Excerpts from latest analyst reports…..

Nomura Singapore’s Singapore Strategy

Analyst: Lim Jit Soon & the Singapore Team

Action

Anchor themes

This year is likely to be one of rebalancing as Singapore re-adjusts its economic policies and model to address the issues of over-reliance on developed markets and declining productivity. Policy risks may emerge, including measures to contain asset inflation and increased regulation on global financial services.

Staying the course

YTD STI up only 1% despite strong 1H10 GDP

The market has edged up by only 1% YTD, despite the remarkable 19% GDP growth recorded in 1H10. Although we expect GDP growth to moderate to a more sustainable 5.3% in 2011F, the STI is likely to rerate 5-10% higher by end-2010F, underpinned by resilient fundamentals and undemanding valuations.

Valuation still reasonable at 13.2x P/E and 1.6x P/BV

Valuations appear undemanding, in our view, at 13.2x FY11F P/E (EPS growth:+10% y-y) and 1.6x P/BV, plus a dividend yield of 3.7%. Also, appreciation of the Singapore dollar is likely to boost returns.

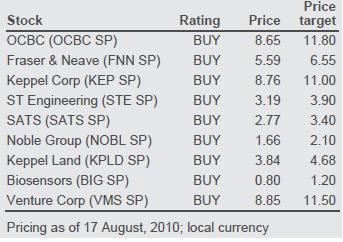

Neutral commodities; Bullish banks and conglomerates

We shift our stance on commodities to Neutral, given lacklustre 2Q10 results and continued risk aversion. However, the market appears to have priced in the weak 2Q results for Noble and thus we expect a rebound. We find value in banks (OCBC preferred) and conglomerates, which show undemanding valuations, EPS growth and attractive dividends. We remain Bearish on gaming (on valuation) and property (policy risks).

Stock picks to enhance performance

ST Engineering and SATS offer exposure to the recovery in the aviation cycle. Keppel could rerate on news of Petrobras contracts, and we like Venture for its strong cashflow, improving margins and high dividend yield (5%-plus).

Themes: M&A and ASEAN Economic Community

M&A and corporate action could provide a rerating catalyst for specific stocks such as F&N and Biosensors. ASEAN member countries are poised to sign an open skies agreement by the end of the year as part of the process of creating a common market by 2015F. SIA is a potential beneficiary.

KevinScully says: Hock Lian Seng reports 62% rise in H1-2010 net profit to S$15.2mn....earnings boosted by S$4mn gain in divestment of investment securities

Hock Lian Seng reported its H1-2010 results which showed a 9% rise in revenue to S$118.7mn while net profit was higher by S$15.2mn. But the profits were boosted by a S$4mn gain from sale of investment in securities - if we strip that out, net profit would have grown by 19.2% to S$11.2mn.

I still like Hock Lian Seng but some how the market/investors dont seem to recognise the value of construction plays. Key points to note in the Hock Lian Seng results:

a) revenue up 9% to $118.7mn - ontrack for S$220-250mn revenue for 2010

b) net profit rose 62% to S$15.2mn boosted by a S$4mn from sale of investment securities. Excluding this net profit would have risen 19% to S$11.2mn

c) order book has declined to S$464.5mn....they have so far not won or been awarded any new project....this is something to watch out for because they has historically secured about 5% of LTA projects in terms of contract value per annum. The current order book can last them another one and half years excluding about S$100mn for H2-2010.

d) Net cash in the company has increased to S$149.7mn

e) Market cap of Hock Lian Seng is now S$147.8mn = cash in the company.

f) EPS for H1-2010 is 3 cents with NAV per share at S$0.15

g) company is convening an EGM to expand its business to include property investment and property development. The change in business makes sense given the large cash position in the company and its experience in construction activity. This is not unlike what other construction groups like Wee Hur and Chip Eng Seng have done in terms of expanding their business vertically.

No major surprises in the results. Company is on track to meet my profit forecasts for 2010. Maintain in my Stock Picks with the award of a new LTA contract or some development in the property investment/development space as being possible catalysts for the rerating of the shares.

Recent stories: HOCK LIAN SENG, OSIM INTERNATIONAL: What analysts say now....