Excerpts from analyst reports...

UOB: Strong BUY on Chinese CONSUMER STOCKS with 'attractive valuations'

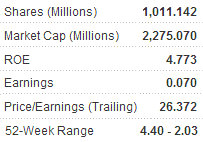

UOB Kay Hian said that the PRC retail sector is recently down 25.8% from highs seen a year ago, and due to the US and EU debt crisis, share prices of Chinese retail stocks dropped around 10% over the past two weeks.

"The department store sector and supermarket sector fell 25.8% and 13.3% respectively from their high levels one year ago while the HSI index only dropped 21.5%. We believe consumer stocks are oversold and they are expected to rebound soon," UOB said.

Limited impact from debt crises Domestic department store companies and supermarket operators only operate in Mainland China and they do not have any exposure in the US and EU.

"Also, they sell mainly domestic products instead of imported products.

"Strong consumption momentum should remain unchanged in 2H11," UOB said.

Secular story intact Strong retail sales growth in 1H11 implied top-line growth should accelerate in department stores.

Retail sales growth fell to16.8% in 1H11 (vs 1H10: 18.2%) mainly due to worse-than-expected automobile sales.

Sales of clothing, cosmetics, gold and jewellery in covered department stores accelerated from 25.3%, 21.6% and 50.4% in 1H10 to 35.1%, 25.2% and 54.3% in 1H11, respectively.

Prefer department stores to supermarkets Beijing Jingkelong (HK: 814) and Lianhua Supermarket (HK: 980) announced 1H11 results last week. Their same-store-sales (SSS) growth increased from 5.7% and 3.5% in 1H10 to 10.4% and 8.6% in 1H11, respectively.

"Strong SSS growth was fully contributed by high inflation as food inflation surged 11.8% in 1H11 which implied sales volume growth was very limited for supermarket operators," UOB said.

In 1H11, the department store industry saw strong SSS growth which could top 20% and SSS growth reached 25-28% for regional department store operators.

It is expected sales volume growth can reach the high-teens in 1H11.

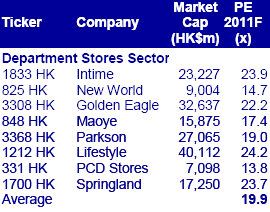

Attractive valuation for department stores vs supermarkets The department store sector is trading at 15.9x FY12F PE while the supermarket sector is trading at 21.9x FY12 F PE.

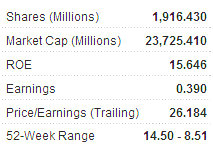

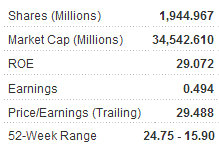

"We see earnings growth in the department store sector possibly reaching 20-25% in the next three years while supermarkets’ earnings growth will decelerate due to low inflation since 4Q11. Top BUYs are Intime (HK: 1833) and Golden Eagle (HK: 3308).

See also: HK WEEKLY WRAP: Index Plummets 6.3%, Third Straight Losing Week

BOCOM: Reaffirms BUY on CHU KONG PIPE after robust 1H

Bocom International is reaffirming its BUY recommendation on Chu Kong Pipe (HK: 1938) with a target price of 4.5 hkd (33.4% upside) after the Hong Kong-listed supplier of pipe products to the petrochemical and power industry’s strong first half earnings.

“Interim results grew sharply but slightly behind our estimate,” Bocom said.

First half revenue surged 118.7% YoY to RMB1.633bn while net profit soared 88.7% YoY to RMB113m, representing an EPS of RMB0.11.

“The strong growth in new orders boosted interim earnings. The results, however, were slightly behind our estimate due to higher management fee and sales and distribution costs,” Bocom said.

Abundant orders to support rapid capacity expansion As of the end of June, the company’s undelivered orders on hand amounted to 354,700 tonnes of steel pipes, which comprise 310,300 tonnes of LSAW steel pipes.

“Chu Kong delivered 215,000 tonnes of orders in 1H11 and expected to deliver nearly 400,000 tonners of orders in 2011. In particular, it is estimated that the company could produce 350,000 tonnes of LSAW steel pipes in 2011.

“Chu Kong Pipe is actively expanding its production capacity. With its new facilities in Zhuhai and Liangyungang commencing production in 4Q11 and 4Q12, its production capacity could reach 2.05m tonnes in the future. Its production capacity of LSAW steel pipes continues to top the country,” Bocom added.

Overseas markets new growth driver Overseas sales accounted for 57.6% of the total sales in 1H11, up from 30.6% in 1H10.

The company has signed a JV agreement with Abdel Hadi Abdullah Al Qahtani Y Sons Co. (“AHQ”) to establish a JV company which possess an annual capacity of 500,000 tonnes (of which 300,000 tonnes are LSAW steel pipes and 200,000 tonnes are ERW steel pipes).

“Chu Kong will hold a 50% stake in the JV. The cooperation will strengthen its presence in the Middle East market,” Bocom said.

See also: CHINA PRINT POWER Prepares HK Listing; CHU KONG PIPE, TECHTRONIC Both BUYs...