Excerpts from latest analyst reports.....

SIAS Research expects CHEUNG WOH TECHNOLOGIES to rebound

Analyst: Liu Jinshu

What Happened: The impact of the Tohoku earthquake on CWM’s HDD customers had been more severe than estimated. Non-auto revenue fell by 21% YoY and removed

any buffer against the higher costs observed.

Recovery in Sight: As Japan’s industries recover, demand should revert to growth mode. A Taiwanese supplier to Western Digital has calculated from its orders that global

HDD shipments will grow by “15% to 20% sequentially” in 3Q 2011, following 5% to 10% revenue growth in 2Q 2011.

Auto to Sustain Outperformance: Sales of auto components grew by 46.8% YoY to S$19.6m in 1Q FY12 and CWM has lined up new products such as motorized auto components and complete seat assemblies, as well as new customers, to drive growth.

We expect these developments to help sustain CWM’s growth in this segment.

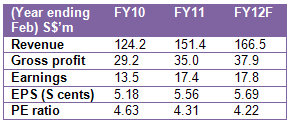

So what? We revised our FY12F revenue growth to 10% versus 15% previously to account for lost production in 1H FY12.

Consequently, we expect CWM to make S$17.8m in PATMI this FY. The lower base in FY12F had a “knock-on” impact on FY13F and FY14F forecasts even though we retained the same growth rate projections for these two years.

This reduced our intrinsic value to a still compelling S$0.490 versus S$0.600 previously.

We note that CWM is currently trading below its book value of S$0.3038 by 20%.

Recent story: CHEUNG WOH TECH: FY2011 revenues up 21.9% at S$151 million

Moody's Red Flags: Overly moody? asked Macquarie Equities Research

China stocks this week have been roiled by Moody's, a major US rating agency, report that used a "20 red flag" framework to assess potential governance or accounting risks for some 60 listed Chinese companies.

However, Macquarie Equities Research has pointed out that rating agency reports tend to address a different audience than equity research, given that they primarily focus on bond issuers' default risks.

"Such focus can result in vastly different risk tolerance and attitudes, e.g. fast growth and related high capex is generally viewed as a positive factor for equity investors, but could concern more conservative or cash-focused bond holders," said Macquarie.

Macquarie believes HK-listed China stocks' valuations in aggregate already discount a significant amount of bad news, leaving limited room for further negative impact.

At 9.9x consensus forward PER, H-shares are selling at a fully 25% discount to long-term average – nearly 3x the roughly 8% discount on the broad Asia ex-Japan index -- and also offer the region's cheapest absolute PER, said Macquarie.

"We reiterate a medium-term positive view on China stocks -- based on cheap multiples and the prospect for policy easing in the next several months. Technical considerations including large existing short positions and under-ownership by benchmarked long-only investors bolster conviction."

Macquarie recommends that investors stick with small caps with private equity or multi-national companies on board of directors (China Glass, Minzhong (MINZ SP, S$1.44, Outperform, TP: S$2.55), Towngas (1083 HK, HK$4.18, Outperform, TP: HK$5.30), AMVIG (2300 HK, HK$5.24, Outperform, TP: HK$7.25)) or very conservative HK management (Dah Chong Hong (1828 HK, HK$9.29, Outperform, TP: HK$13.00)).

UOB KH says downside risks of TIGER AIRWAYS at 97 cents

Analysts: K Ajith and Eugene Ng

The market has realised that the airline is at inflexion point with new management at the helm. Given already low expectations, any perceived positive moves by the new management could re-rate the stock. Tiger Airways will release results on 4 August.

While the results will not showcase the impact of the grounding of aircraft at Australia, the post results analyst meeting could see the management shed more light on strategy. We believe that downside risk will be contained near our target price, which remains at S$0.97.