The following is part of a letter that Singapore-based fund manager Lumiere Capital wrote recently to its investors, and is reproduced here with permission. The entire letter can be accessed at www.lumierecapital.com

THE RAPID decline in stock prices in the second half of 2011 presented huge buying opportunities for the fund, and we have been deploying our capital in a measured pace to invest in these undervalued companies.

Our recent purchases are of good growing companies trading at low single-digit P/E ratios, and at a 60% discount to intrinsic value. Good companies do not remain at these valuations for very long; hence we expect them to perform well over the next few years.

Our current cash levels stand at 20% and we are waiting in eager anticipation for the current weak market conditions to serve up even more interesting opportunities.

Since the middle of July, world headlines have been dominated by grim news flowing out of Europe - sovereign bond yields spiking up, CDS spreads widening, financial institutions going under, political leaders being ousted, strikes and riots. While the adverse unfolding of events in the real world has been nothing short of depressing, commentaries from anyone eager to voice their opinion publicly have been even more sombre, with postulations ranging from major market upheaval to total meltdown.

Anecdotally, whenever we talk to people about the markets, be it in a social or business setting, 9 out of 10 are bearish. I remember a recent conversation I had with a lawyer at a party and he was asking how we’re coping with the markets. I replied that 2011 has not been easy but we are optimistic about doing well in 2012. And to that he said “Oh so you guys are shorting the market?” I suppose that pretty much sums up what the man on the street thinks about the market.

Economics 101 tells us that the current situation of insolvent European governments, coupled with austerity measures being undertaken, plus the overhang of a potential catastrophic Euro beak-up, all point to an impending long-drawn recession in Europe.

With that the nascent US economic recovery could be derailed, and when you add the potential problems arising from the bursting of the property bubble in China, a crash in the financial markets around the world seems to be inevitable. The logic is simple and credible, and there could be a good likelihood of that happening, except for the fact that almost everybody thinks that same way now. Which makes being bearish a somewhat crowded trade.

The market has its own ideas when it comes to crowded trades. Recently, we met with the management of a listed small cap company which had its operations in China. The growth outlook of the company was good, valuation of the stock was low, and its dividend yield was high. Basically there was nothing not to like about the company.

Except that we found out subsequently that the CEO, despite being based in China, spent a few weeks in Singapore selling the company to investors. They also had prominent media coverage in a local leading investment publication, and went to several broker-organised investor conferences to showcase their company, all during the same period of time. And when we quizzed them on their shareholding base, they mentioned quite a few investment funds had invested in them, and that a few more were about to do so. This was quite unusual, as small cap stocks typically do not get that much institutional sponsorship.

While we thought the company looked undervalued on most accounts, we felt it was a crowded trade as many of the potential investors had already bought into the stock. Hence we stayed away. This stock eventually dropped 25% when the roadshows ended, against a fall of 5% in the broad market, despite the absence of any adverse news.

Crowded trades have been a regular feature throughout the history of the markets. Examples from recent times of crowded bullish trades include the Asian economic miracle in the mid-90s, Internet boom of the late 90s, and the derivatives fuelled credit boom of 2006-7. And crowded bearish trades have been just as common – during the depths of the Asian crisis in 1998, the bursting of the internet bubble in 2001, and the global financial crisis of 2008.

One common feature of crowded trades is that they usually mark turning points in the market. And crowded trades have a way of rendering the most logical, compelling hypothesis about how financial markets will unfold, grossly inaccurate, simply because almost everyone has already bet that way.

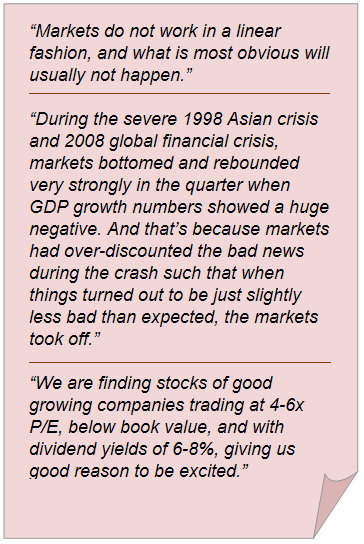

One question on the minds of most investors is if we will see a repeat of the market meltdown in 2008. To that we would like to quote from an old adage: “Generals always fight the last war”. The current macroeconomic situation seems eerily similar to that of 2008, with major credit issues threatening the stability of financial markets. With memories of the recent global financial crisis still fresh on the minds of people, it would be easy to overlay what happened in the 2008 financial crisis on the current situation and call for an impending market crash – just like generals fighting the last war. Unfortunately, markets do not work in a linear fashion, and what is most obvious will usually not happen. While markets do reflect economic reality over the long run, it could diverge from economic fundamentals in the short term. And that is because market participants are human beings who are driven by emotions of greed and fear. So in good times they tend to overshoot economic fundamentals, and in bad times they tend to fall more, somewhat like a pendulum rocked by greed and fear, with economic fundamentals as the plumb line.

