Excerpts from latest analyst reports....

UOB KH initiates coverage of BRIGHT WORLD with ‘buy’ and 98-ct target

Analyst: Jonathan Koh, CFA

Bright World Precision Machinery (BWPM) is a blue-chip S-share in the making. It benefits from diversification and growth from the automobile, locomotive and home appliances industries and rides on the rising trend of investment in capital equipment in China.

It has improved on the quality of its stamping machines through collaboration with industry partners. It benefits from growing demand for its high tonnage stamping machines, which has gained broader market acceptance.

Valuation is attractive with BWPM trading at 7.4x 2011F PE and P/B of 1.3x.

Comparables in the capital equipment industry trade at 13.5x 2010 PE and 11.4x 2011F PE. We initiate coverage with a BUY and a 12-month target price at S$0.98, based on 2011 PE of 12x.

Recent story: BRIGHT WORLD: Stellar growth, continued dividend payout expected this year

NRA Capital lowers fair value of BROADWAY to $1.45

Analyst: Jacky Lee

We have cut our FY10 estimates by 11% to factor in higher-than-expected operating expenses, but kept our FY12-13 forecasts unchanged.

Though we believe the consolidation will be positive over the longer-term, the supply chain will be affected by uncertainty in the short-term. Smaller suppliers could be more aggressive on pricing to capture higher market share.

Given such uncertainty, we lower our peg on 8x PER FY12 to 6x PER FY12, a 25% discount to 8x market valuation for the sector. As such, our fair value drops from S$1.93 to S$1.45. Maintain Overweight.

Recent story: VIKING, BROADWAY, SINO GRANDNESS: What analysts now say...

CIMB highlights TELECHOICE’s strong dividend payouts

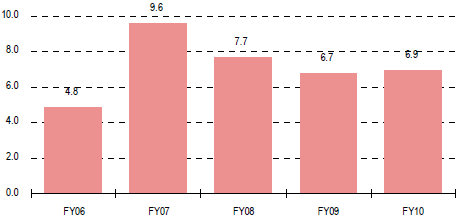

What? Telechoice goes ex-dividend on 3rd May 2011. The DPS of 1.8cts (6.9% yield) will be paid on 20th May 2011.

• So? Telechoice has a strong revenue/profit track record and has been an attractive yield stock since FY06. On average, the Company has paid nearly 70% of its profit as dividends for the past five years.

• Then? Telechoice has a strong balance sheet with net cash per share of 5.6cts. Dividend yield will remain a key attraction in investing in this stock.

But there are growth opportunities still with the rollout of the Next Generation National Broadband Network and its acquisition of a Company in the Info-Comm Technology space. We believe the Company

will report yoy growth when 1Q11 results are announced on Friday the 13th, May.