Sandy Chin, an avid reader of NextInsight, sent us this article to share her ideas and experience of investing. She also hopes to provoke other investors to comment and share their views.

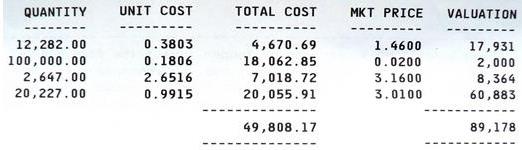

THIS IS an image of the latest statement on my stock investments bought with my Central Provident Fund (CPF) savings.

Looking at it, I cannot help but smile at the capital gain which amounts to about 82%. Throw in the dividends, and the total gain easily exceeds 100%.

For three stocks, the dividends I have received totalled about $8,000 over the past two years. The fourth stock hasn't paid a dividend since 2007.

These three out of four stocks have been invested in for some 10 years or so. The fourth, which happens to be the worst-performer, was accumulated at various times in recent years with the average price being 18 cents (as shown in the statement image).

Taking into account the long horizon, the portfolio gains have been decent but not extraordinary. But they certainly have beaten the 2.5% interest if the money had been left untouched in the CPF Ordinary Account.

I guess I am lucky to have even gains to start with. There are many investors who would have done better just sitting on their retirement savings, instead of investing in stocks or unit trusts.

My current portfolio has only four stocks as it has been scaled down from what it was at various times in the past when the CPF Board was more liberal with the use of CPF savings for stocks.

You may next ask what my overall cumulative result was, considering the stocks that I have bought and sold. I would say it was definitely positive.

I have a couple of nuggets of investment experience to share.

To start with, as you can see, there are extremes in the performance of my four stocks. One was a 3-bagger, rising from $20,000 to $61,000 in value.

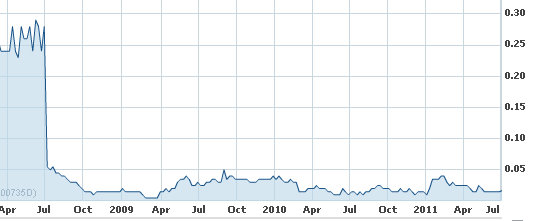

The worst stock? It crashed from being worth $18,000 to a paltry $2,000. Actually, the value can be said to be nothing as the stock is now illiquid and I cannot unload it if I wanted to.

Another stock went nowhere, while the fourth did pretty well. However, the latter was not a major investment at the start as I put in only $4,670 - the smallest investment among the 4 stocks. It surprised me to become a 4-bagger worth $17,931.

I am no investing genius, and never expected such a result.

I dare say that, in many ways, other people’s investments could resemble the performance of my CPF portfolio.

By that I mean some stocks soared, some stayed stubbornly flat, some collapsed. I have not come across anyone who has a hit rate of, say, more than 80% success with his stock picks. Always, there has been some rotten apples in the barrel -- or at least, flattish non-performers.

What makes all the difference to one's portfolio result is the weightage one has placed on each stock.

If one had parked a good amount of money in a few stocks that became multi-baggers, then the overall gain would still be very handsome even if one suffered severe losses on small holdings.

Stock market = 50% casino

In my view, the stock market is akin to a casino - maybe 40-50% casino. Skill and analysis can help one pick gainers to a certain extent, but luck has such a big role.

I recognise that there is only so much that I understand and know about a stock. Beyond that is a landscape that is hazy and gets hazier if I try to peer further into the future.

The future is ever uncertain. How is one to know for certain how a business' profitability would change over months and years?

The business environment is too complex for anyone to be sure - let alone predict the sudden changes that can visit it. The vagaries of business are especially punishing on small companies.

My stock pick that crashed from $18K to $2K is a case in point. To start with, it was a small cap – very small now. No, it is not an S-chip.

I cursed my luck in picking this stock. It had appeared like a decent investment as its regional business seemed to be growing from strength to strength.

