Excerpts from latest analyst reports…

Nomura Singapore initiates coverage of STRAITS ASIA RESOURCES with $2.80 target

Analysts: Tanuj Shori, Nishit Jalan (Associate)

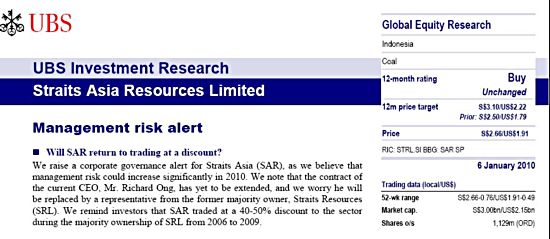

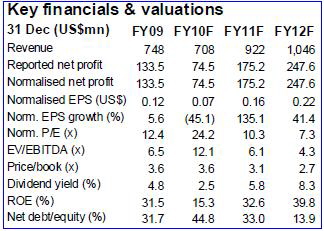

Straits Asia has corrected nearly 50% from the highs of June 2008 (underperforming peers by 42pp), led by execution and regulatory concerns. At 1.3x EV/resource and ~10x FY11F earnings, it trades mostly in line with regional peers but looks attractive on a PEG and dividend yield basis, in our view. Our price target is based on a blended DCF methodology and indicates 30% potential upside.

Current mines are valued at S$1.95/share and this should set a floor price for Straits Asia, in our view.

Strong volume play with coal price support

We expect Straits Asia’s coal sales volumes to almost double over the next five years, driven by production increases at Jembayan mines and a strong ramp-up at Northern leases post regulatory approval. Alongside strong coal prices, we think this should enable Straits Asia to book a strong earnings CAGR of 22.8% over FY09-12F.

Straits Asia generates strong operating cashflow that can be used to fund incremental acquisitions. Even if there is no acquisition, with a 60% dividend payout ratio, we estimate its dividend yield will be 5.8% in FY11F and 8.3% in FY12F — much higher than at regional peers. We think it deserves to trade at a premium to Indonesian names.

Resource and reserve upgrades an option uptick

With 75% of total mines drilled so far, and reserves accounting for only 21% of total resources, Jembayan mines should provide further potential reserve upgrades. We also expect reserve upgrades at Northern leases once regulatory approvals are in place. These have not been captured in our estimates, but under our bull-case scenario analysis, the fair value of Straits Asia is S$3.60/share.

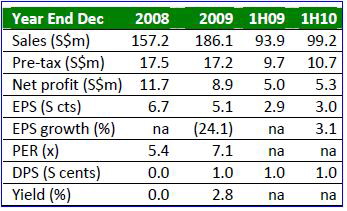

Related story: CHINA QINFA: HK-listed firm's 1H net up nearly 19 fold on coal trading blitz

Kim Eng Research highlights LEEDEN in Hot Stock report

Analyst: James Koh

Recent development: Leeden’s efforts to expand its international footprint have won recognition with its recent award (supported by IE Singapore) as one of the Top 10 “Fastest Growing Internationalising Companies” of 2010.

A leading player in Asia. Leeden offers a unique solution to customers in the marine, oil and gas, and infrastructure industries who prefer to procure the complete range of products and services used for welding.

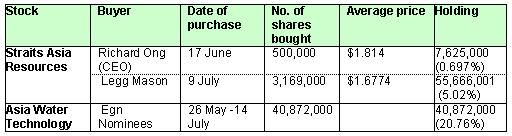

Strong insider buying: With profitability and cash flow improving, Leeden has started paying out dividends. We also note that over the past three years, its key directors and shareholders such as Steven Tham (CEO) and National Oxygen have increased their stake via market purchases for as high as $0.45 apiece, a sign of their confidence in and commitment to the business.

Recent story: LEEDEN: Turnaround success with award-winning CEO