LOFTY GOALS….. ARA Asset Management does have lofty goals.

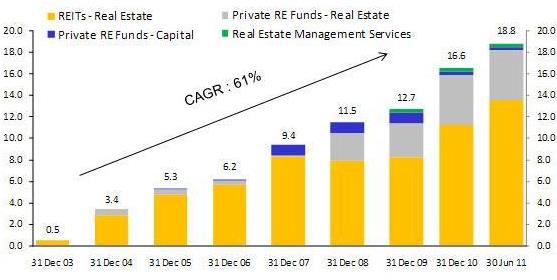

An analyst report dated Jan 5 from IIFL this morning said ARA plans to increase its Assets Under Management (AUM) by S$2bn/annum, similar to the average annual growth achieved over 2004-10.

Another big ambition: The listing a new US$1bn REIT in 2012.

DBS Vickers recently described ARA as "Asia’s finest asset manager with a high cashflow generating business model and little earnings downside."

The Group also plans to list more RMB-denominated REITs in Hong Kong over the next 2-3 years.

There is yet more: ARA plans to drive its medium-term growth by raising and deploying the US$1bn of committed capital for ARA’s Asia Dragon Fund 2 private fund and organic growth of AUM for currently listed REITs.

IIFL expects annual AUM growth of S$1.6bn for ARA over 2011-13.

IIFL has a target price of $1.67 for the stock, representing an upside of 34% from the recent $1.25. Not as exciting is the forecast dividend yield for FY11 and FY12 of 4% and 4.2%, respectively.

Recent stories:

Buying spree by ARA group CEO, XMH buyback programme

XINREN 'extremely undervalued', ARA's target upped, YANGZIJIANG a potential 3-bagger

Deutsche Bank expects 25-30% upside for MSCI China in 2012

There are as many 2012 forecasts out there as there are analysts.

We pick one by Deutsche Bank for reporting here because it was put together by two analysts who hold Ph.D degrees. (We have our little bias!)

For what it is worth Dr Jun Ma, the bank’s chief economist, and Dr Hui Miao, its strategist, expects China to enjoy 8.3% GDP growth, which would in turn support an EPS growth rate of around 10%.

In a report dated Jan 4, the analysts project over 9% sequential GDP growth and 3% inflation in 2H12, which translates into a high likelihood that MSCI China’s forward PE will recover to 10.5x from the current 8.2x.

“The multiple re-rating and our EPS growth outlook suggest 25– 30% upside potential to MSCI China for 2012.”

Despite the hefty upside potential, the analysts are cautious for the near term as 1Q12 will likely witness significant growth deceleration and a more intense fear of a hard-landing for the Chinese economy.

The recovery starts by way of the Purchasing Managers’ Index from 2Q on the back of a monetary and fiscal policy easing, as well as possible incentives for first-home buyers.

“The sequential economic recovery should then provide key support for a market rebound.”

Deutsche highlighted the following investment themes:

* Disinflation: to benefit IPPs, oil refineries, and select manufacturing firms with falling material costs;

* Property and public spending cycle: to provide a short-term buying opportunity for construction materials and machinery;

* Dissipating fear of small business and LGFV default: to support the outperformance of banks;

* Luxury goods: to recover to 25% CAGR from 2H; and

* Peak of China demand for commodities: medium-term negative for cement, steel, coking coal, and iron ore.

To summarize, Deutsche believes banks, insurance, IPPs, oil refining, IT, and luxury goods will outperform in 2012. Short-term buying opportunities should emerge for developers, construction materials, and construction machinery when government policy turns more supportive of real estate and infrastructure.

Recent story: HK jewelry retailers: 'Buy CHOW SANG SANG, LUK FOOK on weakness'