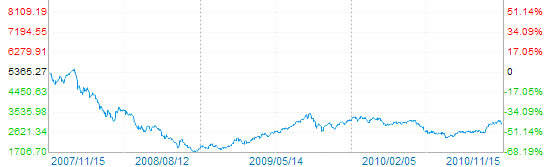

CHINA’S SHANGHAI Composite Index closed up 0.97% today at 3,014.41, regaining its position above the psychologically important 3,000 level, while Hong Kong lost 0.81% to close at 24,027.18.

After the massive 5.2% selloff on Friday, A-share banking stocks came roaring back in the afternoon session which helped push up the benchmark index.

Many investors sought bargains in financials which had been hit by recent skittishness over possible interest rate action due to strong recent inflation figures.

Lenders, property developers and metal firms, all keenly interested spectators of any central bank action, both began the day rangebound, but suddenly jumped to life in late afternoon trade as the recently gutted valuations in key counters were too tempting for bargain hunters to pass up.

Analysts cited in a Chinese language piece in SinaFinance said buyers and sellers alike are of a mind that higher interest rates are imminent, especially after recent inflation figures were made public.

Late last week China’s National Bureau of Statistics said that the country’s broadest measure of inflation in October – the consumer price index (CPI) – jumped 4.4% year-on-year, above the consensus forecast of 4.0%.

The inflation spike marked the fastest growth in over two years, and coupled with recent reserve requirement ratio increases, Chinese shares experienced the major selloff on Friday, the biggest one-day loss in well over a year.

However, analysts added that today’s strong comeback suggests that Friday’s major drop may have been an overreaction, and that bargains do exist in the hardest-hit sectors such as banking and mining.

Investors also took some cheer today -- especially around market close – from the fact that the People’s Bank of China did not choose to tighten lending over the weekend or during today’s trade.

But today was all about banks, as listed domestic lenders kept a close eye on the country’s central bank for any signs of a rate hike.

China’s largest commercial bank, Industrial and Commercial Bank of China (ICBC) (SHA: 601398), was the star performer today, closing up 6.8% at 5.0 yuan.

Other domestic peers weren’t far behind, with China CITIC Bank Corporation Ltd (SHA: 601998) up 2.2% at 5.6 yuan; Bank of Communications (SHA: 601328) up 2.1% at 5.9 yuan; Bank of China (SHA: 601988) 1.8% higher at 3.4 yuan and China Merchants Bank Co Ltd (SHA: 600036) closing up 1.6% at 14.2 yuan.

Even more bullish behavior was seen on China’s year-old ChiNext Board today.

The country’s version of the Nasdaq saw 13 of its 142 listed SMEs rise at or near their 10% daily upside limit.

Analysts say that with the palpable anxiety over almost certain central bank action this week hanging over the market, shares will likely be primed for a bout of volatility, with a clear demarcation between stocks with heavy exposure to inflationary trends and credit availability likely to see another correction following the anticipated announcement.

See recent: CHINA SHARES Continue Ascent Despite Massive Share Unlock