Excerpts from analyst reports...

Capital: GALAXY ENTERTAINMENT enjoying ‘supernormal growth era’

INVESTORS OF Genting Singapore, whose stock has been weak in recent months, might take heart from the amazing performance of Galaxy Entertainment (HK:27) which is listed on the Hong Kong Exchange.

Get this: Galaxy has chalked up a 1,700% return since the start of 2009!

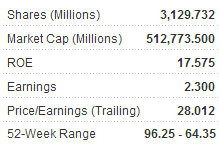

And research house Capital Securities says that leading gaming and leisure firm would continue to enjoy a “supernormal growth era”, and is raising the target price to 28.08 hkd from 18.01, with a potential 51.5% upside.

The “STRONG BUY” rating is maintained on Galaxy.

“Via its subsidiary, Galaxy Casino, S.A., the Group holds one of six Macau gaming oncessions authorized to carry out casino games of chance in Macau. Based on our Discounted 3-Stage FCFE H Model with CAPM 11.2%, gs 15.0%, gl 3.0% and H factor of 4.0, we would like to upgrade our 12-month target price,” Capital said.

The target price will result in EV of HK$121,271.0mn, with regard to FY11E Adjusted EBITDA of HK$5,018.9mn, EV/Adjusted EBITDA 24.2x.

The application of Discounted 3-Stage FCFE H model is due to the start of another “supernormal growth era” of the company, Capital added.

“There is no point in arguing that Galaxy Macau will be the next growth driver, though the existing organic growth of StarWorld Hotel, Waldo casino, Rio casino, Grand Waldo should not be ignored.

"Yes, competition is intensifying. Though, the cake is getting bigger and bigger.”

Capital said that the winner will be those who completed their expansion plans as soon as possible.

“As such, the beginning of operations for Galaxy Macau will be of paramount importance. Key risks include political and policy risks, interest rate risks, intensifying competition and uncertainties from the black market.”

See also: HK WEEKLY WRAP: Index Up 2.6% On US Bounce

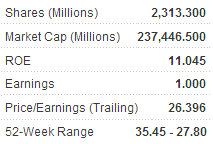

HSBC Global Research upgrades Genting Singapore (GENS) to Overweight from Neutral.

HSBC analyst, Sean Monaghan, noted that the stock has been weak since the company reported 1Q11 results, which showed a slowing in earnings growth (excluding VIP win rate volatility).

"While we acknowledge the slow relative growth of the Singapore casino market vs. the regional peers such as Macau, we suggest the Singapore market offers an excellent platform for casino operators to generate reliable earnings and cash flow."

HSBC maintained its target price of SGD2.22/share, calculated based on a 10% premium to its sum of the parts valuation. For the upcoming 2Q results, HSBC sees an erosion in market share in the mass gaming segment but a retention of its dominant position in the international VIP segment.

HSBC believes GENS is in a position to generate substantial free cash flow from 2012 and will be in a sound position to fund future expansion initiatives or commence paying dividends.

BOCOM: OUTPERFORM on CHINA INSURERS, PING AN top long-term pick

BOCOM International said is reaffirming its OUTPERFORM call on the PRC’s listed insurers, with Ping An (HK: 2318) its top long-term pick, and China Pacific Insurance (Group) Co Ltd (HK: 2601; CPIC) a GOOD BUY in the short term.

For upcoming interim earnings, Bocom expects “fair results” from life insurers, with “flying earnings” forecasted for casualty insurers.

“Listed insurance companies are expected to report mixed interim results.

"In terms of earnings growth: casualty insurers will stand out the most, followed by integrated insurance companies and then life insurance companies.

“PICC P&C (HK: 2328) is expected to report the highest net assets growth, followed by Ping An. Listed insurers are expected to report mixed interim results.”

Casualty insurers show significant growth on a yearly basis and improving ROE, and may report market beating earnings.

“Casualty insurers enjoyed another fruitful quarter. We expect the 1H profit of Ping An Property & Casualty, CPIC Property & Casualty and PICC P&C to jump 107% YoY, 63.7% YoY and 51.7% YoY, and their ROE to hit 22.9%, 29.7% and 27.8% respectively. Growth in premium earned, combined ratio and investment gain offer positive contribution to profit growth.”

Bocom added that since its estimate on combined ratio is relatively conservative, casualty insurers are very likely to report market beating interim results.

“Non-life insurance business contributed a large portion of the earnings growth of Chinese insurers. As for net assets, PICC P&C increased 16% YTD, the highest among all. Ping An’s net assets grew 11.3% excluding the impact of its financing activity. Net asset growth of other insurers was within 10%.”

See also: CHINA HIGH PRECISION: HK Listco’s 1H Off Charts On Indicator Sales