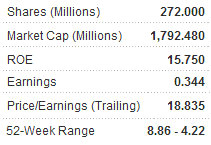

FUJIAN FYNEX Textile Science & Technology Co Ltd (SHA: 600493), a major producer of both woven cotton cloth and dyed textiles, has a P/E of 18.8x and is steadily approaching 52-week highs.

Meanwhile, Singapore-listed peers Foreland (6.5x), China Fibretech (5.0x), China Sky (4.7x) and China Taisan (2.7x) are all stuck in single digits.

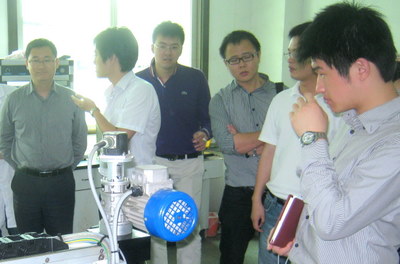

NextInsight recently accompanied 10 Greater China fund managers to meet with Fynex management and learn more about Fujian Province’s top textile firm on a trip organized by Hong Kong-based Aries Consulting.

As Fynex’s raw material costs are dominated by cotton, comprising over 60% of the total, the soft commodity was on the minds of all fund managers visiting the company’s facilities in Jinjiang, Fujian Province.

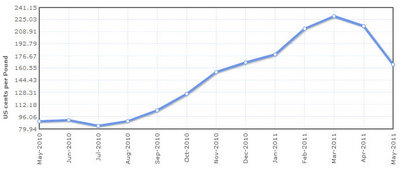

Company Director and Secretary of the Board Jiang Yuan said the company did struggle with raw material price volatility in the first quarter given that cotton hit a record high of nearly 2.30 usd per pound in March.

This is a remarkable run for the commodity which was selling for just 80 US cents in July 2010.

“That being said, we believe we have very effective strategies to maintain a strategic cotton inventory and also have the ability to pass most of the higher raw material costs downstream,” Mr. Jiang said.

The higher input costs were clearly reflected in Fynex’s recent results.

In FY2010, the company’s top line jumped 34.4% year-on-year to 924.2 mln yuan, producing a remarkable net profit leap of 401.3% to 93.6 mln.

Meanwhile, the first quarter – which coincided with the historic surge in global cotton prices – saw revenue rise at a very respectable 31.5% year-on-year to 217.0 mln yuan, while the bottom line grew at 39.8% to 5.6 mln, a much more modest increase than during full-year 2010.

He said that being the biggest textile enterprise in the eastern Chinese province of Fujian and in the top ten nationwide gave the firm obvious advantages.

“Our size affords us economies of scale that help us manage costs much more effectively than our smaller competitors. This was the chief reason we were able to reduce costs as a percentage of sales from 88% to 84% last year.”

And Fynex believed that it was important to retain talent, from the highest levels of management all the way to the factory level, as it was crucial to keep the on-the-job skills acquired in house, given the amount of competitors in a very crowded PRC textile industry.

“We have some 2,000 workers who earn an average of 2,000 yuan per month. This allows Fynex to enjoy enviably stable relations between management and labor,” Mr. Jiang said.

He bristled somewhat at one question asking if the textile trade was a “sunset industry” in the PRC, given the growing competition from Mainland China’s low wage neighbors as well as the rapid ascent up the technology gradient for the PRC’s manufacturing base as a whole.

“Like food and shelter, clothing – the need to cover ourselves -- will never go out of style. People need all three. This has always been the case and always will. Yes, we are a traditional industry, but in the PRC we are certainly not close to being a ‘sunset industry’,” he replied.

Mr. Jiang went on to explain that despite being a “traditional industry,” Fynex was not wedded to using traditional technology or the same old manufacturing processes year in and year out.

“We at Fynex constantly integrate technological innovation and upgrades into our production systems thanks to our aggressive commitment to research and development.

“This allows us to continuously provide value-added products and services to our clients which not only differentiates us from the bulk of our competitors, but also benefits our shareholders in the form of higher margin sales and better returns.”

As a textile producing enterprise engaged in large-scale manufacturing and dyeing, Fynex was of course subject to the same increasingly stringent environmental regulations in Mainland China as its domestic peers.

Part and parcel of the national and provincial-level environmental regulations applied to the textile sector was a sometimes unpredictable restriction on capacity expansion at existing facilities.

Therefore, Mr. Jiang said that Fynex may eventually find it necessary to shift from a predominantly organic expansion to production capacity growth based on mergers and acquisitions (M&As).

“Environmental laws and regulations are getting stricter for our industry, so over the next 10 years we may need to boost capacity via M&As,” he said.

However, he said the company was cautious about setting up plants on foreign soil, whether for reasons of less stringent environmental regulations or in an effort to chase lower labor costs.

“We may consider offshore production if it is feasible in the future, but at this point there is no serious discussion of such a strategy underway.”

Established in 1991 and listed in Shanghai in 2004, Fujian Fynex Textile Science & Technology Co Ltd (SHA: 600493) engages in weaving, bleaching, and dyeing textile products – mainly yarns and fabrics. It is also involved in wastewater treatment services, as well as spinning and dressmaking.

The company's production facilities cover an area of 200,000 square meters and consist of six plants for knitting, yarn dyeing, blanching and garment production, as well as a wastewater treatment plant and a cotton spinning mill.

“Over 80% of our equipment is considered ‘cutting-edge’,” Mr. Jiang said.

Fynex has been classed as one of the 10 Most Competitive Companies in the Chinese Textile Industry for three years running. Over the next few years, the company says it will continue its strategies of business consolidation, diversification and globalization.

“The solid foundations that the company has laid down in previous years will act as a springboard for development into new areas. The ultimate aim of the company is to become a fully modernized large scale textile corporation with a fully developed industrial chain,” Fynex said.

Fynex describes key areas of future business growth to include knitting, dyeing and finishing, but added that it will also integrate spinning, garment manufacturing, environmental facilities operation and domestic trading into its group activities.

Its products were the first in the trade to pass certifications including ISO9001 Management System, ISO14001 Environmental Management System, Oeko-Tex Standard 100 and Intertek Ecological Products (Class I), and its finished knitted fabrics have won the honor of “Fujian Famous Brand Products.”

See also:

HK-LISTED WEIQIAO TEXTILE: High Dividends, Low P/E

ERATAT, GENTING, CITYDEV, FORELAND: What Analysts Now Say...