Excerpts from latest analyst reports…..

CIMB maintains ‘underweight’ call on residential property stocks

Analyst: Donald Chua

Maintain Underweight. In an environment of record prices and heightened regulatory risks in the residential segment, we continue to prefer the relatively inexpensive commercial property developers.

With large exposures to prime office assets, KepLand and OUE remain very well placed in this buyers' market. These remain our top two picks in the property sector.

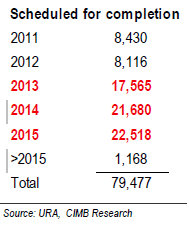

As at 4Q10, total pipeline supply equates to 78.3k units for the next five years. This translates to an average of 15.6k units of physical completions per year.

Average physical take-up per year in the last 15 years is only around 8k units. URA has revised up the expected completions for 2011 from 6.4k units to 8.4k units, in line with our view that initial estimates appear to be too low.

Over 45% of 2011 completions will be within the Core Central Region. The bulk of completing supply will become intensive in the fringe areas beyond 2012. Overall, supply situation looks daunting from 2013 onwards.

Phillip Securities: ‘Home prices may trend sideways in 2011’

Analyst: Bryan Go

* URA 4Q statistics show private home prices increased 2.7% q-q in 4Q2010 and 17.6% for the year.

* Landed property seen the strongest growth with 5.5% q-q in 4Q2010 and 30.8% in the whole year.

* Non-landed private property seen growth moderated with 1.8% q-q in 4Q2010 and 14% for the whole year.

* 2010 marks a record year since 2008 with the number of primary property sales totaling 16,581 units (ex. Executive

Condominiums) compared to 14,991 units in 2009.

* Homes: Following the latest cooling measures on 13 January 2011, we expect sales to drop ~20% for the first two months as buyers tend to wait and see how the market responds to the new measures.

Overall we believe there is healthy demand for houses due to positive economy growth in Singapore. Home prices may trend sideways in 2011 for that reason but likely to drop in 2012 onwards due to supply-side pressures.

* Offices: We expect rental for Grade-A office space to grow moderately between zero to 5%, due to plentiful supply of new stocks but supported by strong economy growth that will continue to drive demand for office space

* We maintain our recommendations of Buy for OUE and SC Global, and Hold for Keppel Land, Ho Bee, and Sing Holdings.