Photo: Yanzhou

Excerpts from latest analyst reports...

Bocom: Keeps BUY call on YANZHOU COAL

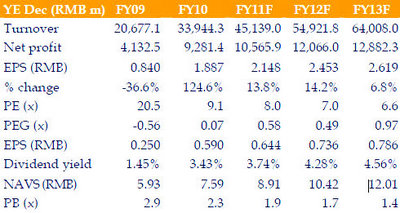

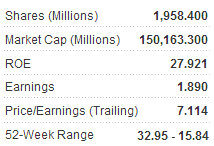

Bocom International says it is maintaining its BUY recommendation on Yanzhou Coal (HK: 1171), but warns that slower expected growth going forward may hurt valuations.

The target price is cut to 35.91 hkd from 41.93 (71% upside potential) on “poor external market environment” and an expected marked decrease in profit CAGR over the next three years, equivalent to FY12F 12x PE.

Interim earnings up sharply Revenue increased 32.9% YoY to RMB20,224.01m in 1H11 while net profit soared 90.9% YoY to RMB5183.34m, representing an EPS of RMB1.05.

“Sales increased sharply on higher sales volume and coal prices,” said Bocom.

Raw coal production reached 25.728m tonnes in 1H11, up 12.4% YoY while coal sales rose 16.6% YoY to 26.12m tonnes.

Weighted average coal prices grew 14.5% YoY to RMB728.9/tonne.

“Since around 95% of the revenue came from coal sales, the change in production and sales of other products has very little impact on the company’s revenue.”

Consolidated GM could be maintained around 44% While coal prices have been climbing, production costs also observed an upward momentum.

“Nonetheless, as it can transfer higher costs to customers, we estimate that the consolidated gross margin could be maintained at around 44% over the next 3 years,” Bocom said.

Long-term growth may slow Over the past few years, Yanzhou’s production and sales increased significantly through the M&A activities of domestic and overseas resources. Coal sales are expected to reach 56.30m tons in 2011, an increase of 73.3% from 2005.

“Meanwhile, FY06-FY10 profit CAGR reached 40.1% and we predict profit CAGR will drop to 12-15% over the next three years,” Bocom added.

See also: GUANGDONG INVESTMENT: Outperforms Hang Seng Index By 23%, Still A 'Buy'

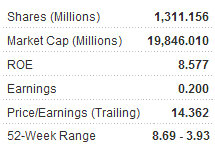

Bocom: BUY call on CMOC maintained

Bocom International says it is keeping its BUY call on rare earth metals miner CMOC (HK: 3993) with a 5.1 hkd target price (26.2% upside) on steady earnings growth.

Interim earnings in line Revenue jumped 52.0% YoY to RMB3.142bn while net profit increased 40.0% YoY to RMB586m in 1H11. Basic EPS was RMB0.12.

“The interim results were basically in line with our forecasts,” Bocom said.

Domestic tungsten concentrate prices have been surging since 1Q11 on tight supply. The company’s ASP of tungsten concentrate increased 52% YoY, boosting the gross margin to 76.1% in 1H11 from 57.5% in 1H10.

“However, since the Yongning Gold & Lead project only commenced trial production in 1H11 and reported losses during the period, the consolidated gross margin of CMOC fell from 33.6% in 1H10 to 32.05 in 1H11,” Bocom added.

Production of molybdenum products remained steady, while production of tungsten concentrates increased significantly. Meanwhile, production of molybdenum concentrates increased 2.68% YoY to 17130 tonnes in 1H11 while scheelite concentrate production jumped 45.5% to 5827 tonnes.

The commencement of production at the Yongning Gold & Lead project added some 10,000 tonnes of electrolytic lead production in the first half of the year, which in turn boosted production of sulphuric acid, gold and silver, contributing to an additional revenue of RMB426m.

“The company projected that its production plan in 2H would be in line with that of 1H11 and the production of scheelite concentrate could exceed 10,000 tonnes in 2011, which is slightly higher than previous forecast. Estimated production of molybdenum concentrate and other products remains unchanged,” Bocom said.

“CMOC has a leading position in tungsten and molybdenum resources in China. Tungsten and molybdenum output is expected to increase significantly given a large-scale resource expansion plan.”

FY11F/FY12F EPS could reach RMB0.28/RMB0.33, a decrease of 3.4% and 10% against Bocom’s previous forecast, mainly due to a cut in the forecasted ASP of molybdenum over the next two years.

See also: COMTEC SOLAR: HK-Listco's 1H Profit Soars 48.1% On Vibrant Wafer Sales