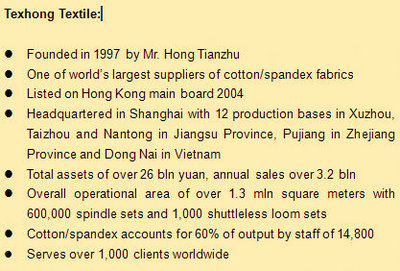

TEXHONG TEXTILE Group Ltd (HK: 2678) will continue to focus on the PRC as both a market and production base despite steady capacity growth in neighboring Vietnam.

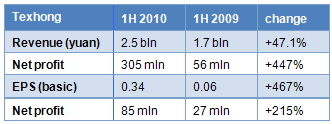

CFO Mr. Charles Hui told NextInsight that the company’s first half bottom line growth of 447% to 305 mln yuan was actually within expectations and testimony to the cotton/spandex yarn supplier’s winning strategy.

Hong Kong-listed Texhong’s January-June sales revenue also rose a very respectable 47.1% year-on-year to 2.5 bln yuan, but the rate of increase was only one-tenth that of the net profit increase over the same period.

I asked Mr. Hui if these very robust results were a surprise, and what were the major reasons behind the strong net earnings.

Mr. Hui: The results were within our expectations. Strong product demand and cotton price increases drove up our yarn selling prices as well. We are optimistic about second half market conditions.

NextInsight: Obviously, with such a growth disparity between your top and bottom line, Texhong either greatly cut costs, had a very low year-earlier basis point for comparison, raised selling prices or enjoyed stronger profit margins for other reasons. What were the chief causes of the extreme jump in profitability in the first six month of the year?

Mr. Hui: We certainly benefited from our Vietnam operations and the steady cotton price increases.

How reliant is Texhong on China’s textile/garment export juggernaut and the latter’s still strong reliance on external demand?

Mr. Hui: We are still much more reliant on the Mainland China market.

Taking all the major industrial sectors into consideration, how much does Beijing favor its yarn/fabric producers compared to other industries, and how does it support domestic producers (tax breaks, subsidies, government contracts, export tax rebates, etc...)?

Mr. Hui: Our successes are purely merit-based, and we currently enjoy no special support from the PRC government.

How has China’s concerted efforts to sell to the domestic market since the 2008 global economic crisis impacted Texhong so far, and how will it affect you going forward?

Mr. Hui: China was our major market before 2008 and will be our top focus in the coming few years.

How has your China-based capacity expansion grown this year and which products is It focused on? Also, please compare to your capacity expansion growth in Vietnam over the same period?

Mr. Hui: We installed 70,000 new spindles in Xuzhou, PRC during the period and initiated commercial production in July. This represents an approximately 10% increase in the number of total spindles. Vietnam expansion continues apace.

What earnings guidance can you provide at this point, for this half or next year?

Mr. Hui: “The first half was a profit-gaining period for the textile industry. While prudent but optimistic for the second half year of 2010, our management believes that the demand of our key products will grow steadily. To capture market opportunities, unit Xuzhou Texhong Times Textile has commenced full operation of phase II of the 70,000 spindles in July this year.

"In addition, Phase III construction of the 190,000-spindle project in Vietnam has already started and is expected to commence production in the first quarter next year. The new project has not only consolidated our leading position in the cotton core-spun yarn market, but also laid a solid foundation for entry into the denim yarn market in the PRC."

See also:

TEXHONG: Major Yarn Producer In Vietnam; Profit Up 33%

TEXHONG: Among 20 Most Competitive In Chinese Cotton Textile Industry