LEADING PRC scientific instrumentation player, Techcomp, is making headway for its manufactured products in Europe.

Last year, as it generated record revenues and profit, it increased its revenue contribution from France and Switzerland by 8 percentage points.

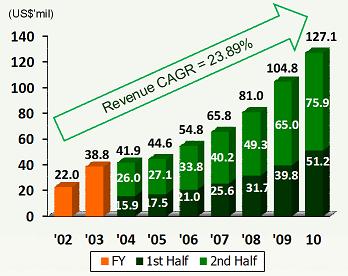

FY2010 group revenues grew 21.3% year on year to US$127.1 million, with across the board growth in China, Southeast Asia and Europe.

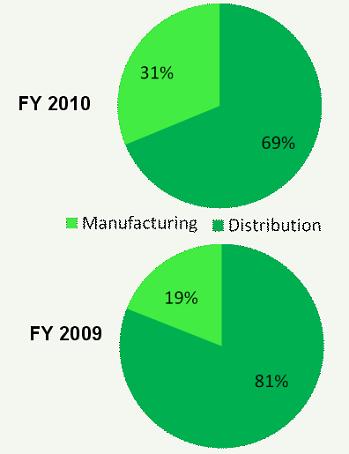

Sales from its manufactured products doubled to US$39.8 million and while revenue contribution grew from 19% in FY2009 to 31% in FY2010.

Gross margins expanded by 4-percentage points to 32.5%, as its manufacturing business commands higher margins than its distribution business.

Net profit attributable to shareholders was US$10.5 million, up 42.5%. Net margins were 8.3%.

A final dividend of 1 Sing cent was proposed for FY2010.

Techcomp has been trying to gain a foothold in Europe’s instrumentation market by buying small, loss-making scientific instrument makers and turning them around. It is able to market the European instruments to its sales network in China’s vast market and Asia. It is also able to procure parts at relatively affordable prices.

In Feb 2010, it acquired 80% in Precisa Gravimetrics AG, a leading Swiss maker of analytical weighing and moisture analysers, for CHF 3.5 million (US$3.9 million).

In Jul 2009, it acquired 75% in France’s HCC group for 1.95 million euros. The HCC group is specialized in temperature control laboratory equipment; cryopreservation and blood-bank equipment. It owns the Froilabo brand, which has a rich history all the way back to 1918, and is the first French manufacturer of centrifuges.

The management expects its European business to contribute positively to the bottom line this year. It intends to scale up its businesses in Precisa and HCC Group in order to turn the business profitable.

In Jul 2010, it disposed its 50% stake in Bibby Scientific (HK) for US$980,000 cash. Bibby Scientific (HK) is a joint venture set up in 2008 by Techcomp and an established laboratory group based in the UK for HK$4 million (about US$500,000).

Techcomp’s president Richard Lo, executive director Eric Chan and chief financial officer Gilbert Sin met up with investors last Friday at Fullerton Hotel. Below is a summary of questions raised by the investors and the management’s replies.

European acquisitions

Q: How much did the European operations lose last year?

Before our acquisition, loss was US$1.8 million. Last year, the loss significantly decreased. It was close to break even during 4Q. We are confident of turning it around this year.

Q: Why were they doing wrong?

Bad debt is seldom a problem in Europe but they did not have sufficient sales. They did not have the economies of scale, and suffered from Europe's recession. As a small company, they had difficult getting funding in Europe. Our sales network and manufacturing capacity in Shanghai help them.

Q: Are they cash flow positive?

We did not have to inject cash to fund them.

Q: What cost savings do you provide?

We did not shift any production out of Europe. We helped them save 10% to 20% by helping in procurement.

Q: Manufacturing margins fell from 17.9% to 8.8%. What do you expect your manufacturing margins to be when you scale up to optimum levels?

We are trying to achieve manufacturing margins we had before the acquisition.

Q: Why do you do not invest more in distribution since it has a better return on capital employed?

We manufacture mid-end products and distribute high-end products. This smooths demand during times of strong economic growth and recessions.

Bibby exercised their rights to buy the shares at a premium when we realized there is no chance for an eventual merger.

Sales strategy

Q: Sales of your manufacturing is almost half of distribution. How do you assure your principals you are not displacing their products?

There is a wide spectrum of products, and we try to target niche that avoids direct conflict. We are a close-knit sector and we present our principals with a feasible plan in advance when we enter a new niche. Most of out trading partners also become our distribution partners. We believe we can grow with our partners.

Q: Why did HK sales fall (by 22% to US$1.9 million) even though the country's economy was strong?

We had an exceptionally large order from Hong Kong in the preceding year.

Q: Do you see the same seasonal sales pattern for manufacturing and distribution?

Yes, the two divisions share the same customer profile.

Cash flow management

Q: What's your capex budget this year?

We do not need further capex to support our organic growth but we are open to good investments.

Q: What portion of your cost of sales is from Japan? How do you manage currency fluctuations?

About 60% for distribution is in Yen. We have to buy about US$30 million worth of Yen. It is a partial hedge.

Dividends

Q: Why did you cut dividends even though you have record profit this year?

Dividend payout was 32% higher, but we had a one-for-two bonus issue in May, so this year’s 0.78-US cent dividend is based on fully diluted capital.

Q: Your payout ratio is on the low side, about 15%. Do you have plans to increase this?

We don't have a fixed policy, but we want to maintain a healthy balance sheet.

Related stories:

TECHCOMP: 'One Of The Most Consistent Companies I Have Researched On”

TECHCOMP: Growth in 1H, much stronger 2H to come