The eight month-old board, also referred to as the Shenzhen GEM (Growth Enterprise Market) Board, has followed the Shanghai Composite down for much of this year, with several of the so called “century stocks,” i.e. those with values in triple digits of at least 100 yuan, flirting with the possibility of losing such a designation.

One of the more indicative counters on ChiNext enduring this phenomenon is Origin Water (SZ: 300070), which fell 4.2% on Thursday last week and then another 5.3% on Friday to close the week at 85.24 yuan, which removes it from “century stock” status.

However, it still managed to hold onto its triple-digit price-to-earnings ratio, finishing at 116.9x for the week yet has lost 46.7% of its value over the past two weeks.

Origin wasn’t alone in the recent waterfall, with non-peer ChiNext listco and IT component firm Beijing Ultrapower Software (SZ: 300002) also taking a dive, losing 45.5% of its share price valuation over the same period.

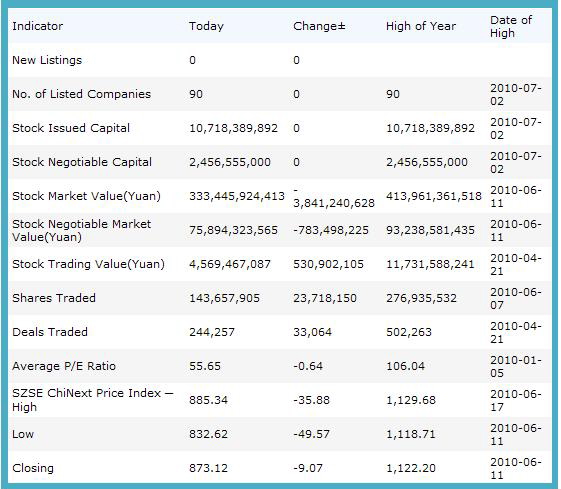

Recent ChiNext market data:

August August?

Fund managers say these precipitous falls should stir up investor interest, with August seen as the best launching point.

Origin Water is just one of several overperformers over its initial stretch on the board that has shed quite a bit of value of late, and it is primarily for this reason that polled fund managers see the valuation leaking completed by next month, and not just for water stocks.

Therefore, most are recommending investors to consider building positions beginning in August, when most corrections in overvaluations are expected to have run their course and the climbing back process should begin in earnest.

They also say the ChiNext-listed Origin Water is recently only following the general market slump into chronic negative territory and also closing the gap with its very exuberant IPO last month in which it jumped 120% in value in its first day of trading in April on ChiNext.

Origin Water’s early performance mimicked that of Shanghai A-share mainboard listco Chongqing Water Group (SHA: 601158), which gained a whopping 129% on its March 29th debut.

Sector Liquidity

Interest has definitely been flooding in for water sector stocks of late on both government policy initiatives and supply/demand forecasts.

|

||

Analysts have said that investors see the intrinsic value of Origin Water in its proprietary development of key membrane bio-reactor (MBR) technology.

"Despite MBR technology not being yet widely appreciated, investors have high expectations for this firm. The reason is quite simplistic: because China has chronic water shortages and also is confronted by severe pollution issues, companies that can resolve these issues will be valued and rewarded down the road,” they said.

This also puts Origin Water in close competition with another membrane technology expert in the water treatment and supply business: Singapore-listed Sinomem Technology Ltd (SGX: SINO).

NextInsight and several Greater China fund managers recently visited Sinomem’s Fujian province facilities and learned that the company was aggressively expanding its large-scale BOT projects with municipal governments for water treatment projects.

The recent success of Origin Water in the eyes of investors signifies that investors appreciate the growth potential of the sector, but unlike a tide, a general rising interest in the sector does not lift all peer valuations.

Several peers in China, especially municipal water suppliers, are either simply treading water or struggling to come up for air.

Based on figures from the China Economic Information Network, 46% of the 1,723 Chinese municipal water suppliers are either breaking even or losing money, while the figure is slightly lower (27%) for the country’s top 246 wastewater treatment firms.

The economic research body said the chief culprit is low water prices in China.

Average water prices in China are currently around 0.31 usd per cubic meter, around a tenth the cost of Germany, Japan and Hong Kong (3.00 usd).

Therefore, it is clear that investors in stocks like Origin Water and Singapore-listed Sinomem are not buying so much on existing deals, but on potential, as it is clear China cannot continue afford to subsidize water prices indefinitely.

Whether high expectations for the sector can be realized depends in large part on Beijing’s willingness to increase water prices – an action that most fund managers are confident that is an inevitability, with the example of petrol price subsidy relaxations given as evidence.

Related story: SINOMEM: Targetting 40 wastewater deals by 2012 from 12 now