Turned out that the books had been cooked! The accounting fraud brought the house down and the (former) chairman and the (former) CFO - both Singaporeans - were fined and sentenced to jail, and most deservedly so.

My other 3 stock picks are Singapore blue chips with multi-billion-dollar market capitalisation.

They are relatively more resilient but does it mean that blue chips are good investments? I don’t necessarily think so.

The two stock picks that became multi-baggers were purchased prior to some M&A activities that transformed the businesses into more profitable entities that enjoyed economies of scale, and became big enough to attract more fund managers.

Does it mean that the stock (worth $2K) is as good as buried alive? Nope.

This is a hope I did not have last year. I may finally get lucky as this particular stock is currently the subject of an acquisition, already announced on the Singapore Exchange.

A new owner has plans to capitalise on business synergies which could revitalize this stock. I’d be the most lucky chap around if I could get back my original monies in this stock. That does sound like a miracle – or in simple market terms, a nine-bagger, if it happens.

Wish me luck!

Please feel free to comment as I would like to learn too from you.

Basically they create an 'investment account' for each of us. If you invest 5k and return 10k sales proceed, your cost of investment under this account will become -5k.

Why does this matter? It does when if you bought several stocks. I have a huge negative value as a cost of investment, even though my holdings in that account (which cost money to buy) is in the tens of thousands.

What will happen during the calculation of your limits, they'd ignore/zerorise the value of your account (since to them it is of negative cost) when calculating the total amount you have if your CPF, but after taking the 35% limit on this amount, DEDUCT the ACTUAL COST of the stocks in that account to come to a total permitted amount.

Pervertedly this has an effect of causing your limits to swing to extremes on every transaction. To grasp this, you have to log into CPF to look at the methodology of calculating investment limits. As a result I'm often forced to make transactions in 1 day (in order to log in the full limit), and don't get to fully invest the 35% permitted.

Over the years I have communicated with CPFB many times on this issue, and they've insisted it is a matter of policy in their methodology. Informally they told me that most CPF investors lose money and the methodology serves to protect them (which I agree), but it has an effect on penalising good investors like yourself. Thought to highlight to you (and other savvy investors) of this issue going forward.

Thanks for your reply. That's the "power" of blue chips - you can easily get very good capital appreciation over the long-term without doing much additional work, as they are mostly solid companies. Of course, there are the exceptions like Creative which has fallen (far) from grace, but with companies like Capitaland, SPH and SIA Engineering, it's hard to go too far wrong unless you purchased it close to the height of a bull market. Your decision to hold on for the long-haul instead of taking profit early on has resulted in you getting extremely good yields on your invested capital, as I am sure dividends from these blue chips would have steadily risen over the last 10 years, such that your yield is probably >10% on some of your purchases (or at least 7-8%), as compared to the 4-5% the current market is yielding for blue chips. Keep up the good work!

As for my own portfolio, haha I think it's OK but not "excellent" lah. Reason is because I made quite a few mistakes on companies like Swiber, Ezra and Tat Hong but managed to extricate myself purely due to margin of safety and an intense study of their businesses. Apparently, I was concentrating on the wrong metrics (P&L and "Growth", instead of Balance Sheet, Debt and Cash Flows) and I have learnt much from these mistakes of judgement.

The 2-bagger I am talking about is Boustead, and it has been giving me a good and steady yield (about 12.5% for this year) for the last 5 years, in addition to capital appreciation.

Good luck!

That's a very impressive result I must say, and kudos to you for being to achieve this kind of result with your CPFOA equity portfolio.

That said, I am curious as to the actual CAGR (compounded) returns made per annum. Understandably, the gain if you included dividends will be >100%, but the capital gains of 82% over a period of 10 years would suggest an annual compounded growth rate of 6.2%. Were all the shares bought around the same time? This would also help in the computation. I am interested as I would also like to benchmark my returns in one company which has doubled (>100%) in 5 years (including dividends).

Thank you!