Rather than economic reality, what drives market cycles is the rate of change of expectations. If we look back at history, just about every major market crash had been preceded by a powerful bull market. The crash of 1932 was preceded by a 495% rise in the market during 1921-1929, the Asian financial crisis was preceded by a multi-year market boom where the markets more than doubled and the global financial crisis of 2008 was preceded by another long boom where major Asian markets tripled. Thus, a key ingredient of the crash is extreme bullishness of the crowd built up over years of economic boom. It is when this extreme bullishness turns to extreme bearishness within a short period of time that a market crash happens.

So where do we stand now? I’m sure most will agree the past 3 years can hardly be described as boom times. We’ve had the US economy mired in high unemployment and low growth, and Europe facing a crisis since mid-2010. And despite a good rebound in markets from the deep financial crisis, valuations did not hit anywhere near the high levels that are typical of major market tops. As mentioned in our 2010 year-end investor letter, Price/Book ratios of the STI and Hang Seng Index reached during the recent market peak in late 2010 were only at their long term median levels as measured over the last 2 decades. In the absence of an exuberant economic climate over the last few years, the probability of a severe market crash in the near future is low.

While good times sow the seeds of a market crash, hard times teach us valuable lessons that can’t be learnt in other ways. The Great Depression of the 1930s spawned an entire generation of Americans that lived frugally. The Asian crisis of 1998 taught Asian banks and corporates the value of financial prudence. In the same way, the global financial crisis of 2008 had fostered a climate of caution in the ensuing years – that is why we believe the level of risk taking in the last 3 years has not been excessive. What’s more, the macroeconomic events that unfolded with the bankruptcy of Lehman Brothers had already served as a dress rehearsal for policy makers dealing with the situation we are facing today. Hence we believe they are better equipped to handle the macro situation today compared to 2008 where there was no precedent.

Given the dismal global macro environment we now face, many would ask what would be the catalyst that is going to spur growth. We do not pretend to have a crystal ball with all the answers - Perhaps an acceleration in the pace of economic recovery in the US? Maybe a more expansionary monetary policy adopted by China? Or quantitative easing by the ECB? The interesting thing about markets is that while a catalyst or “story” is needed to bring it from normal to elevated levels (e.g. Asian tiger economies in 1990s, the internet revolution in late 90s), most times no catalyst is needed for it to recover from depressed levels.

From the depths of the global financial crisis in early 2009, no catalyst for recovery was foreseeable then but yet the market rose strongly. And many times the market rebounded strongly in the face of abysmal economic situation – during both the severe 1998 Asian crisis and 2008 global financial crisis, markets bottomed and rebounded very strongly in the quarter when GDP growth numbers showed a huge negative. And that’s because markets had over-discounted the bad news during the crash such that when things turned out to be just slightly less bad than expected, the markets took off.

There is probably a high opportunity cost to be bearish now. The bearish trade is getting pretty crowded - risk aversion is high, as evidenced by the strength of the US dollar against emerging market currencies and also investors’ high level of cash holdings. Most importantly, stock valuations are low now.

Both the STI and Hang Seng index are trading at a Price/Book of 1.3x, and over the last 18 years there were only 3 short periods of time when they have dropped to these levels – during the Asian financial crisis of 1998, SARS epidemic in 2003, and global financial crisis of 2008. Historically, whenever they drop to these levels, returns over the subsequent 3 years have been good, ranging from 33-90%. On the ground, we are finding stocks of good growing companies trading at 4-6x P/E, below book value, and with dividend yields of 6-8%, giving us good reason to be excited.

Remember, we can either have good news or cheap stock prices, but not both at the same time.

No part of this article is to be construed as investment advice nor a solicitation to trade in any of the securities or investments mentioned herein. This publication and the contents hereof are intended for information purposes only, and may be subject to change without further notice. Lumiere Capital Ltd neither represent nor warrant the accuracy or completeness of the information contained herein or as to the existence of other facts which might be significant, and will not accept any responsibility or liability whatsoever for any use of or reliance upon this publication or any of the contents hereof.

Our 2011 story: How LUMIERE CAPITAL became top fund, what it is betting on

Related story: CLSA: 'Run Singa Run', sizeable investible funds waiting to be deployed

There are there to earn your money not help you earn money.

http://www.nextinsight.net/index.php/story-archive-mainmenu-60/912-2011/3490-what-top-fund-lumiere-capital-is-betting-on

You should ask them how much of their networth is tied up with the fund.

not true : the was a ver strong catalst and it was the printing of US$ that flooded the stock market. Will there be another one now and even if there is, will investor believe that it will solve the problems the west is facing ? I fear not.