company’s dual primary listing in Hong Kong and the absence of a one-off gain (US$0.7 million on disposal of a jointly controlled entity in FY2010).

Excluding such non-recurring items, the adjusted net profit increased by 13.8% to US$11.2 million in FY2011 (see chart below).

In other words, Techcomp would have achieved a record profit on record revenue in 2011.

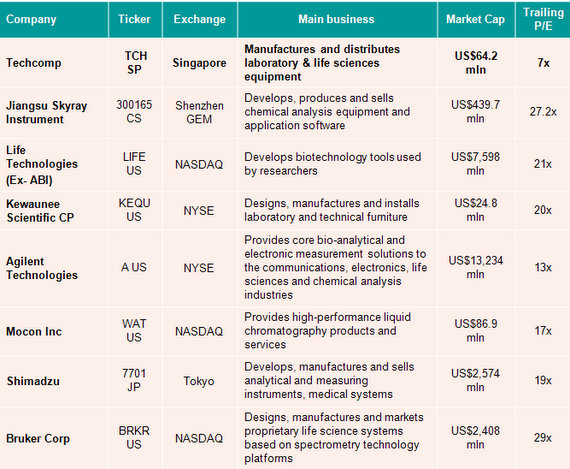

The PE ratio based on earnings of USD11.2 million would then be 6.7X, calculated using earnings per share of 4.82 US cents and the recent stock price of 40 Singapore cents.

With the HK listing exercise completed, a record profit in 2012 for Techcomp is all but certain.

Demand for its products will continue to grow as China and India, in particular, boost investments in science and technology, R&D and public healthcare and food safety, said Techcomp executive director Eric Chan yesterday.

For an additional boost to growth, Techcomp is exploring M&A and strategic alliances, he added.

Techcomp is a manufacturer of highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments. It is also a distributor for Hitachi.

Techcomp proposed a final dividend of 6.2 HK cents, equivalent to 1 Singapore cent, a share, which is virtually unchanged from FY2010.

Here are highlights of the Q&A session during a results briefing held at Tower Club yesterday:

Q: The strong Japanese yen has impacted the gross profit. Adjusting for that, what would have been the result?

Richard Lo (President and CEO): We don’t have data on that. In the past few years, we transferred cost increases to our customers, which protects our gross margin but that affected the growth of our distribution business. In 2010, the growth was only 3-4%.

Last year, we transferred less of the appreciation of the cost, because after the tsunami we couldn’t deliver the goods in a timely manner.

Secondly, we didn’t want to lose market share or grow less than the market.

In the past two weeks, the yen has weakened 6-7%. I hope the yen can maintain at this level, so our distribution margin can go back to its normal level, or a more favourable level.

Q: Can you tell us more about how your European business is doing?

Gilbert Sin (CFO): Last year, it was still incurring some losses and there was some cash outflow. Hopefully, it can break even this year.

Q: Can you expand on that because for the 1H of last year, you were talking about the business doing well but it faced a strong Swiss franc?

Richard: There is a combination of factors. The growth was below our expectations partly because of the very strong Swiss franc and a reorganization fee in our France operations. I am more optimistic this year as the topline is growing and the bottomline is improving.

Q: Last year you spent US$2.8 m on the dual listing in Hong Kong. What is the maintenance expense for the HK listing this year?

Gilbert: It’s a bit more than what we pay in Singapore. It is US$300,000-500,000.

Q: Can you comment on your receivables – the growth is quite large and the aging too?

Richard: The management is comfortable with the growth of receivables. Last year, due to the Japanese tsunami, some shipments were delayed and even in the 4Q, Hitachi’s production had not fully recovered. But because of our relationship, they made an extraordinarily large shipment to us in December to clear some backlog.

That’s why the AR looks bigger – and the inventory. I am sure in the 1Q, you will see the AR and inventory get back to normal levels.

Gilbert: Regarding the receivables aged over six months, most of these belong to customers in China and involve projects where we had to install the equipment and get them accepted first. The time for installation and acceptance is much longer than for routine orders. We deliver upon the customer’s request but the site is not available or the condition of the site is not ready for installation.

However, we book sales when we deliver the goods and transfer the risk of ownership of the equipment.

Eric Chan (executive director): Most of these are tertiary institutions – so these are government orders. Only one of them is from the industry and is a major listed company, so we are not worried about bad debts.

Q: Your net debt to equity has increased. Given what you have just said about your appetite for acquisitions, what is the size of an acquisition you might undertake?

Richard: We don’t have a solid target on how much we will spend on an acquisition. It depends on the opportunity. We have a strong capability to raise bank loans. We believe the two acquisitions we did in Europe are very good ones.

Q: Do you have a maximum net debt to equity level that you are comfortable with?

Gilbert: We don’t draw a line on this. We now have 46% gearing. We will ask ourselves: What will be our expected cash inflow? What is our ability to raise funds from the bank, or internally, or from the equity market?

Richard: Most of our short-term debt is supported by customers’ LC, some kind of payable.... If you take all this short-term debt out, our debt ratio is very low. And if you look at our assets – properties, machinery – they are solid.

Techcomp's financial statements for FY2011 can be accessed at the SGX website.

Recent stories:

TECHCOMP dual-lists on HK Stock Exchange

TECHCOMP: 1H Sales up 19%, HK dual-listing plan on track