Excerpts from latest analyst reports.....

UOB KH notes stock price catalyst from possible asset injection into WORLD PRECISION MACHINERY

Analyst: Jonathan Koh, CFA

Earnings Revision/Risk

• We have revised our earnings forecast due to an expected slowdown in 2H11 and 1H12.

We expect revenue growth of 14.2% in 2012 and 24.8% in 2013. We expect earnings growth of 8.6% in 2012, improving to 22.0% in 2013.

Stronger growth in 2013 is due to full-year impact of cyclical recovery in China.

Valuation/Recommendation

• Lucrative dividend yield. We estimate final dividend at 15 fen/share based on a payout ratio of 31.2% for 2011. The generous payout translates to a lucrative dividend yield of 5.2%.

• Re-iterate BUY. Valuation is attractive with World Precision trading at 5.8x 2012F PE (Chongqing Machinery: 5.7x and Haitian International: 10.9x). Our 12-month target price is S$0.81 based on 8.5x 2012F PE.

Share Price Catalyst

• Order flows. Contract flow for high-tonnage stamping machines, particularly from automobile customers.

• Restructuring within World Group. There could be potential asset injections from parent company World Group, an industrial equipment conglomerate involved in production of agricultural machineries, construction equipment, gantry cranes, horticultural tools and automobile components.

Recent story: DMG: 5 companies expected to achieve record earnings for FY11

Macquarie expects strong earnings result from CHINA MINZHONG

Macquarie Equities Research this morning said it expects China Minzhong's (MINZ) 2Q results, to be announced on 13 Feb, to be strong and act as a catalyst for the stock price.

Macquarie's 12-month price target based on a Price-Earnings Ratio methodology is S$2.35, which is substantially higher than the recent trading price of $1.01.

"Management indicated from our recent discussion that order book remains strong despite macro concerns, particularly in Europe.

"As MINZ is heading into peak season, strong operating cash inflow should follow as well. We forecast Rmb880m for FY12," wrote Macquarie analysts Jake Lynch and Jamie Zhou, CFA.

China Minzhong is generating a Return On Equity of 23% and Macquarie expects it to grow organically 33% this year and 29% in FY13.

"The balance sheet is strong with virtually no net debt. Yet valuations remain at distressed levels of 0.8x P/BV and 3.2x CY12E PER. We target 7.4x CY12 PER – in line with its average level prior to the sector’s corporate governance scandals erupted in 2Q11."

Recent story: Neutral on STX OSV, $1.65 target for ARA, 'cheap' is CHINA MINZHONG

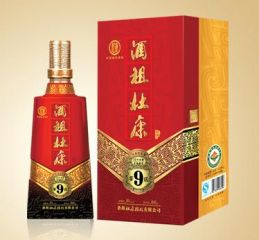

UOH KH initiates coverage of DUKANG DISTILLERS with 51-ct target

Analyst: Tan Jun Da

Since acquiring the Dukang brand in 2010, Dukang Distillers Holdings (DDH) has made headway in restoring the brand’s former glory as a national icon synonymous with baijiu, a spirit distilled from wheat and sorghum.

Under DDH, sales of Dukang products hit a record Rmb581.8m in 9MFY11, a twofold increase from 9MFY10.

The group has ambitious plans to revive the brand, which involve: a) fine-tuning its product mix under a unified brand, b) aggressive nationwide advertising campaigns, and c) expanding and strengthening its distribution network.

• Regional and international expansion. In a bid to expand its regional footprint beyond Henan, DDH plans to develop distribution networks in four main provincial markets, namely Guangdong, Guangxi, Heilongjiang and Gansu.

In addition, the group has inked a distribution agreement with Lotte Chilsung Beverage Co Ltd in a first attempt to expand internationally.

Under the agreement, the latter will distribute Dukang baijiu via its vast network of hotels, supermarkets and department stores in South Korea.

• Key risks to our recommendation include a) a potential structural shift in alcohol consumption, b) regulatory risks, c) raw material costs, and d) weather and contamination risks.

• We initiate coverage on DDH with a BUY recommendation and target price of S$0.51, representing 32.5% upside from the current price.

Our valuation is based on a target PEG of 0.4x, which is at a 20% discount to peers' average of 0.5x.

Recent story: DUKANG, HU AN CABLE, SAMKO TIMBER, MENCAST: What Analysts Now Say…